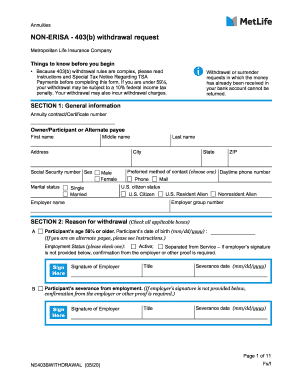

MetLife Non-Erisa 403(b) Withdrawal Request 2020-2025 free printable template

Get, Create, Make and Sign non erisa 403 b withdrawal form

How to edit non erisa withdrawal request form fillable online

Uncompromising security for your PDF editing and eSignature needs

MetLife Non-Erisa 403(b) Withdrawal Request Form Versions

How to fill out non erisa 403 withdrawal request form make

How to fill out MetLife Non-Erisa 403(b) Withdrawal Request

Who needs MetLife Non-Erisa 403(b) Withdrawal Request?

Video instructions and help with filling out and completing metlife fmla paperwork

Instructions and Help about non erisa 403 request form

Hi I'm Nick Ortiz I'm a board certified disability attorney in Florida today I'm here to talk to you about MetLife is short for Metropolitan Life Insurance Company my life is one of the largest long term disability insurance companies in the world you're probably here today because MetLife has denied your long term disability claim or has unreasonably delayed its decision-making in your claim there are several reasons why MetLife may have denied your long term disability claim first and foremost and perhaps the most likely reason is that they had one of their doctors review your file and their doctor has placed very few limitations on you and therefore the insurance company believes you could work based on the limitations identified by their doctor another reason why MetLife denies claims is because they may have had your file reviewed by a vocational expert and this vocational expert gives an opinion that there are jobs that you can do give the limitations identified by their doctor a third reason why your claim may have been denied or terminated is because of a change in the definition of the term disability what that means is most policies define disability as whether you could perform the material duties of your job for the first two years but then that definition changes such that they look to see whether you could do any job or what we call any occupation after two years and in many cases the insurance company says we understand you could not do the material duties of your job, but we believe that you could do the material duties of other types of work, and therefore they cut you off of your benefit another reason why MetLife may have denied your claim is because they say that there is insufficient medical evidence to support the case that doesn't mean that you don't have a problem what they're saying is that they don't believe that your problem is significant enough to limit you from doing work activity for example in a back pain problem they may say that the MRI from your medical records does not show a significant enough problem to caused the types of pain that you're experiencing, and therefore they don't believe that your pain would keep you from working but here's an interesting side note about the insufficient medical evidence argument they may not have all of your medical records and that is one of the key things that we can assist our clients in is making sure that the insurance company has all the evidence it needs to make the decision in the claim, and I'll give you one more reason why they might not your claim these insurance companies in today's day and age they're conducting video surveillance, so they may have hired a private investigator to follow you around and record you, and they may say that your activities in the video recording or inconsistent with a disability, and they also may be conducting surveillance by going to social media checking you out on Facebook or Twitter, and they may say that the photos or comments...

People Also Ask about non erisa b request

Is MetLife and Brighthouse the same?

Is Brighthouse Financial related to MetLife?

How do I file a claim with Brighthouse Financial?

Are Brighthouse annuities safe?

Is Brighthouse in financial trouble?

Is Brighthouse a good annuity?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send non erisa withdrawal fillable to be eSigned by others?

Can I sign the non erisa b request form edit electronically in Chrome?

How do I fill out the non erisa b request form create form on my smartphone?

What is MetLife Non-Erisa 403(b) Withdrawal Request?

Who is required to file MetLife Non-Erisa 403(b) Withdrawal Request?

How to fill out MetLife Non-Erisa 403(b) Withdrawal Request?

What is the purpose of MetLife Non-Erisa 403(b) Withdrawal Request?

What information must be reported on MetLife Non-Erisa 403(b) Withdrawal Request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.