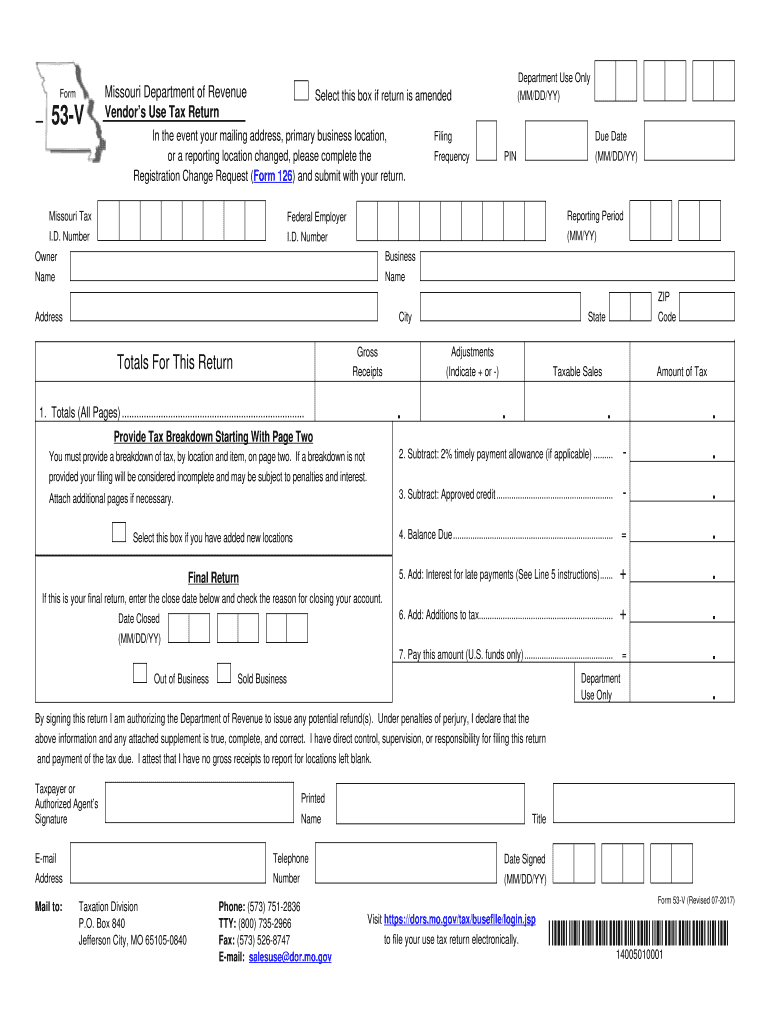

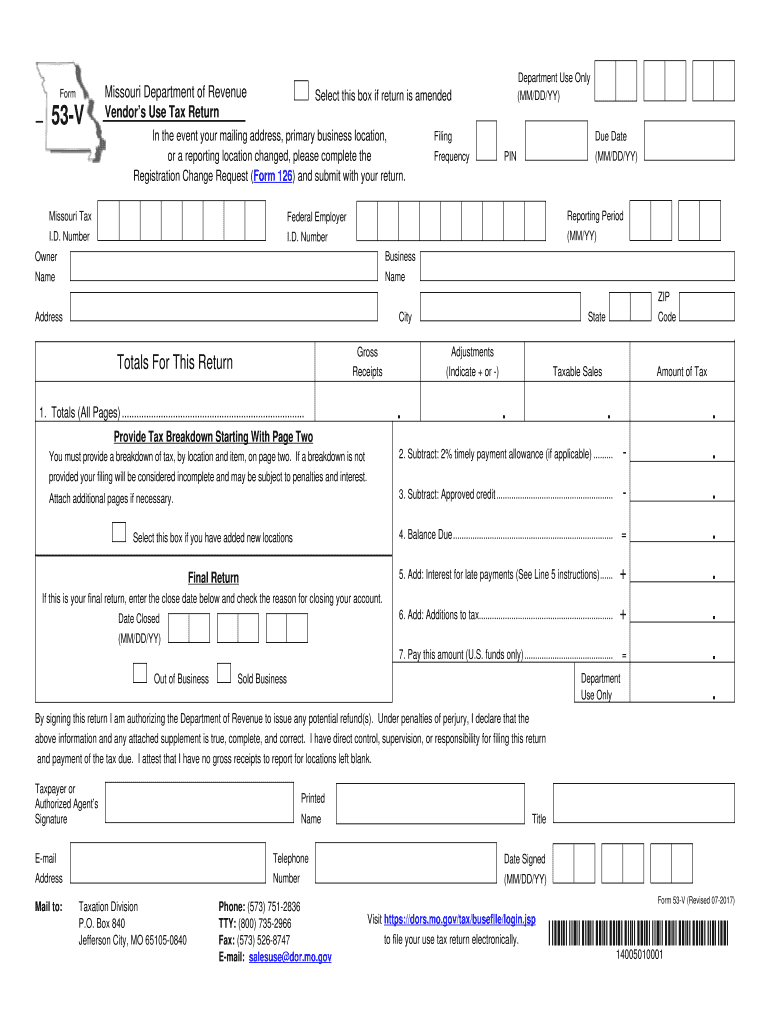

MO 53-V 2017 free printable template

Get, Create, Make and Sign MO 53-V

How to edit MO 53-V online

Uncompromising security for your PDF editing and eSignature needs

MO 53-V Form Versions

How to fill out MO 53-V

How to fill out MO 53-V

Who needs MO 53-V?

Instructions and Help about MO 53-V

Business owners that collect and remit sales and use tax may have to file an amended return the process doesn't have to feel overwhelming here I'll go through the necessary steps to file an amended return if you are filing an amended sales tax return use form 53 dash 1 if you are an out-of-state vendor filing an amended use tax return use form 53 dash V for consumers filing an amended use tax return use form 53 dash C remember amending your return may result in an overpayment or under payment of the sales or use tax let's assume for example that a customer provides you with a valid exemption certificate after you reported the taxes on a transaction your customer requests that you refund the amount of tax collected from the exempt transaction and you in turn want a refund of the tax from the department when filling out the amended return your amount of gross receipts will not change because the sale is still part of the gross receipts instead include the amount of the sale excluding the taxes as a negative amount in the adjustments' column for each applicable location now let's look at another scenario this time a customer returns a product purchased last month you refund your customer the full amount but have already reported the transaction to the department in this case the amount of the sale is deducted from your gross receipts if you originally reported five hundred dollars as your gross receipts and the sale price of the merchandise being returned is twenty-five dollars before taxes you enter 475 dollars as your amended gross receipts if you kept copies of your originally filed return you may make changes to amend the return instead of submitting a new form simply update this form with the correct amounts where necessary it is helpful to indicate that the return is amended you may correct the