IMG ACH Transfer Authorization and Agreement Form 2019 free printable template

Show details

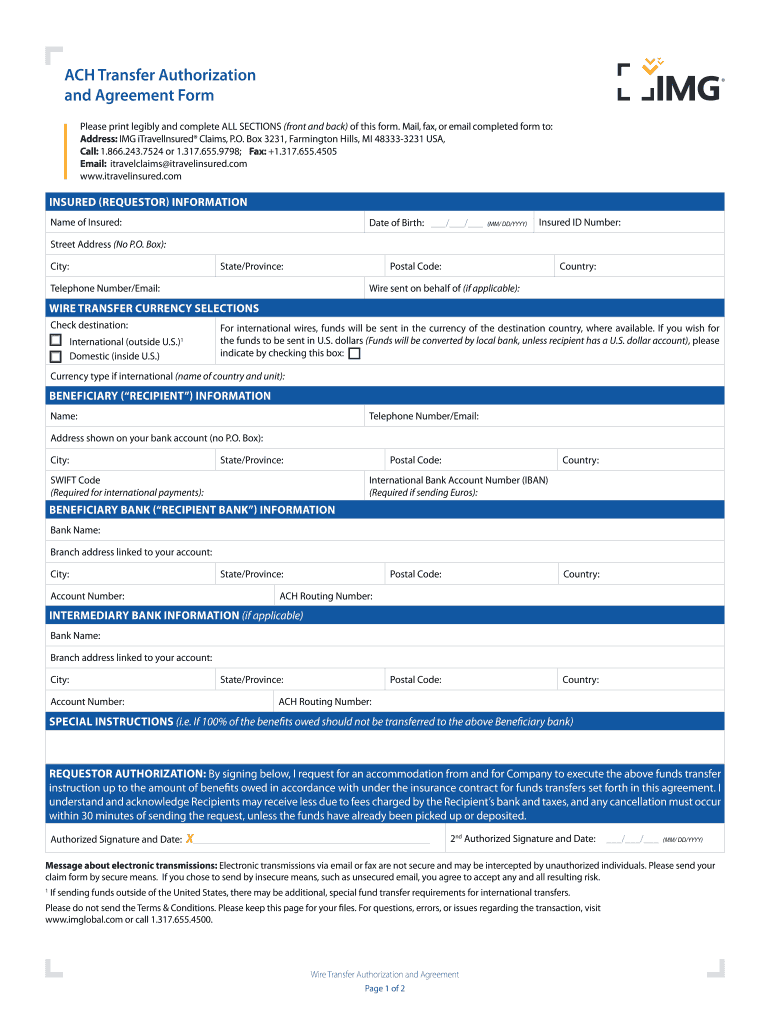

ACH Transfer Authorization and Agreement Form Please print legibly and complete ELECTIONS (front and back) of this form. Mail, fax, or email completed form to: Address: IMG iTravelInsured Claims,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IMG ACH Transfer Authorization and Agreement

Edit your IMG ACH Transfer Authorization and Agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IMG ACH Transfer Authorization and Agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IMG ACH Transfer Authorization and Agreement online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IMG ACH Transfer Authorization and Agreement. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IMG ACH Transfer Authorization and Agreement Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IMG ACH Transfer Authorization and Agreement

How to fill out IMG ACH Transfer Authorization and Agreement Form

01

Begin by downloading the IMG ACH Transfer Authorization and Agreement Form from the IMG website or requested via customer service.

02

Fill in your personal information including your name, address, phone number, and email address in the designated fields.

03

Provide your bank account information, including the bank name, account number, and routing number.

04

Specify the type of transaction you are authorizing, such as one-time transfer or recurring transfers.

05

Read through the terms and conditions of the agreement carefully to ensure you understand the obligations involved.

06

Sign and date the form at the bottom to validate your authorization.

07

Submit the completed form to IMG as per the instructions provided on the form, either via mail or electronically.

Who needs IMG ACH Transfer Authorization and Agreement Form?

01

Individuals who wish to set up automatic payments or direct transfers from their bank accounts to IMG.

02

Policyholders or members of IMG who want to manage premium payments, claims, or other transactions electronically.

03

Anyone who requires authorization for the transfer of funds related to IMG services.

Fill

form

: Try Risk Free

People Also Ask about

Is ACH considered a wire transfer?

Both ACH and wire transfers work in a similar way, but with different timelines and rules. Wire transfers are direct, generally immediate transfers between two financial institutions. ACH transfers, meanwhile, pass through the Automated Clearing House, and can take up to a few business days.

Is wiring money faster than ACH?

Transfer speed Domestic wire transfers usually clear within minutes and settles within a business day. ACH transfers can take between hours and days to both clear and settle.

Is ACH better than wire?

ACH payments are less expensive than wire transfers. ACH payments are generally more secure compared to wire transfers. Wire transfers can be sent internationally, whereas ACH is a U.S.-only network. ACH transactions are ideal for businesses that process payments in bulk.

