Get the free Credit Application - Business Account - March 2010 Revision.doc

Show details

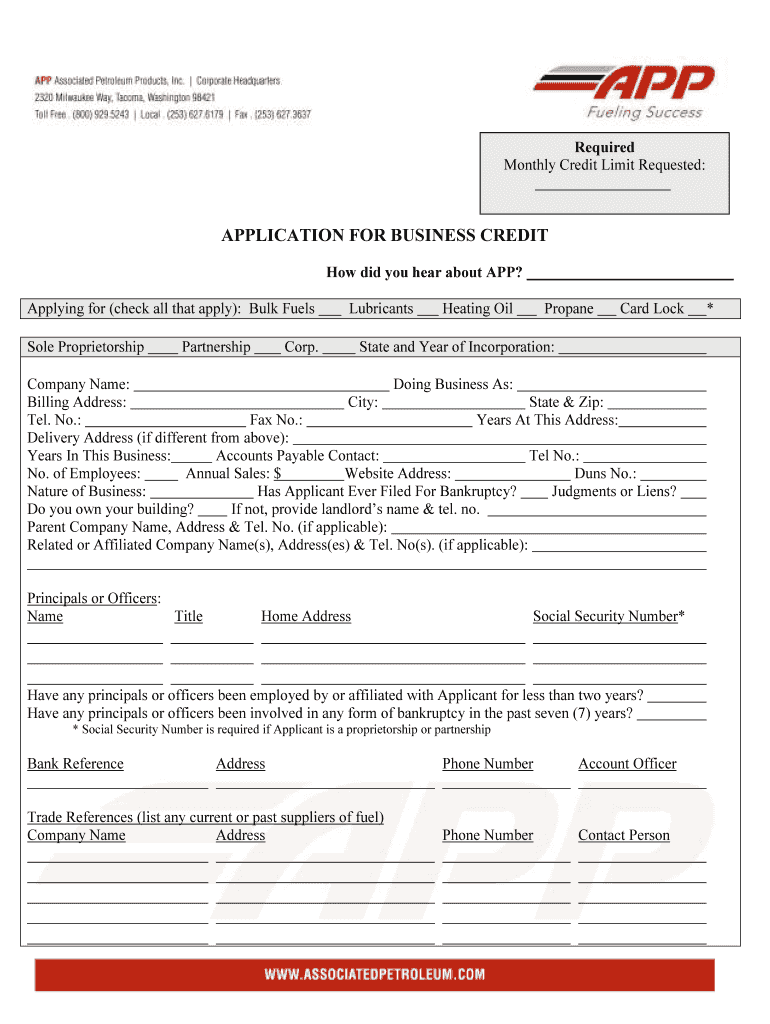

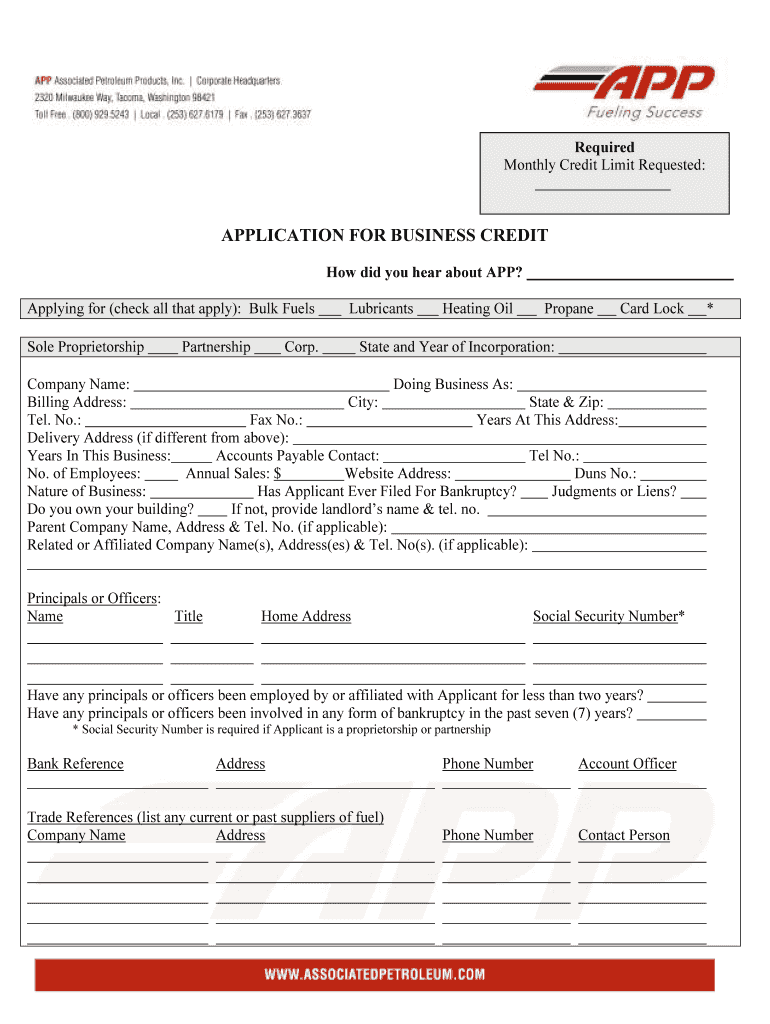

Required Monthly Credit Limit Requested: APPLICATION FOR BUSINESS CREDIT How did you hear about APP? Applying for (check all that apply): Bulk Fuels Sole Proprietorship Partnership Lubricants Corp.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit application - business

Edit your credit application - business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit application - business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit application - business online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit application - business. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit application - business

How to fill out a credit application - business:

01

Start by gathering all the necessary information about your business, including its legal name, address, and contact details.

02

Provide details about the nature of your business, such as its industry, the number of years in operation, and the type of ownership (e.g., sole proprietorship, partnership, corporation).

03

Indicate the purpose of the credit application, whether it's for a line of credit, business loan, or other financial needs.

04

Include financial information about your business, such as annual revenue, net income, and total assets and liabilities.

05

Provide details about any outstanding debts or loans your business currently has, including the names of the lenders and the amounts owed.

06

Disclose information about any other owners or individuals who have a significant interest in your business, including their names, addresses, and ownership percentages.

07

If applicable, include references from other businesses or professionals who can vouch for your business's creditworthiness.

08

Review the credit application thoroughly for accuracy and completeness before submitting it to the lender.

Who needs a credit application - business:

01

Small businesses looking to secure financing for various purposes, such as funding expansion, purchasing equipment, or managing cash flow.

02

Startups that need capital to launch their business operations or expand their market presence.

03

Established companies aiming to acquire a new line of credit or refinance their existing debt.

04

