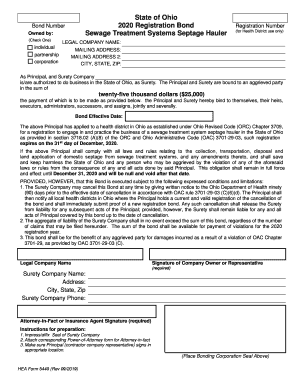

Canada CIBC Mellon Direct Deposit Request Form 2017-2026 free printable template

Show details

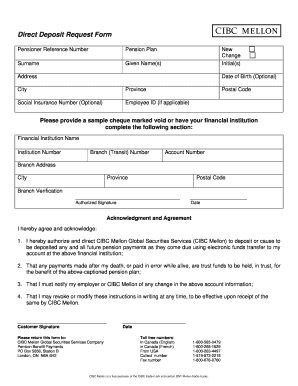

Direct Deposit Request Form

Participant ID (if applicable)Pension Plan Nameless NameFirst Name

Change

Initial(s)Addressable of BirthCityProvincePostal Voicemail Address (Optional)Telephone NumberSocial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cibc site pdffiller com site blog pdffiller com form

Edit your Canada CIBC Mellon Direct Deposit Request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada CIBC Mellon Direct Deposit Request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada CIBC Mellon Direct Deposit Request online

Follow the steps down below to use a professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada CIBC Mellon Direct Deposit Request. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada CIBC Mellon Direct Deposit Request Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada CIBC Mellon Direct Deposit Request

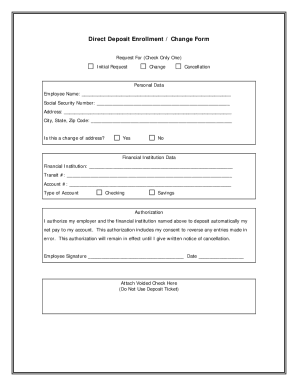

How to fill out Canada CIBC Mellon Direct Deposit Request Form

01

Obtain the Canada CIBC Mellon Direct Deposit Request Form from the official website or your employer.

02

Fill in your personal information, including your name, contact information, and address.

03

Provide your bank account details, including the bank name, account number, and transit number.

04

Indicate the type of account you are using (checking or savings).

05

Review the form for any errors or missing information.

06

Sign and date the form to authenticate your request.

07

Submit the completed form to your employer or the designated financial department.

Who needs Canada CIBC Mellon Direct Deposit Request Form?

01

Employees who wish to receive their pay or benefits directly into their bank accounts.

02

Individuals who are required to set up direct deposit for government benefits or pensions.

03

Anyone needing to streamline their payment process by enabling direct deposits.

Fill

form

: Try Risk Free

People Also Ask about

How do I fill out a direct deposit slip?

Provide personal information, including your name and your account number. Fill in additional details such as the date. If you are cashing the check or any part of the check, it is also required you sign the signature line. List the cash amount of your deposit, if any.

How do I get a direct deposit letter from the bank?

In-person: The quickest way to obtain a bank letter is to request one in-person. By doing so, you'll be able to ensure that everything you need is on the letter & be able to make changes if necessary. By phone: Another convenient way to obtain a bank letter is to call your bank's support line.

How do I get a bank direct deposit form?

Get a direct deposit form from your employer Ask for a written or online direct deposit form. If that isn't available, ask your bank or credit union for one. We've included a list of forms from top banks, including the Capital One and Bank of America direct deposit forms.

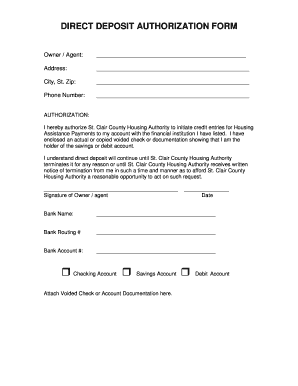

What is the form for direct deposit?

A direct deposit authorization form is a form that employees fill out to authorize their employer to deposit money straight into their bank account. Direct deposit is the standard method most businesses use for paying employees.

Do you need a check for direct deposit form?

Most employers will ask for a voided check to set up your direct deposit in addition to filling out a form. They ask for this because a check has all the information your employer needs to help ensure your paycheck is deposited in your account. If you don't already have checks, you can order checks online.

What is a bank direct deposit form?

A direct deposit authorization form is a form that employees fill out to authorize their employer to deposit money straight into their bank account. Direct deposit is the standard method most businesses use for paying employees.

Who completes the direct deposit form?

The employee will be required to complete and return the Direct Deposit Authorization Form for the employer to add the information to their payroll and begin depositing their pay into their account.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find Canada CIBC Mellon Direct Deposit Request?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the Canada CIBC Mellon Direct Deposit Request in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make changes in Canada CIBC Mellon Direct Deposit Request?

The editing procedure is simple with pdfFiller. Open your Canada CIBC Mellon Direct Deposit Request in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I fill out the Canada CIBC Mellon Direct Deposit Request form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign Canada CIBC Mellon Direct Deposit Request. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is Canada CIBC Mellon Direct Deposit Request Form?

The Canada CIBC Mellon Direct Deposit Request Form is a document used to authorize the direct deposit of payments, such as pensions or benefits, directly into a person's bank account.

Who is required to file Canada CIBC Mellon Direct Deposit Request Form?

Individuals receiving payments from Government of Canada, provincial governments, or other agencies that offer direct deposit options are required to file the form.

How to fill out Canada CIBC Mellon Direct Deposit Request Form?

To fill out the form, you need to provide your personal information, such as your name, address, and Social Insurance Number, along with your bank details, including the account number and institution information.

What is the purpose of Canada CIBC Mellon Direct Deposit Request Form?

The purpose of the form is to facilitate the automatic deposit of payments into an individual's bank account, ensuring timely and secure receipt of funds.

What information must be reported on Canada CIBC Mellon Direct Deposit Request Form?

The information required includes your personal details (name, address, Social Insurance Number), banking information (bank name, account number, branch number), and possibly your signature for authorization.

Fill out your Canada CIBC Mellon Direct Deposit Request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada CIBC Mellon Direct Deposit Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.