Get the free Payroll Deduction Change Request Form

Show details

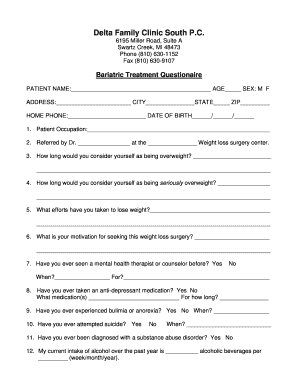

2751 De Rode Drive Fairfield, CA 94533-9710 PAYROLL DEDUCTION CHANGE REQUEST Please change my payroll deduction to: New deduction amount: Effective date of change: Signature Date Printed Name Last

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payroll deduction change request

Edit your payroll deduction change request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll deduction change request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payroll deduction change request online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit payroll deduction change request. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payroll deduction change request

How to Fill Out Payroll Deduction Change Request:

01

Obtain the payroll deduction change request form from your employer or HR department.

02

Fill in your personal information, such as your full name, employee ID, and contact details.

03

Indicate the effective date for the payroll deduction change. This is the date when the new payroll deduction amount or deduction category will take effect.

04

Specify the reason for the change request. It could be a change in financial circumstances, a new benefit enrollment, or any other valid reason.

05

Select the new deduction category or amount that you wish to be deducted from your payroll. This could include voluntary deductions for retirement plans, health insurance, loan repayments, or other benefits.

06

If necessary, provide any additional documentation or supporting materials as required by your employer.

07

Review the completed form to ensure all information is accurate and complete.

08

Sign and date the form.

09

Submit the payroll deduction change request form to the appropriate department or personnel designated by your employer.

Who Needs Payroll Deduction Change Request:

01

Employees who wish to make changes to their existing payroll deductions. This could include increasing or decreasing the amount of deductions or changing the deduction category, such as enrolling in a new benefit program or discontinuing an existing deduction.

02

Employees who experience a change in their financial situation, such as getting married, having a child, or experiencing a significant shift in income.

03

Employees who wish to take advantage of new benefits or programs offered by the employer, such as a new retirement plan option or health insurance coverage.

04

Employees who need to update or modify their loan repayments or other financial obligations that are deducted from their payroll.

05

Employees who have been notified by their employer or HR department that a payroll deduction change request is required due to policy changes, system updates, or other organizational reasons.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in payroll deduction change request?

With pdfFiller, the editing process is straightforward. Open your payroll deduction change request in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I sign the payroll deduction change request electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your payroll deduction change request and you'll be done in minutes.

How can I edit payroll deduction change request on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing payroll deduction change request.

Fill out your payroll deduction change request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payroll Deduction Change Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.