Get the free presumptive tax payer identification number form - keralataxes

Get, Create, Make and Sign presumptive tax payer identification

Editing presumptive tax payer identification online

Uncompromising security for your PDF editing and eSignature needs

How to fill out presumptive tax payer identification

How to fill out presumptive tax payer identification:

Who needs presumptive tax payer identification:

Instructions and Help about presumptive tax payer identification

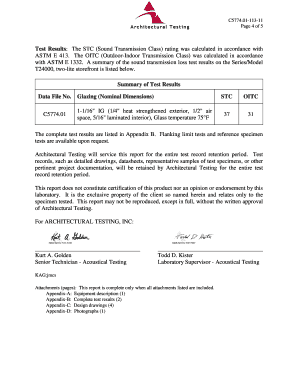

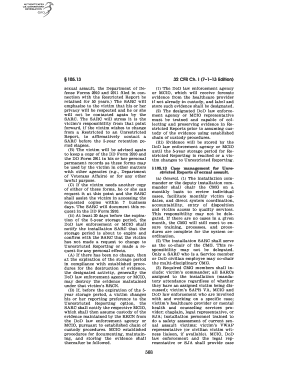

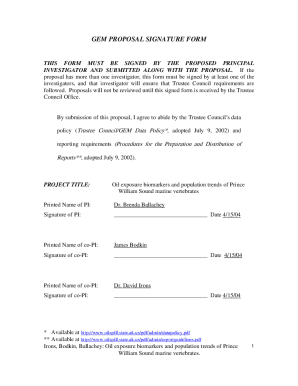

WELCOME TO THE IRS’S INTERNATIONAL INDIVIDUAL TAXPAYERS ASSISTANCE OR IATA VIDEO SERIES. IN THIS VIDEO YOU WILL BE ABLE TO DETERMINE IF YOU NEED AN INDIVIDUAL TAXPAYER IDENTIFICATION NUMBER, OR ITIN. AN ITIN IS ISSUED BY THE INTERNAL REVENUE SERVICE AND IS USED FOR TAX PURPOSES ONLY. WE ISSUE ITIN TO INDIVIDUALS WHO ARE NOT ELIGIBLE TO OBTAIN A SOCIAL SECURITY NUMBER, OR SSN. TO QUALIFY FOR AN ITIN, YOU MUST HAVE A TAX FILING AND REPORTING REQUIREMENT AND FILE A U.S. INCOME TAX RETURN ALONG WITH THE ITIN APPLICATION. HOWEVER, THERE ARE EXCEPTIONS. A LIST OF EXCEPTIONS CAN BE FOUND IN THE INSTRUCTIONS FOR FORM W-7. ITIN ARE ISSUED REGARDLESS OF IMMIGRATION STATUS SINCE BOTH RESIDENT AND NONRESIDENT ALIENS MAY HAVE A U.S. FILING OR REPORTING REQUIREMENT UNDER THE INTERNAL REVENUE CODE. TO DETERMINE IF YOU NEED AN ITIN, ASK YOURSELF, “DO I HAVE OR AM I ELIGIBLE TO OBTAIN A SOCIAL SECURITY NUMBER OR SSN?quot; IF YOU DON'T KNOW OR IF YOU ARE NOT SURE if YOU HAVE AN SSN, WE RECOMMEND YOU CONTACT THE SOCIAL SECURITY ADMINISTRATION, OR SSA, FOR CONFIRMATION. JUST GO TO SSA.GOV/AGENCY/CONTACT IF THE SOCIAL SECURITY ADMINISTRATION CONFIRMS THAT YES, YOU HAVE A SOCIAL SECURITY NUMBER, THEN YOU DON'T NEED AN ITIN. USE YOUR SSN WHEN FILING YOUR FEDERAL TAX RETURN– FOR INDIVIDUAL OR JOINT RETURNS. NOW, IF YOU HAVE AN SSN OR ARE ELIGIBLE TO OBTAIN ONE, YOU ARE NOT ELIGIBLE TO APPLY FOR AN ITIN. IF THE SOCIAL SECURITY ADMINISTRATION CONFIRMS THAT YOU DON'T HAVE A SOCIAL SECURITY NUMBER, THEN VISIT SSA.GOV/SSNUMBER. IT WILL HELP YOU DETERMINE IF YOU’RE ELIGIBLE FOR A SOCIAL SECURITY NUMBER AND, IF SO, WALK YOU THROUGH THE APPLICATION PROCESS. IF YOU ANSWERED NO, YOU DO NOT HAVE AN SSN, OR THE SSA CONFIRMS THAT YOU DON'T HAVE AN SSN, AND YOU DETERMINED THAT YOU ARE NOT ELIGIBLE TO OBTAIN AN SSN, THEN ASK YOURSELF, “DID I RECEIVE ANY PAYMENTS OR INCOME FROM U.S. SOURCES?” IF YOU ANSWERED YES, THEN GENERALLY, YOU NEED AN ITIN. A COPY OF FORM W-7 AND ITS INSTRUCTIONS CAN BE FOUND ON OUR WEBSITE, IRS.GOV ONCE THERE, TYPE “FORM W-7” IN THE SEARCH BOX. HOWEVER, IF YOU ANSWERED NO, YOU DO NOT HAVE AN SSN AND NO, YOU DID NOT RECEIVE PAYMENTS OR INCOME FROM U.S. SOURCES, THEN ASK YOURSELF THE FOLLOWING QUESTION: “DO I HAVE TO PROVIDE A U.S. TAX IDENTIFICATION NUMBER TO ANYONE?” EXAMPLES OF WHY YOU MAY HAVE TO PROVIDE AN ITIN ARE YOU PLAN TO FILE YOUR INCOME TAX RETURN JOINTLY WITH YOUR SPOUSE, OR YOU WILL BE CLAIMED AS A DEPENDENT ON SOMEONE ELSE'S TAX RETURN, OR YOU WANT TO OPEN A U.S. BANK ACCOUNT. AGAIN, YOU WILL NEED TO COMPLETE AND SUBMIT FORM W-7 ALONG WITH SUPPORTING IDENTIFICATION DOCUMENTS. NOW, IF YOUR ANSWERS ARE NO, YOU DON’T HAVE AN SSN AND YOU’RE NOT ELIGIBLE FOR ONE, AND NO, YOU DIDN't’T RECEIVE PAYMENTS OR INCOME FROM U.S. SOUR CES, AND NO, YOU DON’T HAVE TO PROVIDE A U.S. TAX IDENTIFICATION NUMBER TO ANYONE, THEN GENERALLY, YOU DON’T NEED AN ITIN. FINALLY, FOR MORE INFORMATION FOR ALL TYPES OF INTERNATIONAL TAXPAYERS, GO TO IRS.GOV AND TYPE INTERNATIONAL...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my presumptive tax payer identification directly from Gmail?

How can I get presumptive tax payer identification?

How do I complete presumptive tax payer identification on an Android device?

What is presumptive tax payer identification?

Who is required to file presumptive tax payer identification?

How to fill out presumptive tax payer identification?

What is the purpose of presumptive tax payer identification?

What information must be reported on presumptive tax payer identification?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.