MetLife Non-Erisa 403(b) Withdrawal Request 2018 free printable template

Show details

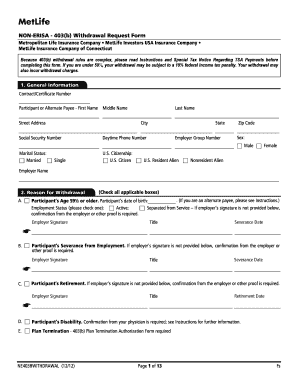

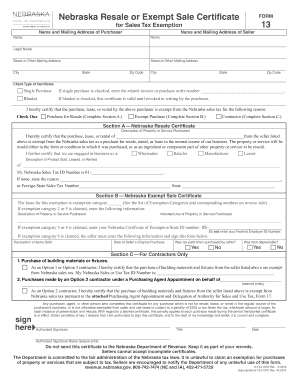

AnnuitiesNONERISA 403(b) withdrawal request Metropolitan Life Insurance CompanyThings to know before you begin Because 403(b) withdrawal rules are complex, please read Instructions and Special Tax

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MetLife Non-Erisa 403b Withdrawal Request

Edit your MetLife Non-Erisa 403b Withdrawal Request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MetLife Non-Erisa 403b Withdrawal Request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MetLife Non-Erisa 403b Withdrawal Request online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MetLife Non-Erisa 403b Withdrawal Request. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MetLife Non-Erisa 403(b) Withdrawal Request Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MetLife Non-Erisa 403b Withdrawal Request

How to fill out MetLife Non-Erisa 403(b) Withdrawal Request

01

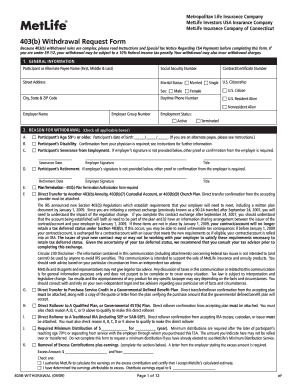

Begin by downloading the MetLife Non-Erisa 403(b) Withdrawal Request form from the MetLife website or obtaining a physical copy from your plan administrator.

02

Read the instructions carefully before filling out the form to ensure you understand the requirements.

03

Fill in your personal information, including your name, address, and Social Security number.

04

Indicate the type of withdrawal you are requesting (e.g., hardship withdrawal, age-related withdrawal).

05

Provide details about the amount you wish to withdraw and the reason for the withdrawal.

06

If applicable, include any supporting documentation that may be required for your specific withdrawal type.

07

Review the completed form for accuracy and completeness to avoid any delays in processing.

08

Sign and date the form, certifying that all the information provided is true and correct.

09

Submit the form to MetLife via the specified submission method (mail, fax, or online submission) as indicated in the instructions.

Who needs MetLife Non-Erisa 403(b) Withdrawal Request?

01

Individuals who are currently enrolled in a MetLife Non-Erisa 403(b) plan and wish to access their funds.

02

Employees seeking to make a withdrawal due to financial hardship, retirement, or other eligible reasons.

03

Plan participants who need to formally record their request for withdrawal from their retirement savings account.

Fill

form

: Try Risk Free

People Also Ask about

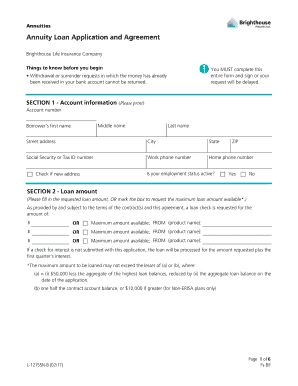

Is MetLife and Brighthouse the same?

November 2014 Through a series of mergers, MetLife Insurance Company USA is formed as an insurance company, which includes MICC, MetLife Investors Insurance Company and MetLife Investors USA Insurance Company. Today, MetLife Insurance Company USA is Brighthouse Life Insurance Company, licensed in 49 states.

Is Brighthouse Financial related to MetLife?

Brighthouse Financial is an independent company, meaning that they operate completely separate from MetLife. However, while Brighthouse Financial is a completely separate entity from MetLife, meaning that MetLife does not have any direct control over Brighthouse Financial.

How do I file a claim with Brighthouse Financial?

Claims Packet from Brighthouse Claims at (800) 882-1292. calendar days of receiving the Notice of Claim. information, which must include the LTC Claim Form, Licensed Health Care Practitioner Statement, and Plan of Care to Brighthouse Claims within 90 days of submitting the Notice of Claim.

Are Brighthouse annuities safe?

Overall, Brighthouse Financial is a good choice for annuities or life insurance coverage. Consider the Brighthouse SmartCare product if you're planning your financial future.

Is Brighthouse in financial trouble?

Based on the latest financial disclosure, Brighthouse Financial has a Probability Of Bankruptcy of 39.0%. This is 21.89% lower than that of the Insurance sector and significantly higher than that of the Financials industry.

Is Brighthouse a good annuity?

Bottom Line. Overall, Brighthouse Financial is a good choice for annuities or life insurance coverage. Consider the Brighthouse SmartCare product if you're planning your financial future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in MetLife Non-Erisa 403b Withdrawal Request without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your MetLife Non-Erisa 403b Withdrawal Request, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an eSignature for the MetLife Non-Erisa 403b Withdrawal Request in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your MetLife Non-Erisa 403b Withdrawal Request directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I edit MetLife Non-Erisa 403b Withdrawal Request on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing MetLife Non-Erisa 403b Withdrawal Request.

What is MetLife Non-Erisa 403(b) Withdrawal Request?

The MetLife Non-Erisa 403(b) Withdrawal Request is a form used by individuals to request a withdrawal of funds from their Non-Erisa 403(b) retirement plan, which is typically offered to employees of educational institutions, certain non-profits, and religious organizations.

Who is required to file MetLife Non-Erisa 403(b) Withdrawal Request?

Individuals who wish to withdraw funds from their Non-Erisa 403(b) accounts must file the MetLife Non-Erisa 403(b) Withdrawal Request. This includes plan participants who meet the eligibility criteria for withdrawal.

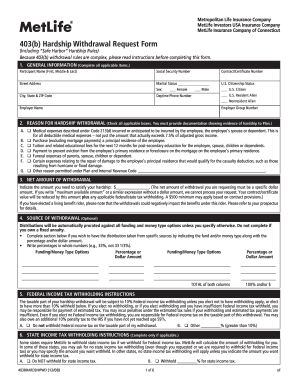

How to fill out MetLife Non-Erisa 403(b) Withdrawal Request?

To fill out the MetLife Non-Erisa 403(b) Withdrawal Request, participants should provide their personal information, account details, the reason for withdrawal, the amount requested, and any necessary signatures. It's important to follow the instructions provided on the form carefully.

What is the purpose of MetLife Non-Erisa 403(b) Withdrawal Request?

The purpose of the MetLife Non-Erisa 403(b) Withdrawal Request is to formally document and process an individual's request to withdraw funds from their Non-Erisa 403(b) retirement plan, ensuring compliance with regulatory requirements and plan rules.

What information must be reported on MetLife Non-Erisa 403(b) Withdrawal Request?

The information that must be reported on the MetLife Non-Erisa 403(b) Withdrawal Request includes the participant's name, Social Security number, account number, withdrawal amount, reason for withdrawal, and any applicable signatures or certifications.

Fill out your MetLife Non-Erisa 403b Withdrawal Request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MetLife Non-Erisa 403b Withdrawal Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.