IMG ACH Transfer Authorization and Agreement Form 2017 free printable template

Show details

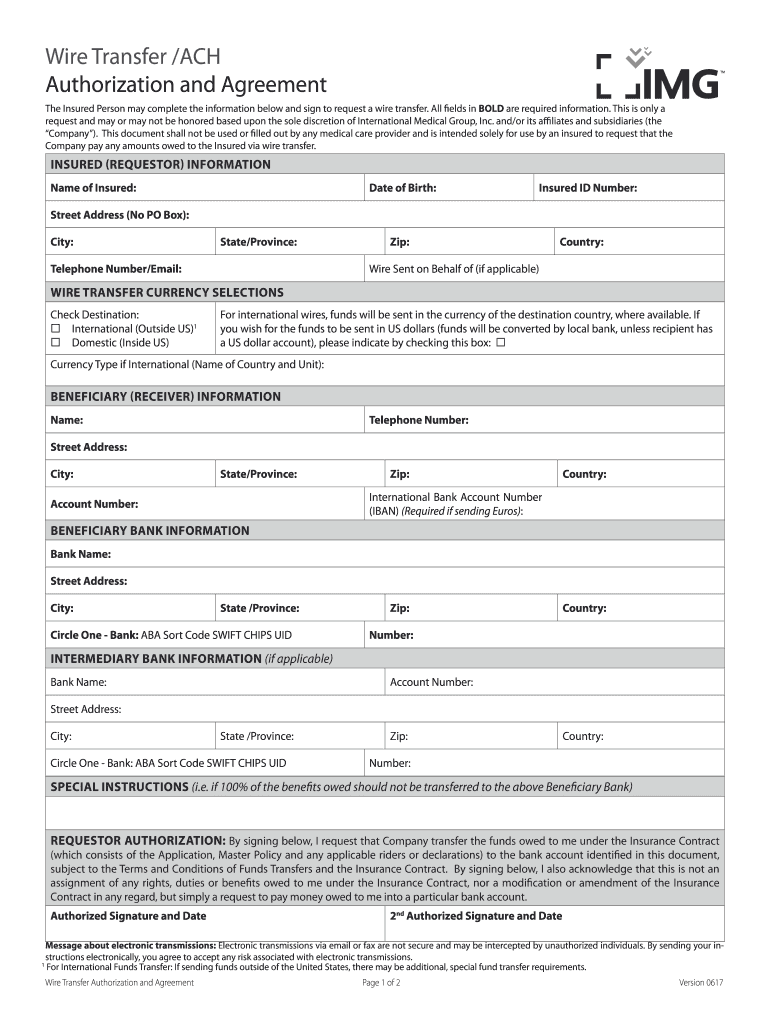

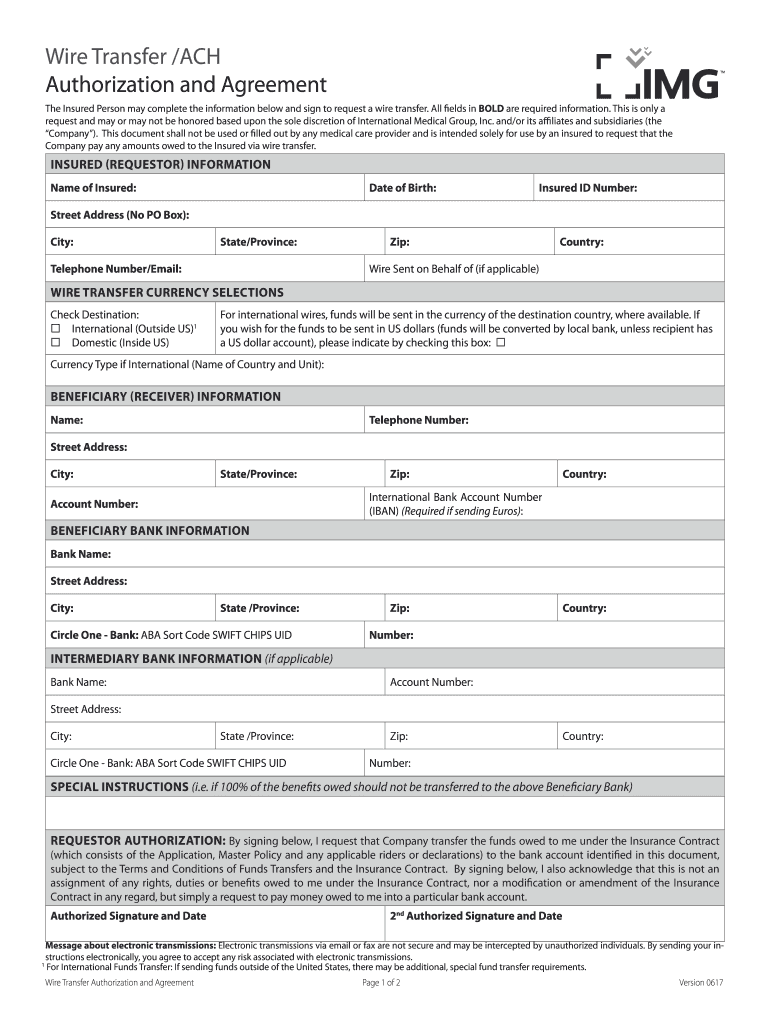

Wire Transfer /ACH

Authorization and Agreement

The Insured Person may complete the information below and sign to request a wire transfer. All fields in BOLD are required information. This is only

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IMG ACH Transfer Authorization and Agreement

Edit your IMG ACH Transfer Authorization and Agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IMG ACH Transfer Authorization and Agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IMG ACH Transfer Authorization and Agreement online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IMG ACH Transfer Authorization and Agreement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IMG ACH Transfer Authorization and Agreement Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IMG ACH Transfer Authorization and Agreement

How to fill out IMG ACH Transfer Authorization and Agreement Form

01

Obtain the IMG ACH Transfer Authorization and Agreement Form from the IMG website or customer service.

02

Fill out your personal information in the designated fields, including your name, address, and contact information.

03

Provide your bank account details, including the bank name, account number, and routing number.

04

Indicate whether you want to set up a one-time transfer or recurring transfers.

05

Review the terms and conditions associated with the ACH transfer.

06

Sign and date the form to authorize the transfer.

07

Submit the completed form to IMG via the specified method (email, mail, etc.).

Who needs IMG ACH Transfer Authorization and Agreement Form?

01

Individuals who want to authorize automatic ACH transfers for insurance premiums or payments with IMG.

02

Customers of IMG who prefer electronic payment options instead of traditional payment methods.

Fill

form

: Try Risk Free

People Also Ask about

Is ACH considered a wire transfer?

Both ACH and wire transfers work in a similar way, but with different timelines and rules. Wire transfers are direct, generally immediate transfers between two financial institutions. ACH transfers, meanwhile, pass through the Automated Clearing House, and can take up to a few business days.