Is ACH and wire the same?

What Is the Difference Between ACH and Wire Transfers? An ACH transfer is completed through a clearing house and can be used to process direct payments or direct deposits. Wire transfers allow for the movement of money from one bank account to another, typically for a fee.

How do I create an ACH form?

Requirements of an ACH Authorization Form Payor's name and contact information. So that the payee can get in touch with the payor. Payee's name and contact information. Payment details. Authorization statement. Recourse statement. Payor's bank details. Date of agreement and signature. Sample of a Paper ACH Form.

How is wire transfer different from ACH transfer?

An ACH transfer is completed through a clearing house — a network of financial institutions — and is used most often for processing direct deposits or payments. A wire transfer is typically used for high-value transactions and is completed through a bank, which makes it faster, but it does have a fee.

What is an ACH form for direct deposit?

An ACH direct deposit is a type of electronic funds transfer made into a consumer's checking or savings account from their employer or a federal or state agency. The most common types of ACH direct deposits include salary payment, tax returns, and government benefits. ACH transfers have made paper checks obsolete.

Do I need an ACH authorization form?

An ACH debit authorization is consent given by a customer for a business to collect future payments from them. Before a business can begin collecting ACH debit payments from a customer, they must receive an ACH debit authorization from them.

What is an ACH form?

An Automated Clearing House (ACH) authorization is a payment authorization that gives the lender permission to electronically take money from your bank, credit union, or prepaid card account when your payment is due. You can revoke this authorization.

What is an ACH form used for?

An Automated Clearing House (ACH) authorization is a payment authorization that gives the lender permission to electronically take money from your bank, credit union, or prepaid card account when your payment is due. You can revoke this authorization.

What is needed on an ACH form?

To be valid, the ACH form must contain all its required information. At the minimum, it should have: Signature of the payer (accountholder of the bank account) Permission to the ACH payee to debit/credit the payer's account. The amount (or range of amounts) debited or credited.

What are the disadvantages of ACH payments?

There is a risk of fraud from inside threat actors. For example, if a bank employee has access to customer account data and ACH payment facilities and makes unauthorized transactions. There is also the risk of cybercriminals breaching security at financial institutions.

Why is ACH cheaper than wire?

Wire Transfer vs. ACH. Because a wire transfer requires the individual bank-to-bank process, it is usually more expensive than an automated clearing house (ACH) transaction, which requires minimal involvement by individuals at the financial institutions involved.

Can you use ACH for wire transfer?

Availability: ACH transfers only work for domestic transactions. If you want to send funds abroad through the ACH network, you must do so using an international wire transfer.

How do you create ACH?

How to Set up ACH Payments Set up your account. Choose an ACH payment processor. Fill out the accompanying paperwork. Understand the different types of ACH payments. Choose the right entry class. Read the ACH payment terms & conditions.

Is there a difference between ACH and wire transfer?

What Is the Difference Between ACH and Wire Transfers? An ACH transfer is completed through a clearing house and can be used to process direct payments or direct deposits. Wire transfers allow for the movement of money from one bank account to another, typically for a fee.

Can I get an ACH form online?

You can complete the ACH Authorization Form manually on paper or online. Also, you can have a copy for the customers while the companies retain the signed form for at least two years.

Is ACH the same as wire routing number?

And while they do have similarities — and an ACH routing number is an ABA routing number — there are differences between ACH and ABA routing numbers: ABA routing numbers are used for paper or check transfers. ACH routing numbers are used for electronic transfers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IMG ACH Transfer Authorization and Agreement to be eSigned by others?

When your IMG ACH Transfer Authorization and Agreement is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I sign the IMG ACH Transfer Authorization and Agreement electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your IMG ACH Transfer Authorization and Agreement in seconds.

Can I create an electronic signature for signing my IMG ACH Transfer Authorization and Agreement in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your IMG ACH Transfer Authorization and Agreement and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is IMG ACH Transfer Authorization and Agreement Form?

The IMG ACH Transfer Authorization and Agreement Form is a document that allows individuals to authorize recurring electronic payments to be made from their bank account for services provided by IMG.

Who is required to file IMG ACH Transfer Authorization and Agreement Form?

Individuals receiving services from IMG who wish to set up automatic payments are required to file the IMG ACH Transfer Authorization and Agreement Form.

How to fill out IMG ACH Transfer Authorization and Agreement Form?

To fill out the form, individuals need to provide their personal information, banking details, and specify the amount and frequency of the ACH transfers. They must also sign the form to authorize the transactions.

What is the purpose of IMG ACH Transfer Authorization and Agreement Form?

The purpose of the form is to facilitate automatic and timely payments for services without the need for manual intervention, ensuring that payments are processed efficiently.

What information must be reported on IMG ACH Transfer Authorization and Agreement Form?

The form must report personal identification details, bank account information (such as account number and routing number), the amount to be transferred, and the schedule for recurring payments.

Fill out your IMG ACH Transfer Authorization and Agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IMG ACH Transfer Authorization And Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.