MO 53-V 2022 free printable template

Show details

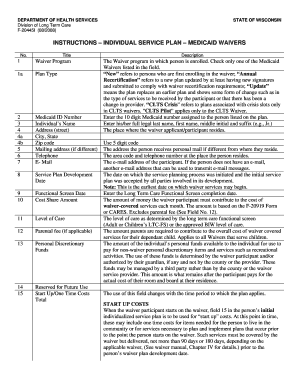

Reset Form Have you considered filing electronically Click here for more information. Print Form CLICK HERE Missouri Department of Revenue Vendor s Use Tax Return Form 53-V Select one if RETE for instructions to complete this form. Missouri Tax Identification Number Federal Employer Identification Number r Amended Return r Additional Return Owner Name Business Name Mailing Address Business Phone Number - Address Correction Reporting Period City...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO 53-V

Edit your MO 53-V form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO 53-V form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MO 53-V online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MO 53-V. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO 53-V Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO 53-V

How to fill out MO 53-V

01

Begin by downloading the MO 53-V form from the official website.

02

Fill in your personal details in the designated sections, including your name, address, and contact information.

03

Carefully read the instructions provided at the top of the form to ensure compliance.

04

Provide any additional required information such as your identification number or tax information.

05

Review the form for accuracy before submitting it.

06

Submit the completed form either electronically or by mail, following the submission guidelines.

Who needs MO 53-V?

01

Individuals or entities required to report specific information to the relevant authority.

02

Businesses applying for permits or licenses that necessitate the use of this form.

03

Anyone engaged in activities that require official documentation as regulated by the authority.

Fill

form

: Try Risk Free

People Also Ask about

How do I pay taxes to the state of Missouri?

The Missouri Department of Revenue accepts online payments — including extension and estimated tax payments — using a credit card or eCheck. An eCheck is an easy and secure method to pay your individual income taxes by electronic bank draft.

What is the penalty for paying sales tax late in Missouri?

When your sales tax return has been filed, but not paid by the required due date, you should calculate your penalty by multiplying the tax amount due by 5 percent. This penalty does not increase.

Why would I get a letter from the Missouri Department of Revenue Taxation Division?

You received this notice for one of the following reasons: The Internal Revenue Service (IRS) provided information to the Department indicating your federal return was filed with a Missouri address and a Missouri return was not filed.

Where is my amended return in Missouri?

How Do I Check My Missouri State Amended Return Status? Call the Missouri Department of Revenue at 573-751-3505.

What is the Withholding Tax in Missouri?

Withholding Formula (Effective Pay Period 06, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $1,1211.5%Over $1,121 but not over $2,242$16.82 plus 2.0% of excess over $1,121Over $2,242 but not over $3,363$39.24 plus 2.5% of excess over $2,2426 more rows • Mar 30, 2022

How do I pay my quarterly sales tax in Missouri?

The Missouri Department of Revenue accepts two methods for electronic payment: Electronic File Specifications and Record Layouts for EFT of Business Tax Return and Payment Using ACH Credit with TXP Addendum (DOR-4585) Internet filing via credit card or electronic bank draft.

How do I fix a mistake on my state tax return?

How do I amend my state tax return? You can amend your state tax return in two simple steps: First, fill out an amended federal income tax return, Form 1040-X. Second, get the proper form from your state and use the information from Form 1040-X to help you fill it out.

How do I pay my Missouri business sales tax?

If you are a registered MyTax Missouri user, please log in to your account to file your return. If you are not a registered MyTax Missouri user, you can file and pay the following Business taxes online using a credit card or E-Check (electronic bank draft).

Can Missouri amended return be filed electronically?

For 2020 tax year and forward, Amended returns can be submitted electronically or by paper form. For tax years prior to 2020, all amended returns must be completed on a paper form, Form MO-1040.

How do I get a tax clearance letter in Missouri?

How do I apply for a tax clearance? Complete Form 943PDF Document a Request For Tax Clearance and submit it to the Department of Revenue's Tax Clearance Unit. Once the form is completed and signed by a corporate officer it can be mailed or faxed to the tax clearance unit.

What do I write on check when paying taxes?

Make sure your check or money order includes the following information: Your name and address. Daytime phone number. Social Security number (the SSN shown first if it's a joint return) or employer identification number. Tax year. Related tax form or notice number.

How do I find my Missouri withholding account number?

Missouri Withholding Account Number You can find your Withholding Account Number on any previous quarterly return, or on any notices you have received from the Department of Revenue. If you're unable to locate this, contact the agency at (573) 751-8750.

Is Missouri a mandatory withholding state?

Yes, an employer is required to withhold Missouri tax from all wages paid to an employee in exchange for services the employee performs for the employer in Missouri.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit MO 53-V from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your MO 53-V into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send MO 53-V to be eSigned by others?

To distribute your MO 53-V, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I edit MO 53-V on an Android device?

With the pdfFiller Android app, you can edit, sign, and share MO 53-V on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is MO 53-V?

MO 53-V is a form used in Missouri for reporting certain tax-related information concerning the financial activities of businesses.

Who is required to file MO 53-V?

Businesses operating in Missouri that meet specific criteria related to their financial transactions are required to file MO 53-V.

How to fill out MO 53-V?

To fill out MO 53-V, businesses must provide accurate financial details, including income and expenses, and ensure all sections are completed according to the state guidelines.

What is the purpose of MO 53-V?

The purpose of MO 53-V is to gather financial data from businesses to assess tax liability and ensure compliance with state revenue laws.

What information must be reported on MO 53-V?

The information reported on MO 53-V includes business identification details, income, expenses, and any applicable deductions or credits.

Fill out your MO 53-V online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO 53-V is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.