IRS 1094-C 2018 free printable template

Show details

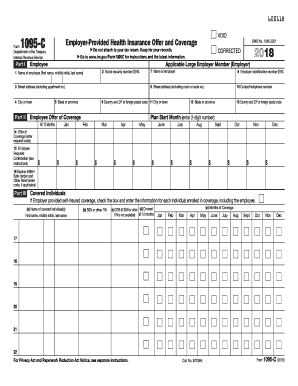

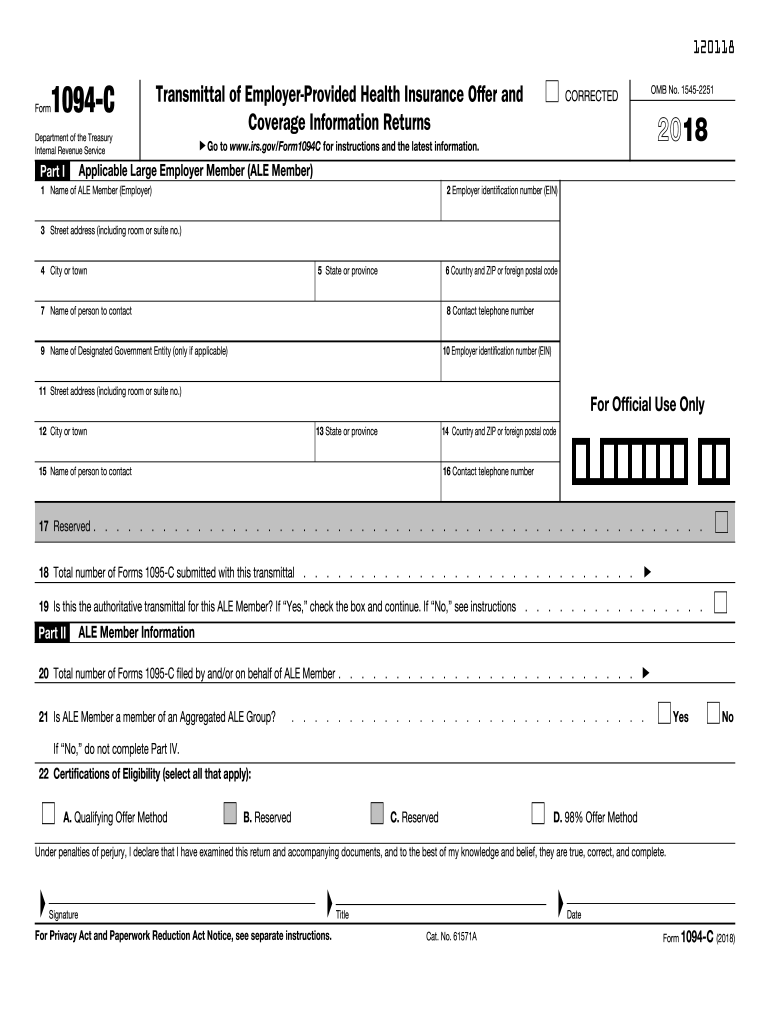

120118 1094-C Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns Form Department of the Treasury Internal Revenue Service Part I Go OMB No. 1545-2251 CORRECTED to www.irs.gov/Form1094C for instructions and the latest information. Applicable Large Employer Member ALE Member 1 Name of ALE Member Employer 2 Employer identification number EIN 3 Street address including room or suite no. Signature For Privacy Act and Paperwork Reduction Act Notice see separate...instructions. Title Cat. No. 61571A Date Form 1094-C 2018 Page 2 a Minimum Essential Coverage Offer Indicator b Section 4980H Full-Time Employee Count for ALE Member c Total Employee Count for ALE Member d Aggregated Group Indicator All 12 Months Jan Feb Mar Apr May June July Aug Sept Oct Nov Dec 120316 Page 3 Other ALE Members of Aggregated ALE Group Enter the names and EINs of Other ALE Members of the Aggregated ALE Group who were members at any time during the calendar year. 4 City or town 5...State or province 6 Country and ZIP or foreign postal code 7 Name of person to contact 8 Contact telephone number 9 Name of Designated Government Entity only if applicable For Official Use Only 17 Reserved. 18 Total number of Forms 1095-C submitted with this transmittal 19 Is this the authoritative transmittal for this ALE Member If Yes check the box and continue. If No see instructions ALE Member Information 21 Is ALE Member a member of an Aggregated ALE Group Yes No If No do not complete...Part IV. 22 Certifications of Eligibility select all that apply A. Qualifying Offer Method B. Reserved D. 98 Offer Method Under penalties of perjury I declare that I have examined this return and accompanying documents and to the best of my knowledge and belief they are true correct and complete. 4 City or town 5 State or province 6 Country and ZIP or foreign postal code 7 Name of person to contact 8 Contact telephone number 9 Name of Designated Government Entity only if applicable For Official...Use Only 17 Reserved. 18 Total number of Forms 1095-C submitted with this transmittal 19 Is this the authoritative transmittal for this ALE Member If Yes check the box and continue. 18 Total number of Forms 1095-C submitted with this transmittal 19 Is this the authoritative transmittal for this ALE Member If Yes check the box and continue. If No see instructions ALE Member Information 21 Is ALE Member a member of an Aggregated ALE Group Yes No If No do not complete Part IV. If No see...instructions ALE Member Information 21 Is ALE Member a member of an Aggregated ALE Group Yes No If No do not complete Part IV. 22 Certifications of Eligibility select all that apply A. Qualifying Offer Method B. Reserved D. 98 Offer Method Under penalties of perjury I declare that I have examined this return and accompanying documents and to the best of my knowledge and belief they are true correct and complete. 4 City or town 5 State or province 6 Country and ZIP or foreign postal code 7 Name...of person to contact 8 Contact telephone number 9 Name of Designated Government Entity only if applicable For Official Use Only 17 Reserved. 18 Total number of Forms 1095-C submitted with this transmittal 19 Is this the authoritative transmittal for this ALE Member If Yes check the box and continue. If No see instructions ALE Member Information 21 Is ALE Member a member of an Aggregated ALE Group Yes No If No do not complete Part IV.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1094-C

