Canada RC151 E 2017 free printable template

Show details

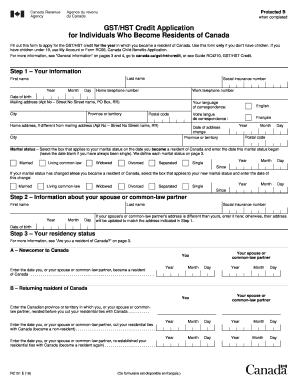

RC151 E 17 Ce formulaire est disponible en fran ais. Part D Statement of income Enter your income from all sources both inside and outside Canada in Canadian dollars. To register your child for the GST/HST credit go to My Account at cra.gc.ca/myaccount or send Form RC66 Canada Child Benefits Application. If you share custody of a child go to cra.gc.ca/gsthstcredit and select Shared custody call 1-800-387-1193 or see Booklet T4114 Canada Child Benefits for more information. Your child should...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada RC151 E

Edit your Canada RC151 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada RC151 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada RC151 E online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada RC151 E. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada RC151 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada RC151 E

How to fill out Canada RC151 E

01

Obtain the Canada RC151 E form from the Canada Revenue Agency (CRA) website or your local CRA office.

02

Fill in the required personal information, including your name, address, and Social Insurance Number (SIN).

03

Indicate the applicable tax year for which you are filing the form.

04

Provide information regarding any applicable tax credits or deductions.

05

If applicable, include details about your income or any other relevant financial information.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form to certify that the information provided is true and complete.

08

Submit the completed form as directed by the CRA, either online or via mail.

Who needs Canada RC151 E?

01

Individuals or organizations seeking to request a refund or adjustment related to their tax return.

02

Canadian taxpayers who have overpaid their taxes or are entitled to certain tax credits.

03

People who need to report changes in their financial situation affecting their tax obligations.

Instructions and Help about Canada RC151 E

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between RC and RT?

The most common CRA program accounts a business may need are: GST/HST (RT), if your business collects GST/HST. Payroll deductions (RP), if your business pays employees. Corporation income tax (RC), if your business is incorporated.

Who is eligible for GST credit in Canada?

Generally, you have to be 19 years of age or older to get the GST/HST credit. If you turn 19 years of age before April 2023, make sure that you file your 2021 tax return.

What is the GST credit in Canada?

The goods and services tax/harmonized sales tax (GST/HST) credit is a tax-free quarterly payment that helps individuals and families with low and modest incomes offset the GST or HST that they pay. It may also include payments from provincial and territorial programs.

What does rt001 mean?

If the number is a business number (BN) ending in RT0001*, it's your GST/HST remittance owing. If the number is a BN ending in RC0001, it's your corporate tax owing.

What is GST paid?

GST is payable if you make a taxable supply. A taxable supply is a supply you have paid for or receive consideration for in the course of running your business.

What is RC151?

RC151 GST/HST Credit and Climate Action Incentive Payment Application for Individuals Who Become Residents of Canada - Canada.ca.

How do I pay GST?

Pay your GST through the ATO's online portal using BPAY, or a credit or debit card. You can also pay by phone on 1300 898 089, electronic transfer or in person at Australia Post.

What is the new drug for PSP?

ASN90 received orphan drug designations from EMA and the US FDA for the treatment of progressive supranuclear palsy.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify Canada RC151 E without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your Canada RC151 E into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send Canada RC151 E to be eSigned by others?

To distribute your Canada RC151 E, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete Canada RC151 E on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your Canada RC151 E by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is Canada RC151 E?

Canada RC151 E is a form used by the Canada Revenue Agency (CRA) that allows individuals and businesses to provide information about their tax situation, specifically regarding certain tax credits and benefits.

Who is required to file Canada RC151 E?

Individuals and businesses that are claiming specific tax credits or benefits, or that have had changes in their tax situation affecting those claims, are required to file the Canada RC151 E.

How to fill out Canada RC151 E?

To fill out Canada RC151 E, individuals must provide accurate personal and business information, specific tax-related details, and ensure all required sections are completed clearly and correctly according to the instructions provided by the CRA.

What is the purpose of Canada RC151 E?

The purpose of Canada RC151 E is to collect information from taxpayers that will help the Canada Revenue Agency administer tax credits and benefits accurately, ensuring that individuals and businesses receive appropriate financial support.

What information must be reported on Canada RC151 E?

Information that must be reported on Canada RC151 E includes personal identification details, income information, changes in filing status, and any relevant tax credits or benefits being claimed.

Fill out your Canada RC151 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada rc151 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.