Is wiring money faster than ACH?

Transfer speed Domestic wire transfers usually clear within minutes and settles within a business day. ACH transfers can take between hours and days to both clear and settle.

Is ACH better than wire?

ACH payments are less expensive than wire transfers. ACH payments are generally more secure compared to wire transfers. Wire transfers can be sent internationally, whereas ACH is a U.S.-only network. ACH transactions are ideal for businesses that process payments in bulk.

Is ACH and wire the same?

What Is the Difference Between ACH and Wire Transfers? An ACH transfer is completed through a clearing house and can be used to process direct payments or direct deposits. Wire transfers allow for the movement of money from one bank account to another, typically for a fee.

How do I create an ACH form?

Requirements of an ACH Authorization Form Payor's name and contact information. So that the payee can get in touch with the payor. Payee's name and contact information. Payment details. Authorization statement. Recourse statement. Payor's bank details. Date of agreement and signature. Sample of a Paper ACH Form.

How is wire transfer different from ACH transfer?

An ACH transfer is completed through a clearing house — a network of financial institutions — and is used most often for processing direct deposits or payments. A wire transfer is typically used for high-value transactions and is completed through a bank, which makes it faster, but it does have a fee.

What is an ACH form for direct deposit?

An ACH direct deposit is a type of electronic funds transfer made into a consumer's checking or savings account from their employer or a federal or state agency. The most common types of ACH direct deposits include salary payment, tax returns, and government benefits. ACH transfers have made paper checks obsolete.

Do I need an ACH authorization form?

An ACH debit authorization is consent given by a customer for a business to collect future payments from them. Before a business can begin collecting ACH debit payments from a customer, they must receive an ACH debit authorization from them.

