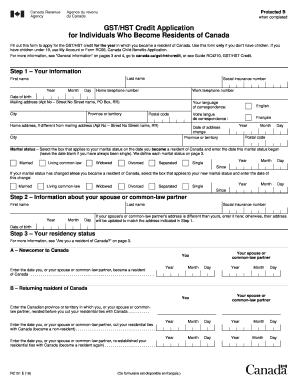

Canada RC151 E 2018 free printable template

Get, Create, Make and Sign Canada RC151 E

Editing Canada RC151 E online

Uncompromising security for your PDF editing and eSignature needs

Canada RC151 E Form Versions

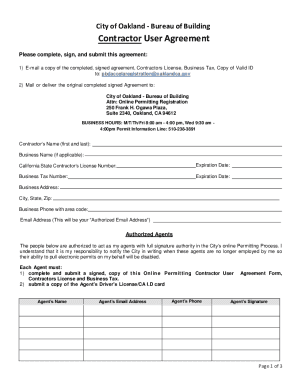

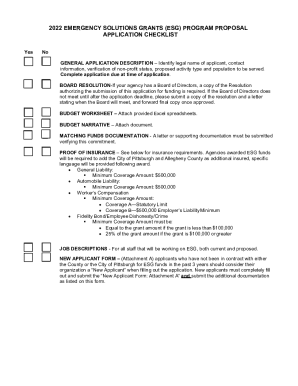

How to fill out Canada RC151 E

How to fill out Canada RC151 E

Who needs Canada RC151 E?

Instructions and Help about Canada RC151 E

Music hello Canadians I'm your mentor buck ability CEU pads in this presentation I'm going to discuss with you how to fill up form our c151 there is a very important form for getting Goths credit especially for new immigrants, but before we proceed formally with this presentation there's a disclaimer it simply tells you that the purpose of this presentation is to educate Canadians about filling up a form or discussing some legal related issues but if you need any specific advice on any legal matters where it pertains to taxation or accounting you may contact us at for number two eight nine five two three four nine four, or you may email us at pascal 2017 at Malcolm now we move for with the formal presentation here is the scheme of presentation if you just look at the screen behind me, you'll find that there are certain important area that I am going to share with you first we look into the purpose or form our c151 and then of course its different parts, and you can see from the screen there are five important parts in this form a B C D and E and each part has a specific purpose we look at rate that what those specific purposes are and what care you have to keep in mind while filling up this form okay we move forward now what is the purpose of form our c151 the purpose is to apply for the Goths credit for the year that you became a resident of Canada since Canada is a country of immigrants and every year about 03 24 million Canadians are entering this country, so their first concern is that they should be entitled to Goths credit because initially most of the immigrants have low income levels and this is one income boost that they may get immediately after landing into Canada okay now Part A of form 1 5rc five one is it relates to information about the applicant, and you can see on the screen and this part you have to as the main applicant you have to mention your name your social insurance number that is normally issued once you learn from the airport then your date of birth your telephone number your mailing address and your marital status whether you are married they were separated or unmarried now we move to the next part it is Part B and the information relates to your spouse this information is comparatively limited its only restricted to the name of your spouse his or her same number and his or her date of birth then there is Part C area to ask you about your residency status now there could be two categories in this context one is the new residents of Canada the people who are learning in Canada for the first time what type of information they have to provide first information relates to the date you became resident of Canada, and usually it is the date when you land in Canada then date your spouse or common-law partner became resident of Canada of course if you are traveling together it would be the same day now the second part relates to those residents who happen to be residents earlier, but somehow they left Canada and how they are...

People Also Ask about

Who is eligible for GST credit in Canada?

What does rt001 mean?

What services are exempt from GST in Canada?

What is GST paid?

How do I pay GST?

What is RC151?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify Canada RC151 E without leaving Google Drive?

How can I get Canada RC151 E?

How do I fill out Canada RC151 E on an Android device?

What is Canada RC151 E?

Who is required to file Canada RC151 E?

How to fill out Canada RC151 E?

What is the purpose of Canada RC151 E?

What information must be reported on Canada RC151 E?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.