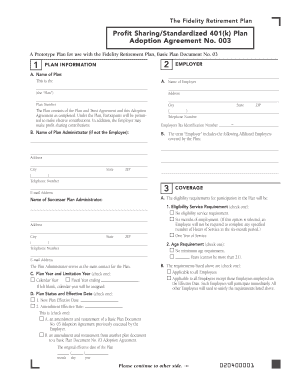

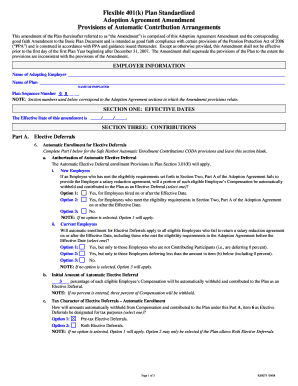

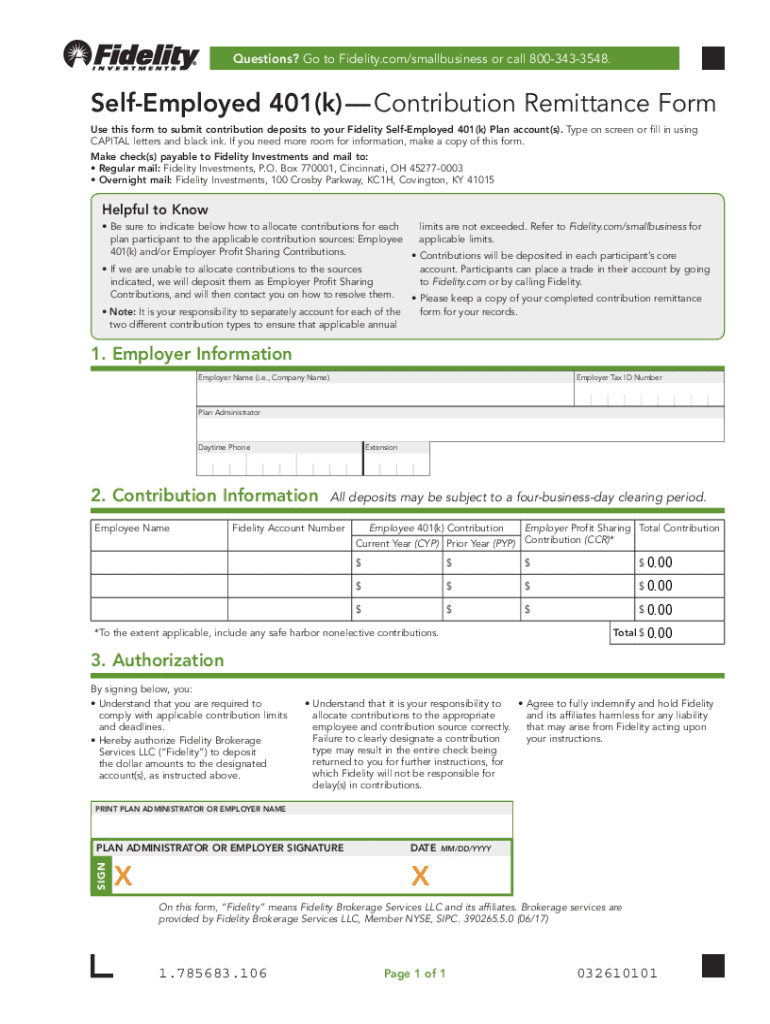

Fidelity Brokerage Services Self-Employed 401(k) - Contribution Remittance Form 2017-2025 free printable template

Show details

This form is used to submit contribution deposits to a Fidelity Self-Employed 401(k) Plan account. It provides guidelines for completing the form and indicates where to send contributions.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign self-employed 401k contribution remittance

Edit your self-employed 401k contribution remittance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self-employed 401k contribution remittance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit self-employed 401k contribution remittance online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit self-employed 401k contribution remittance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fidelity Brokerage Services Self-Employed 401(k) - Contribution Remittance Form Form Versions

Version

Form Popularity

Fillable & printabley

4.8 Satisfied (75 Votes)

4.4 Satisfied (42 Votes)

How to fill out self-employed 401k contribution remittance

How to fill out Fidelity Brokerage Services Self-Employed 401(k) - Contribution

01

Gather your personal and business information, including your Social Security Number and tax identification number.

02

Determine your eligibility as a self-employed individual to contribute to a 401(k) plan.