What is an ACH form?

An Automated Clearing House (ACH) authorization is a payment authorization that gives the lender permission to electronically take money from your bank, credit union, or prepaid card account when your payment is due. You can revoke this authorization.

What is an ACH form used for?

An Automated Clearing House (ACH) authorization is a payment authorization that gives the lender permission to electronically take money from your bank, credit union, or prepaid card account when your payment is due. You can revoke this authorization.

What is needed on an ACH form?

To be valid, the ACH form must contain all its required information. At the minimum, it should have: Signature of the payer (accountholder of the bank account) Permission to the ACH payee to debit/credit the payer's account. The amount (or range of amounts) debited or credited.

What are the disadvantages of ACH payments?

There is a risk of fraud from inside threat actors. For example, if a bank employee has access to customer account data and ACH payment facilities and makes unauthorized transactions. There is also the risk of cybercriminals breaching security at financial institutions.

Why is ACH cheaper than wire?

Wire Transfer vs. ACH. Because a wire transfer requires the individual bank-to-bank process, it is usually more expensive than an automated clearing house (ACH) transaction, which requires minimal involvement by individuals at the financial institutions involved.

Can you use ACH for wire transfer?

Availability: ACH transfers only work for domestic transactions. If you want to send funds abroad through the ACH network, you must do so using an international wire transfer.

How do you create ACH?

How to Set up ACH Payments Set up your account. Choose an ACH payment processor. Fill out the accompanying paperwork. Understand the different types of ACH payments. Choose the right entry class. Read the ACH payment terms & conditions.

Is there a difference between ACH and wire transfer?

What Is the Difference Between ACH and Wire Transfers? An ACH transfer is completed through a clearing house and can be used to process direct payments or direct deposits. Wire transfers allow for the movement of money from one bank account to another, typically for a fee.

Can I get an ACH form online?

You can complete the ACH Authorization Form manually on paper or online. Also, you can have a copy for the customers while the companies retain the signed form for at least two years.

Is ACH the same as wire routing number?

And while they do have similarities — and an ACH routing number is an ABA routing number — there are differences between ACH and ABA routing numbers: ABA routing numbers are used for paper or check transfers. ACH routing numbers are used for electronic transfers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find IMG ACH Transfer Authorization and Agreement?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific IMG ACH Transfer Authorization and Agreement and other forms. Find the template you need and change it using powerful tools.

How do I make changes in IMG ACH Transfer Authorization and Agreement?

The editing procedure is simple with pdfFiller. Open your IMG ACH Transfer Authorization and Agreement in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How can I fill out IMG ACH Transfer Authorization and Agreement on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your IMG ACH Transfer Authorization and Agreement. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

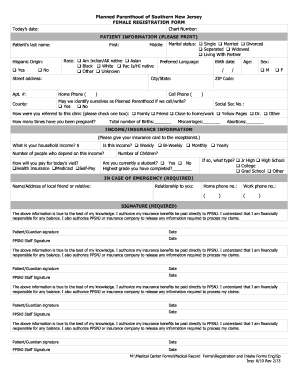

What is IMG ACH Transfer Authorization and Agreement Form?

The IMG ACH Transfer Authorization and Agreement Form is a document used to authorize automatic transfers of funds from a bank account. It establishes an agreement between the account holder and IMG regarding the initiation of ACH transactions.

Who is required to file IMG ACH Transfer Authorization and Agreement Form?

Individuals or entities that wish to set up automatic transfers of funds to or from IMG are required to file the IMG ACH Transfer Authorization and Agreement Form.

How to fill out IMG ACH Transfer Authorization and Agreement Form?

To fill out the form, provide the required personal or business information, including bank account details, specify the amount and frequency of the transfers, and sign the document to authorize the transactions.

What is the purpose of IMG ACH Transfer Authorization and Agreement Form?

The purpose of the form is to provide a formal authorization for the automatic transfer of funds and to outline the terms of the agreement between the account holder and IMG.

What information must be reported on IMG ACH Transfer Authorization and Agreement Form?

The form must include information such as the account holder's name, address, bank account number, routing number, the amount to be transferred, the frequency of transfers, and the signature of the account holder.

Fill out your IMG ACH Transfer Authorization and Agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IMG ACH Transfer Authorization And Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.