401k Paycheck Calculator

What is 401k paycheck calculator?

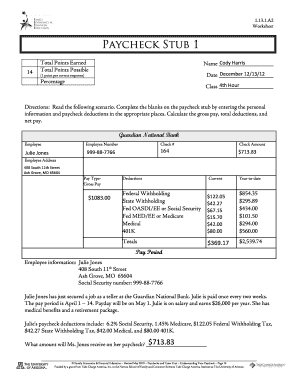

A 401k paycheck calculator is a useful tool that allows individuals to estimate how much money they can contribute to their 401k plan from each paycheck. It takes into account various factors such as salary, tax brackets, and contribution percentages to provide an accurate calculation of the amount that will be deducted from your paycheck and allocated towards your retirement savings.

What are the types of 401k paycheck calculator?

There are several types of 401k paycheck calculators available online. Some calculators focus solely on determining the contribution amount, while others provide additional features such as estimating the potential growth of your 401k savings over time. It is essential to choose a calculator that suits your specific needs and provides accurate results.

How to complete 401k paycheck calculator

Completing a 401k paycheck calculator is a straightforward process. Follow these steps to accurately calculate your 401k contributions:

By following these steps, you can ensure that you are maximizing your 401k contributions and planning for a secure retirement future. Remember, using a reliable paycheck calculator, like the ones offered by pdfFiller, can significantly simplify this process and provide accurate results.