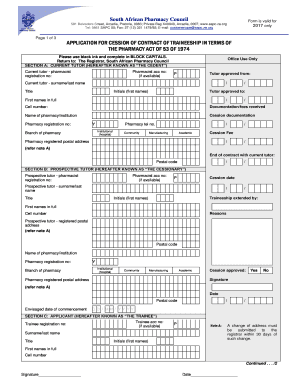

MA M-8453 2017 free printable template

Show details

2017Form M8453

Individual Income Tax Declaration

for Electronic Filing Massachusetts

Department of

RevenuePlease print or type. Privacy Act Notice available upon request. For the year January 1December

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign m 8453 tax form

Edit your m 8453 tax form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your m 8453 tax form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing m 8453 tax form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit m 8453 tax form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA M-8453 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out m 8453 tax form

How to fill out MA M-8453

01

Start with the taxpayer's personal information including name, address, and Social Security number.

02

Indicate the type of tax return being filed (e.g., individual, joint).

03

Fill out the income section, providing details about all sources of income.

04

Report any adjustments to income accurately.

05

Complete the deductions section, listing all applicable deductions.

06

Calculate the total tax owed or refund expected.

07

Sign and date the form to certify that the information provided is correct.

Who needs MA M-8453?

01

Individuals or businesses filing a tax return in Massachusetts who require an electronic submission.

02

Tax professionals preparing and submitting tax returns on behalf of clients who live in Massachusetts.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of form 8453?

Form FTB 8453, California e-fle Return Authorization for Individuals, is the signature document for individual e-fle returns. By signing form FTB 8453 the taxpayer, electronic return originator (ERO), and paid preparer declare that the return is true, correct, and complete.

Do I need to mail 8453 form?

If you are an ERO, you must mail Form 8453 to the IRS within 3 business days after receiving acknowledgement that the IRS has accepted the electronically filed tax return.

Where do I send my IRS form 8453?

Where to File Forms Beginning with the Number 8 Form Name (For a copy of a Form, Instruction, or Publication)Address to Mail Form to IRS:Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file ReturnInternal Revenue Service Attn: Shipping and Receiving, 0254 Receipt and Control Branch Austin, TX 73344-025447 more rows

Why do I have to submit form 8453?

If you received a request to submit Form 8453 (U.S. Individual Income Tax Transmittal for an IRS e-file Return), it means you'll need to mail some forms to the IRS that can't be e-filed. Federal tax returns that are e-filed need to contain the same information that paper-filed returns contain.

What is a 8879 form used for?

What's New. Form 8879 is used to authorize the electronic filing (e-file) of original and amended returns. Use this Form 8879 (Rev. January 2021) to authorize e-file of your Form 1040, 1040-SR, 1040-NR, 1040-SS, or 1040- X, for tax years beginning with 2019.

What is 8453 S form used for?

Use this form to: Authenticate an electronic Form 1120S, U.S. Income Tax Return for an S Corporation, Authorize the ERO, if any, to transmit via a third-party transmitter, Authorize the intermediate service provider (ISP) to transmit via a third-party transmitter if you are filing online (not using an ERO), and.

Will form 8453 delay my tax return?

Form 8453 won't hold up the processing of your return, but you should mail it within 48 hours of when the IRS accepted your return.

What is the difference between 8453 and 8879?

If the taxpayer is signing the electronically filed return by using a PIN, use Form 8879, California e-file Signature Authorization for Individuals. If the taxpayer is signing the return via handwritten signature, use Form 8453, California e-file Return Authorization for Individuals.

Can I file form 8453 online?

If you are filing your tax return using an online provider, mail Form 8453 to the IRS within 3 business days after you have received acknowledgement from your intermediate service provider and/or transmitter that the IRS has accepted your electronically filed tax return.

What is the difference between Form 8453 and 8879?

If the taxpayer is signing the electronically filed return by using a PIN, use Form 8879, California e-file Signature Authorization for Individuals. If the taxpayer is signing the return via handwritten signature, use Form 8453, California e-file Return Authorization for Individuals.

What is a 8453?

About Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return | Internal Revenue Service.

What is an 8453 signature document?

A signed Form 8453 authorizes the transmitter to send the return to the IRS. Form 8453 includes the taxpayer's declaration under penalties of perjury that the return is true and complete, as well as the taxpayer's Consent to Disclosure.

How do I use Form 8453?

Use Form 8453 to send any required paper forms or supporting documentation listed next to the checkboxes on Form 8453 (don't send Form(s) W-2, W-2G, or 1099-R). Don't attach any form or document that isn't shown on Form 8453 next to the checkboxes.

How long do I have to mail form 8453?

Form 8453 won't hold up the processing of your return, but you should mail it within 48 hours of when the IRS accepted your return.

What causes a processing delay on an IRS refund?

Early or last-minute tax filing. If you file too early, some of the tax forms you need may not be finalized for handling yet by the IRS. This delays your refund since the IRS won't process a return until their software is ready to handle all necessary tax forms. But filing at the last minute can be just as problematic.

What is form M 8453?

About Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return | Internal Revenue Service.

Who must file form 8879?

Complete Form 8879 when the Practitioner PIN method is used or when the taxpayer authorizes the ERO to enter or generate the taxpayer's personal identification number (PIN) on his or her e-filed individual income tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute m 8453 tax form online?

Filling out and eSigning m 8453 tax form is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for the m 8453 tax form in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your m 8453 tax form in seconds.

Can I create an eSignature for the m 8453 tax form in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your m 8453 tax form directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is MA M-8453?

MA M-8453 is a form used by taxpayers in Massachusetts to authorize electronic filing of their tax returns.

Who is required to file MA M-8453?

Taxpayers who file their Massachusetts state tax returns electronically and are required by the Massachusetts Department of Revenue to submit this authorization form.

How to fill out MA M-8453?

To fill out MA M-8453, provide your personal information such as name, address, Social Security number, and the electronic software used for tax preparation, and sign the form to authorize electronic filing.

What is the purpose of MA M-8453?

The purpose of MA M-8453 is to serve as a declaration of the taxpayer's intention to file electronically, and it provides authorization for the tax preparer to file the tax return on the taxpayer's behalf.

What information must be reported on MA M-8453?

The information that must be reported on MA M-8453 includes taxpayer's name, Social Security number, address, the tax year, and details about the electronic filing including the signature of the taxpayer.

Fill out your m 8453 tax form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

M 8453 Tax Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.