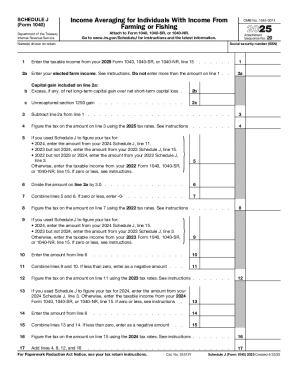

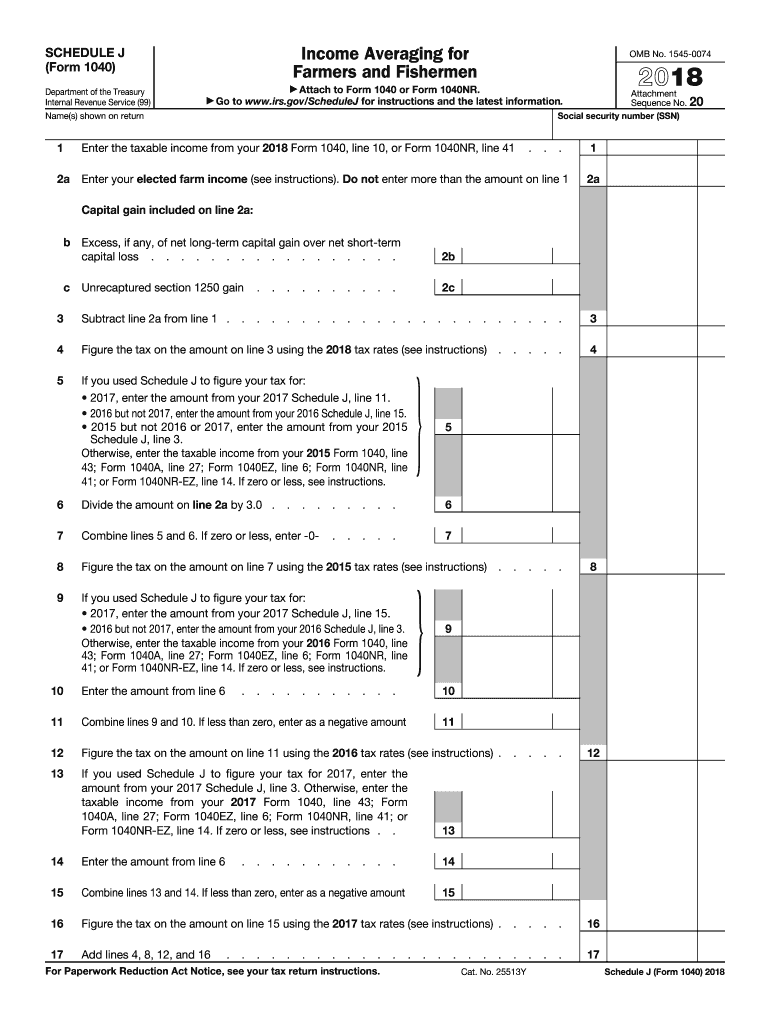

IRS 1040 Schedule J 2018 free printable template

Instructions and Help about IRS 1040 Schedule J

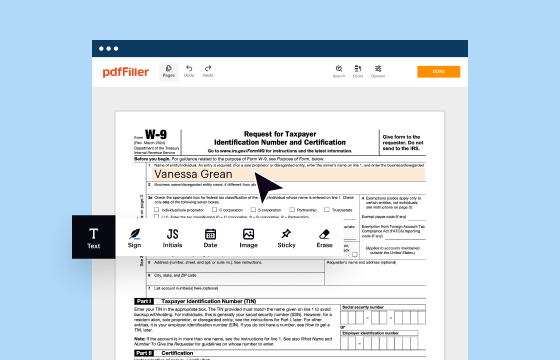

How to edit IRS 1040 Schedule J

How to fill out IRS 1040 Schedule J

About IRS 1040 Schedule J 2018 previous version

What is IRS 1040 Schedule J?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

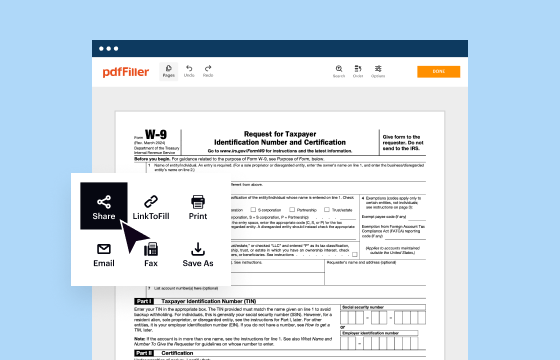

Where do I send the form?

FAQ about IRS 1040 Schedule J

What steps should I take if I need to correct an error on my submitted schedulle j 2017?

To correct any mistakes made on your schedulle j 2017, you should file an amended version of the form. Ensure that you highlight the corrections clearly and provide any necessary explanations for the changes. Always keep a copy of the amended form for your records, as proper documentation is key.

How can I verify if my schedulle j 2017 has been received and is being processed?

You can verify the receipt and processing status of your schedulle j 2017 by contacting the relevant tax authority or using their online tracking system, if available. Be sure to have your submission details on hand for reference.

What common errors should I look out for when submitting schedulle j 2017?

Common errors when submitting schedulle j 2017 include incorrect taxpayer identification numbers, incomplete fields, and mismatched information compared to prior filings. Double-check all entries and ensure they match your records to avoid processing delays.

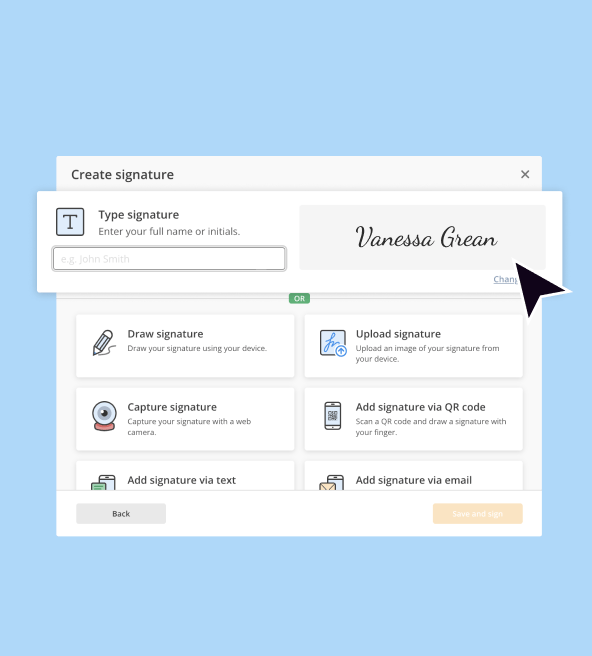

Are e-signatures acceptable for filing schedulle j 2017, and what are the privacy considerations?

Yes, e-signatures are generally acceptable for filing schedulle j 2017. When using e-signatures, it's important to comply with the specific guidelines provided by the tax authority. Additionally, ensure that sensitive personal information is adequately protected to maintain privacy and data security.