MA M-8453 2019 free printable template

Show details

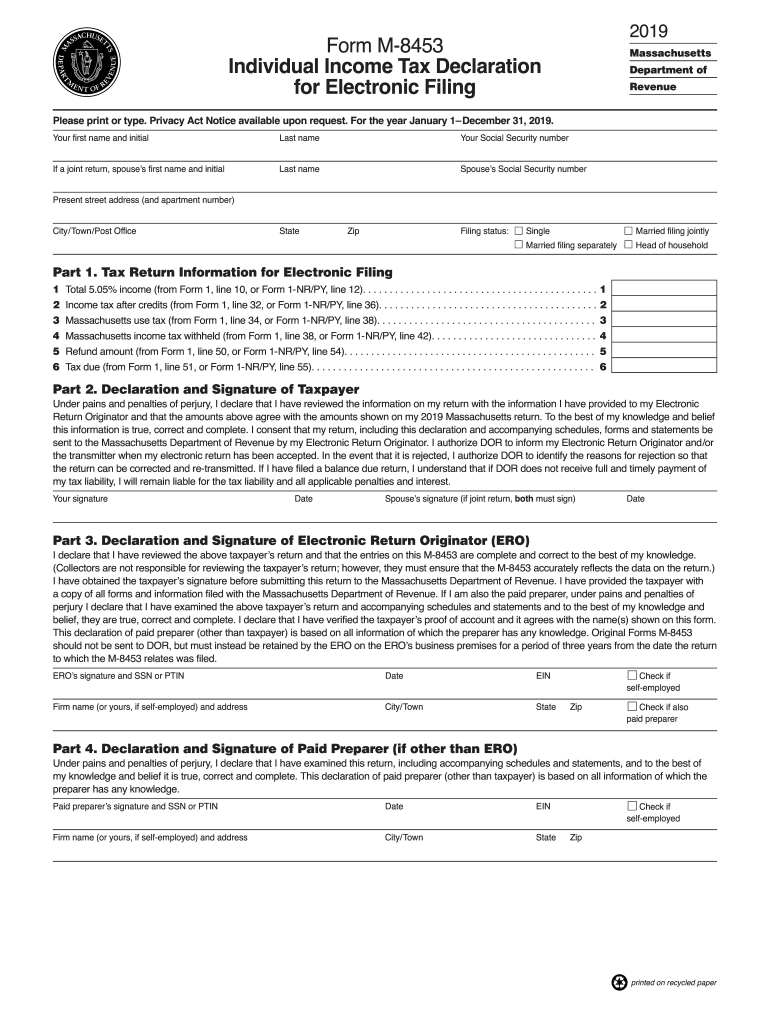

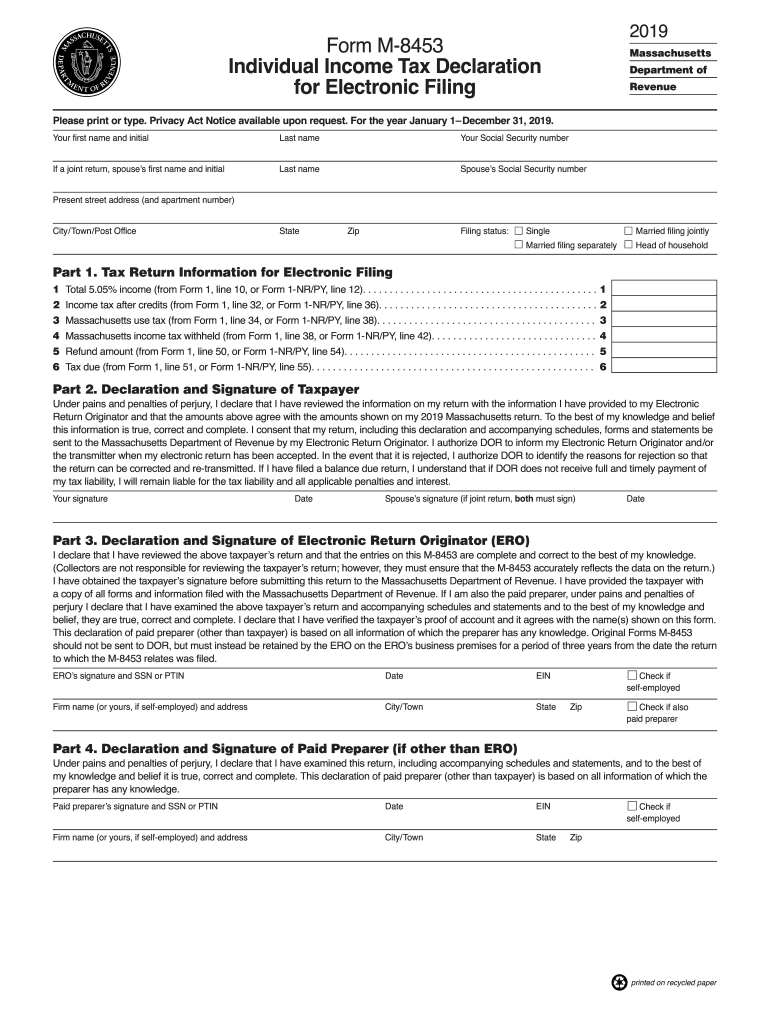

2019Form M8453

Individual Income Tax Declaration

for Electronic Filing Massachusetts

Department of

RevenuePlease print or type. Privacy Act Notice available upon request. For the year January 1 December

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA M-8453

Edit your MA M-8453 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA M-8453 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MA M-8453 online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MA M-8453. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA M-8453 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA M-8453

How to fill out MA M-8453

01

Obtain the MA M-8453 form from the Massachusetts Department of Revenue website or your local tax office.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Enter the tax year for which you are filing.

