UT 75-6-416 2018 free printable template

Show details

Utah Noneffective 5/8/2018

756416 Form of transfer on death deed.

The following form may be used to create a transfer on death deed. The other sections of this

chapter govern the effect of this or

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign quitclaim deed utah form

Edit your utah transfer on death deed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transfer on death deed form utah form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing utah transfer on death online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit utah transfer on death. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT 75-6-416 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out utah transfer on death

How to fill out UT 75-6-416

01

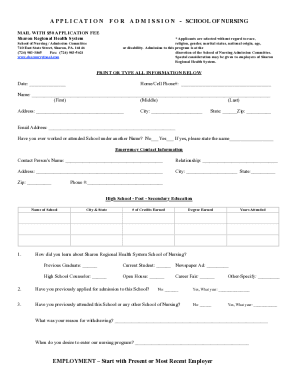

Obtain a copy of the UT 75-6-416 form from the official website or designated office.

02

Read the instructions provided with the form carefully to ensure all requirements are understood.

03

Fill in the personal information section with your name, address, and contact details.

04

Provide relevant details in each subsection of the form as required, ensuring accuracy.

05

Attach any necessary documentation that supports the information provided in the form.

06

Review your completed form for any errors or omissions.

07

Submit the form through the specified method, either in person or via mail, to the appropriate office.

Who needs UT 75-6-416?

01

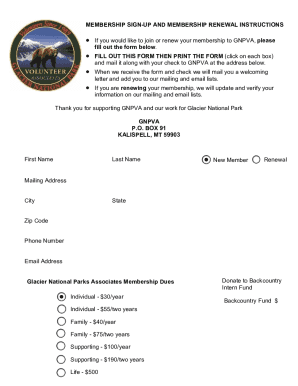

Individuals who are applying for a specific license or permit regulated under UT 75-6-416.

02

Organizations or businesses that need to comply with regulations pertaining to the form.

03

Persons seeking permission for activities that fall under the jurisdiction of UT 75-6-416 policies.

Fill

form

: Try Risk Free

People Also Ask about

How to do a transfer on death deed in Utah?

(Utah Code Ann. §§ 75-6-401 and following.) You must sign the deed and get your signature notarized, and then record (file) the deed with the county recorder's office before your death. Otherwise, it won't be valid.

Does Utah allow Tod deeds?

In Utah, real estate can be transferred via a TOD deed, otherwise known as a beneficiary deed. This deed permits a property owner to designate a beneficiary who will automatically inherit the property upon the owner's death, avoiding probate.

How to transfer a property deed from a deceased relative Utah?

The TOD deed must state specifically that the transfer will occur at the owner's death. The deed must be recorded before the owner's death in the public records in the county recorder's office of the county where the property is located.

What is the statute of transfer on death deed in Utah?

When you die, this deed transfers the described property, subject to any liens or mortgages (or other encumbrances) on the property at your death. Probate is not required. The TOD deed has no effect until you die. You can revoke it at any time.

Does Utah recognize a transfer on death deed?

Utah TOD deeds are specifically authorized by the Utah Uniform Real Property Transfer on Death Act. The Act includes several specific requirements that must be met to create a valid TOD deed: With few exceptions, a Utah TOD deed must meet of the general requirements that apply to Utah deeds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get utah transfer on death?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific utah transfer on death and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I complete utah transfer on death online?

With pdfFiller, you may easily complete and sign utah transfer on death online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit utah transfer on death on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute utah transfer on death from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is UT 75-6-416?

UT 75-6-416 is a tax form used in the state of Utah for reporting certain financial information to the state tax commission.

Who is required to file UT 75-6-416?

Individuals, businesses, or entities that meet specific criteria established by the Utah state tax regulations are required to file UT 75-6-416.

How to fill out UT 75-6-416?

To fill out UT 75-6-416, you need to gather the required financial information, complete the form with accurate details, and ensure all sections are filled according to the provided instructions.

What is the purpose of UT 75-6-416?

The purpose of UT 75-6-416 is to provide the Utah state tax commission with necessary data for tax assessment and compliance purposes.

What information must be reported on UT 75-6-416?

The information that must be reported on UT 75-6-416 typically includes financial details, income sources, deductions, and other relevant tax-related information as required by the form.

Fill out your utah transfer on death online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Utah Transfer On Death is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.