Canada 22-054-300 2018-2025 free printable template

Show details

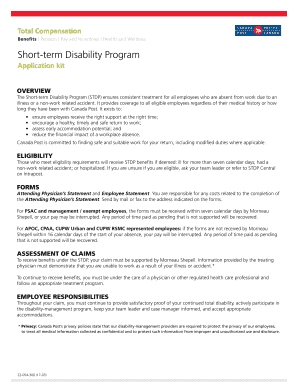

Total Compensation Benefits Pension Pay and Incentives Health and WellnessShortterm Disability Program Application overview The Short term Disability Program (STOP) ensures consistent treatment for

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada 22-054-300

Edit your Canada 22-054-300 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada 22-054-300 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada 22-054-300 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Canada 22-054-300. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada 22-054-300 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada 22-054-300

How to fill out Canada 22-054-300

01

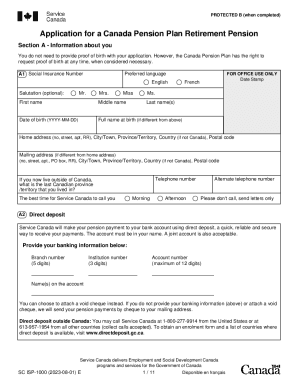

Gather all necessary personal information, including your name, address, and contact details.

02

Ensure you have your Social Insurance Number (SIN) ready.

03

Fill out the sections for employment details, including your employer's name and your job title.

04

Provide any relevant information regarding your eligible expenses that may be claimed.

05

Carefully review each section to ensure accuracy.

06

Sign and date the form as required.

07

Submit the completed form to the appropriate Canadian tax authority.

Who needs Canada 22-054-300?

01

Individuals who apply for certain government programs in Canada.

02

People seeking to claim benefits related to employer-related deductions or credits.

03

Taxpayers looking to report specific financial information as part of their tax filings.

Fill

form

: Try Risk Free

People Also Ask about

What is timeframe for short term disability?

As the name indicates, short term disability insurance is intended to cover you for a short period of time following an illness or injury that keeps you out of work. While policies vary, short term disability insurance typically covers you for a term between 3-6 months.

How much does disability pay per month in Canada?

The basic payment amount is $524.64.Benefit amounts. Type of benefitAverage monthly amountMaximum monthly payment amount (2022)CPP Disability benefit$1,070.40$1,464.83CPP Post-retirement disability benefit$524.64$524.64CPP children's benefit$264.53$264.53 Aug 18, 2022

What qualifies for short term disability in Canada?

Who qualifies for short-term disability? As long as an employee has short-term disability benefits coverage at the time they become disabled, they are qualified to receive short-term disability benefits. The medical conditions covered by a policy range from physical to psychological, cognitive, or emotional.

How long does Canada Life take to process a claim?

How long does it take to process my claim? Canada Life will process all health and dental claims under the Plan within 7 calendar days of receipt.

Is there short term disability in Canada?

Short-term disability coverage typically provides benefits for up to 6 months while you're sick or injured. If your employer has a short-term disability plan, your claim must be made through your disability plan. Employers aren't required to provide paid sick leave and each employer is different.

How much does short term disability pay in Canada?

This means that claimants can receive a maximum payment of $638 in EI benefits per week. Therefore, for 2022, the short-term disability plan must provide at least 55% of an employee's normal weekly insurable earnings, to a maximum of at least $638.

How do I apply for short term disability in Canada?

Short term disability application If you wish to apply for EI sickness benefits, you can visit the government of Canada's Employment Insurance website. The website also provides details about EI short term disability eligibility and benefits.

How much money do you get on disability Canada?

The average monthly payment from the disability pension in 2022 is $1,053.20 with a maximum of $1,464.83. Your payment is calculated by adding the basic monthly amount with an amount based on your CPP contributions.

How long is short term disability in Canada?

Short term disability benefit terms depend on your insurance coverage, but commonly can provide you with income assistance for up to 6 months. If your doctor recommends that you remain off work for longer than 6 months, you may be required to apply for Long Term Disability benefits, if you have this coverage.

How long is short term disability Canada life?

Short term It often provides coverage for up to 6 months if you have an illness or are injured. The waiting period for short term disability is typically shorter than long-term disability.

How much does EI pay for short-term disability?

You could receive 55% of your earnings up to a maximum of $638 a week. The number of weeks of benefits you could receive depends on the date your claim begins: before December 18, 2022: up to 15 weeks. on or after December 18, 2022: up to 26 weeks New.

How long does it take to get short-term disability Canada Life?

This waiting period, chosen at the time you apply, can be anywhere from 30 days to a year. After this period is fulfilled, your monthly benefit would begin. The monthly benefit replaces a percentage of your paycheque when an illness or accident stops you from working.

How much does short term disability pay in Canada?

Generally, disability insurance replaces between 60% and 85% of your regular income, up to a maximum amount, for a specified time if you: temporarily can't work.

How much does short term disability pay in Canada?

The amount of your short-term disability benefits is dependent on your plan. There are some that offer a full income replacement; however, many only cover a portion of your salary. The short-term disability benefit may range from 60% to 100% of your salary.

What qualifies for short-term disability in Canada?

Who qualifies for short-term disability? As long as an employee has short-term disability benefits coverage at the time they become disabled, they are qualified to receive short-term disability benefits. The medical conditions covered by a policy range from physical to psychological, cognitive, or emotional.

How much does EI pay for short term disability?

You could receive 55% of your earnings up to a maximum of $638 a week. The number of weeks of benefits you could receive depends on the date your claim begins: before December 18, 2022: up to 15 weeks. on or after December 18, 2022: up to 26 weeks New.

How much does most short term disability pay?

How much does short term disability pay? If you qualify for short term disability benefits, you will typically be reimbursed for about 60 percent of your lost wages. Depending on the policy, the benefit may be as low as 40 percent or as high as 70 percent. Most policies have a benefit cap as well.

How long does it take to get short term disability Canada Life?

This waiting period, chosen at the time you apply, can be anywhere from 30 days to a year. After this period is fulfilled, your monthly benefit would begin. The monthly benefit replaces a percentage of your paycheque when an illness or accident stops you from working.

What conditions automatically qualify you for disability in Canada?

You may be eligible for CPP disability benefits if: you contributed to the CPP for a certain number of years. you're under 65 years old. you have a severe and prolonged mental or physical disability. your disability prevents you from working on a regular basis.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify Canada 22-054-300 without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your Canada 22-054-300 into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I sign the Canada 22-054-300 electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your Canada 22-054-300 in minutes.

How do I edit Canada 22-054-300 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as Canada 22-054-300. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is Canada 22-054-300?

Canada 22-054-300 is a form used by the Canada Revenue Agency (CRA) to report certain financial information relevant to tax compliance in Canada.

Who is required to file Canada 22-054-300?

Individuals and entities that are required to report specific financial activities or transactions as mandated by the CRA must file Canada 22-054-300.

How to fill out Canada 22-054-300?

To fill out Canada 22-054-300, individuals or entities must provide accurate details regarding their financial information as specified in the guidelines provided by the CRA, including any transactions or income that fall under the reporting criteria.

What is the purpose of Canada 22-054-300?

The purpose of Canada 22-054-300 is to ensure compliance with Canadian tax laws by consolidating required financial information that may impact tax obligations and liabilities.

What information must be reported on Canada 22-054-300?

Information that must be reported on Canada 22-054-300 typically includes details of financial transactions, income sources, and any other financial information required by the CRA to assess tax liability.

Fill out your Canada 22-054-300 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada 22-054-300 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.