04

Complete the sections related to your income, deductions, and credits as required.

05

Ensure that all calculations are correct and match your supporting documents.

06

Sign and date the form at the bottom.

07

Submit the completed MA M-8453 form along with your tax return to the appropriate tax authority.

Who needs MA M-8453?

01

Individuals or businesses filing taxes in Massachusetts.

02

Anyone who is required to verify their identity for their tax return.

03

Taxpayers who do not file electronically and are submitting a paper return.

Fill

form

: Try Risk Free

People Also Ask about

Who signs form 8453?

An electronically transmitted return signed by an agent must have a power of attorney attached to Form 8453 that specifically authorizes the agent to sign the return.

Who should file form 8453?

You'll need to file this federal tax signature form if you're attaching the following forms and documents: Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes.

Can you submit 8843 late?

If you were unaware of the fact that you were required to submit Form 8843 for previous tax years in which you resided in the U.S. in F or J student/scholar status, you may file retroactively for each year the form was not filed. Simply include a separate Form 8843 for each year that was missed.

Why do I need to mail form 8453?

However, if you don't have the documents available electronically, you can use Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file return, to mail certain paper documents to support data within a taxpayer's e-file to the IRS.

What happens if I don't file form 8843?

There is no monetary penalty for failure to file Form 8843. However, in order to be compliant with federal regulations one must file Form 8843 if required to do so. (Remember, being compliant can affect the issuing of future US visas or granting of legal permanent resident status.)

Can you email form 8453?

Form 8453 (with the required forms or supporting documents) must be mailed to the IRS within three business days after receiving acknowledgement that the return was accepted. An electronically-transmitted return will not be considered complete until a Form 8453 is received by the IRS.

Who has to file form 8453?

You'll need to file this federal tax signature form if you're attaching the following forms and documents: Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes. Form 2848, Power of Attorney and Declaration of Representative. Form 3115, Application for Change in Accounting Method.

What is the 8453 form used for?

Use Form 8453 to send any required paper forms or supporting documentation listed next to the checkboxes on Form 8453 (don't send Form(s) W-2, W-2G, or 1099-R). Don't attach any form or document that isn't shown on Form 8453 next to the checkboxes.

Do I need to submit 8453?

IRS Form 8453 is required to be completed and mailed to the IRS when one or more of the forms listed on it are included in an e-filed return. (See below for the mailing address.)

Will form 8453 delay my tax return?

Form 8453 won't hold up the processing of your return, but you should mail it within 48 hours of when the IRS accepted your return.

What is form 8453 S used for?

Use this form to: Authenticate an electronic Form 1120S, U.S. Income Tax Return for an S Corporation, Authorize the ERO, if any, to transmit via a third-party transmitter, Authorize the intermediate service provider (ISP) to transmit via a third-party transmitter if you are filing online (not using an ERO), and.

How long do I have to mail form 8453?

If you are an ERO, you must mail Form 8453 to the IRS within 3 business days after receiving acknowledgement that the IRS has accepted the electronically filed tax return.

Who needs to fill out 8843?

What is Form 8843? Form 8843 is not an income tax return. Form 8843 is merely an informational statement required by the U.S. government for certain nonresident aliens (including the spouses or dependents of nonresident aliens).

How do I use Form 8453?

Use Form 8453 to send any required paper forms or supporting documentation listed next to the checkboxes on Form 8453 (don't send Form(s) W-2, W-2G, or 1099-R). Don't attach any form or document that isn't shown on Form 8453 next to the checkboxes.

What is IRS form 8453 used for?

Use this form to: authenticate an electronic employment tax return; authorize an electronic return originator (ERO) or an intermediate service provider (ISP) to transmit via a third party; and. authorize an electronic funds withdrawal for payment of federal taxes owed.

What is a 8453?

About Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return | Internal Revenue Service.

Why do I have to mail 8453?

IRS Form 8453 is required to be completed and mailed to the IRS when one or more of the forms listed on it are included in an e-filed return. (See below for the mailing address.)

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get MA M-8453?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific MA M-8453 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an eSignature for the MA M-8453 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your MA M-8453 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit MA M-8453 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share MA M-8453 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is MA M-8453?

MA M-8453 is a form used by taxpayers in Massachusetts to authorize electronic filing of their tax returns.

Who is required to file MA M-8453?

Taxpayers who file their Massachusetts tax returns electronically and need to provide a signature may be required to file MA M-8453.

How to fill out MA M-8453?

To fill out MA M-8453, taxpayers must provide personal identification information, sign the form, and ensure it is submitted according to instructions provided by the Massachusetts Department of Revenue.

What is the purpose of MA M-8453?

The purpose of MA M-8453 is to serve as a signature declaration for electronic filing, allowing taxpayers to file their tax returns electronically while meeting signature requirements.

What information must be reported on MA M-8453?

MA M-8453 requires taxpayers to provide their name, Social Security number, and details about the tax return being filed, including a declaration of electronically submitted information.

Fill out your MA M-8453 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA M-8453 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.