What is 401k calculator simple?

A 401k calculator simple is a tool that helps individuals estimate how much money they will have saved for retirement by contributing to a 401k retirement plan. It takes into account factors such as current age, annual income, contribution percentage, and expected rate of return to calculate the potential growth of the investment over time.

What are the types of 401k calculator simple?

There are several types of 401k calculator simple available to users. Some popular types include:

Basic 401k calculator: This type requires basic inputs such as age, income, and contribution percentage to provide a rough estimate of retirement savings.

Advanced 401k calculator: This type offers more detailed inputs such as expected rate of return, inflation rate, and retirement age to provide a more accurate projection of retirement savings.

Rollover 401k calculator: This type specifically helps individuals calculate the potential growth of their retirement savings when rolling over funds from a previous employer's 401k plan to a new plan.

Multiple scenario calculator: This type allows users to input different scenarios and compare the potential outcomes of their retirement savings based on various factors such as different contribution percentages or retirement ages.

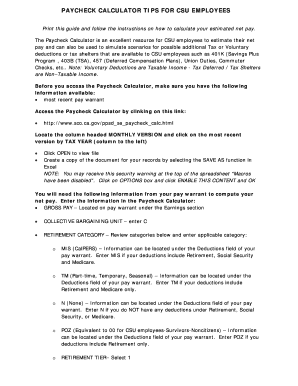

How to complete 401k calculator simple

Completing a 401k calculator simple is easy and straightforward. Here are the steps to follow:

01

Gather the necessary information: Collect your current age, annual income, desired contribution percentage, expected rate of return, and retirement age.

02

Access a 401k calculator simple: You can find various 401k calculator tools online or through financial planning websites.

03

Input the required information: Enter the gathered information into the calculator's fields, following the instructions provided.

04

Review the results: Once you have entered all the necessary information, the calculator will generate an estimate of your potential retirement savings.

05

Analyze and adjust: Use the calculator's results to assess your retirement goals and make any necessary adjustments to your contribution percentage or retirement age.

06

Repeat the process periodically: As your circumstances change, it's recommended to revisit the 401k calculator and update your information to ensure your retirement savings are on track.

pdfFiller empowers users to create, edit, and share documents online, including 401k calculators. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to efficiently manage their documents and achieve their financial goals.