How to edit IRS 1094-C

How to fill out IRS 1094-C

Instructions and Help about IRS 1094-C

How to edit IRS 1094-C

Editing IRS 1094-C can be necessary for organizations that need to correct errors or make updates before filing. Use a tool such as pdfFiller to access the original form, make the necessary changes, and ensure compliance with IRS requirements. When editing, double-check all information to reflect accurate employee data, coverage details, and applicable codes.

How to fill out IRS 1094-C

To fill out IRS 1094-C correctly, follow these steps:

01

Gather necessary information about your organization and its employees.

02

Provide employer identification details, including the Employer Identification Number (EIN).

03

Fill in information about the coverage offered to your employees and indicate the number of full-time employees.

04

Complete all applicable sections, ensuring accuracy in employee counts and coverage types.

05

Review the form for completeness before submission.

About IRS 1094-C 2018 previous version

What is IRS 1094-C?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1094-C 2018 previous version

What is IRS 1094-C?

IRS 1094-C is a tax form used by Applicable Large Employers (ALEs) to report offers of health coverage to their full-time employees under the Affordable Care Act (ACA). This form serves as a transmittal to the IRS for related 1095-C forms, detailing the health coverage provided to employees and compliance with the ACA mandates.

What is the purpose of this form?

The purpose of IRS 1094-C is to enable employers to report information about the health coverage they offer to employees, specifically ensuring compliance with the ACA provisions. It helps the IRS verify whether employers are meeting their obligations under the ACA, such as offering minimum essential coverage to full-time employees.

Who needs the form?

Applicable Large Employers, defined as businesses with 50 or more full-time equivalent employees, are required to file IRS 1094-C. Additionally, employers that are part of a controlled group may also need to file the form collectively, reporting combined employee numbers across the group. Smaller employers, those with fewer than 50 full-time employees, generally do not need to submit this form.

When am I exempt from filling out this form?

Employers with fewer than 50 full-time equivalent employees are typically exempt from filing IRS 1094-C. Additionally, some employers may qualify for other specific exemptions based on their unique circumstances. It is important to verify whether any special statuses or exemptions apply to your organization before avoiding this filing requirement.

Components of the form

IRS 1094-C consists of several key components, including employer information, a summary of health coverage offered, and employee counts. The form includes various sections designed to capture detailed information about employee enrollments, the months coverage was offered, and codes to specify the type of coverage provided. Completing all sections accurately ensures compliance and avoids penalties.

What are the penalties for not issuing the form?

Failure to issue IRS 1094-C can result in significant penalties, including fines for each day the form is not filed. The penalties can accumulate quickly, so timely filing is essential. The IRS encourages compliance to avoid financial repercussions and possible audits.

What information do you need when you file the form?

When filing IRS 1094-C, gather information such as the Employer Identification Number (EIN), total number of full-time employees, and details of health coverage provided. Accurate employee records, including social security numbers and coverage months, are crucial for completion and submission.

Is the form accompanied by other forms?

IRS 1094-C serves as a transmittal form, which must be accompanied by employee-specific IRS 1095-C forms. Each 1095-C provides detailed information on health coverage offered to individual employees, while IRS 1094-C summarizes this data for the employer's reporting requirements.

Where do I send the form?

IRS 1094-C should be sent to the IRS based on the filing method. If filing by mail, refer to the IRS instructions for the correct address depending on your location. If filing electronically, use the IRS-approved e-filing systems to submit your forms. Always verify the latest instructions for any changes to filing procedures or addresses.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.