figures by crossing out the original figures and replacing them with a different colored pen or by erasing or cover the previous figures and replacing them with new figures the changes to the return must be legible if the original return was filed timely, and you paid more than the amount owed you may take the two percent timely payment allowance when figuring the amount of tax if the return was filed after the due date interest in additions will apply to the tax and the two percent timely payment allowance may not be deducted if a tax amount was already paid along with the originally filed return enter this amount in the cell labeled subtract approved credit and the line that is marked paid this amount enter the new amount owed less the amount originally paid if the amount is greater than zero that is the amount of additional tax you owe remember on an amended return interest and additions to tax should be calculated on the new amount if the amount is less than zero you may request a refund however there are additional steps that may be required to claim the refund these requirements can be found on the department's website if you have questions or...

People Also Ask about

How do I pay taxes to the state of Missouri?

What is the penalty for paying sales tax late in Missouri?

Why would I get a letter from the Missouri Department of Revenue Taxation Division?

Where is my amended return in Missouri?

What is the Withholding Tax in Missouri?

How do I pay my quarterly sales tax in Missouri?

How do I fix a mistake on my state tax return?

How do I pay my Missouri business sales tax?

Can Missouri amended return be filed electronically?

How do I get a tax clearance letter in Missouri?

What do I write on check when paying taxes?

How do I find my Missouri withholding account number?

Is Missouri a mandatory withholding state?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my MO 53-V in Gmail?

How do I execute MO 53-V online?

How can I edit MO 53-V on a smartphone?

What is MO 53-V?

Who is required to file MO 53-V?

How to fill out MO 53-V?

What is the purpose of MO 53-V?

What information must be reported on MO 53-V?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.