03

Calculate your maximum contribution limit based on your net earnings from self-employment. This includes both employee and employer contributions.

04

Log in to your Fidelity Brokerage Services account or create a new one if you don’t have an account.

05

Navigate to the 401(k) contribution section of your account.

06

Fill out the contribution form with the calculated amount you wish to contribute.

07

Choose the frequency of contributions (e.g., one-time contribution or recurring contributions).

08

Review the information for accuracy before submitting.

09

Submit the form and keep a copy for your records.

10

Confirm your contribution has been processed through your account dashboard.

Who needs Fidelity Brokerage Services Self-Employed 401(k) - Contribution?

01

Self-employed individuals looking to save for retirement.

02

Freelancers who have a consistent income and wish to invest in their retirement.

03

Small business owners without employees who want an efficient retirement plan.

04

Individuals seeking higher contribution limits than traditional or Roth IRAs allow.

05

Those looking to reduce their taxable income while contributing to retirement savings.

Fill

form

: Try Risk Free

People Also Ask about

How do I contact Fidelity self-employed 401k?

Please contact a Fidelity retirement representative at 800-544-5373 and select option 3 for more information.

Does Fidelity have a self-directed account?

Fidelity BrokerageLink® is a self-directed brokerage account that gives participants access to thousands of mutual funds from many different mutual fund companies. A self-directed brokerage account is essentially a do-it-yourself option that is designed for investors who desire more choice of investments.

What is the best 401k for self-employed?

Compare Best Solo 401(k) Companies Solo 401(k) ProviderInvestment SpecialtyRoth Contributions SupportedFidelity Investments Best OverallGeneralNoCharles Schwab Best for Low FeesGeneralNoE*TRADE Best for Account FeaturesGeneralYesVanguard Best for Mutual FundsVanguard Mutual FundsYes2 more rows

Does Fidelity have a solo 401k plan?

A Fidelity Solo 401K allows you to contribute up to $57,000 per year (an additional $6,500 in catch-up contributions are allowed for those over 50). Just like a traditional 401K, you can make contributions pre-tax or you can invest in a Roth 401K, contributing after-tax dollars.

Can you set up a 401k if self-employed?

401(k) plan Contribute up to an additional 25% of your net earnings from self-employment for total contributions of $66,000 for 2023 ($61,000 for 2022; $58,000 for 2021; $57,000 for 2020 and $56,000 for 2019), including salary deferrals.

Does Fidelity have self directed 401k?

If you are one of the 22 million investors with a retirement plan at Fidelity, you may have access to an option within your plan that could dramatically improve the success of your 401k. Fidelity's BrokerageLink® option is a self-directed brokerage account within the 401k or 403b plan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify self-employed 401k contribution remittance without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including self-employed 401k contribution remittance. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit self-employed 401k contribution remittance in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing self-employed 401k contribution remittance and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out the self-employed 401k contribution remittance form on my smartphone?

Use the pdfFiller mobile app to fill out and sign self-employed 401k contribution remittance on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is Fidelity Brokerage Services Self-Employed 401(k) - Contribution?

Fidelity Brokerage Services Self-Employed 401(k) - Contribution refers to the contributions made by self-employed individuals to their self-employed 401(k) retirement plans, allowing them to save for retirement while also reducing their taxable income.

Who is required to file Fidelity Brokerage Services Self-Employed 401(k) - Contribution?

Self-employed individuals, including sole proprietors, independent contractors, and small business owners, are required to file Fidelity Brokerage Services Self-Employed 401(k) - Contributions if they choose to contribute to their retirement plan.

How to fill out Fidelity Brokerage Services Self-Employed 401(k) - Contribution?

To fill out the Fidelity Brokerage Services Self-Employed 401(k) - Contribution, individuals should gather their business income information, determine their contribution amount based on IRS limits, and complete the necessary forms or online submissions through Fidelity's platform.

What is the purpose of Fidelity Brokerage Services Self-Employed 401(k) - Contribution?

The purpose of this contribution is to enable self-employed individuals to save for retirement effectively while also maximizing their tax benefits, facilitating greater financial security for the future.

What information must be reported on Fidelity Brokerage Services Self-Employed 401(k) - Contribution?

Information that must be reported includes the amount of contribution being made, the self-employed individual's income, the business entity type, and any relevant tax identification numbers or forms as required by the IRS.

Fill out your self-employed 401k contribution remittance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self-Employed 401k Contribution Remittance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.