Businesses planning to apply for trade credit with suppliers or establish relationships with lenders.

05

Companies going through a transitional period, such as mergers, acquisitions, or ownership changes, which may require additional financing.

It is important to note that the specific requirements for a credit application may vary depending on the lender and the type of credit being sought. It's advisable to consult with the lender or a financial advisor for guidance on filling out a credit application tailored to your business's needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit application - business from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including credit application - business, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make changes in credit application - business?

The editing procedure is simple with pdfFiller. Open your credit application - business in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I edit credit application - business on an Android device?

The pdfFiller app for Android allows you to edit PDF files like credit application - business. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is credit application - business?

A credit application for a business is a document that requests information from a company in order to establish credit terms with a potential creditor or supplier.

Who is required to file credit application - business?

Any business that wants to obtain credit from a creditor or supplier is required to file a credit application.

How to fill out credit application - business?

To fill out a credit application for a business, the company must provide basic information such as business name, address, contact information, financial details, and trade references.

What is the purpose of credit application - business?

The purpose of a credit application for a business is to assess the creditworthiness of the company and determine whether to extend credit terms.

What information must be reported on credit application - business?

Information such as business name, address, contact information, financial statements, bank references, trade references, and any other relevant business data must be reported on a credit application.

Fill out your credit application - business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Application - Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.