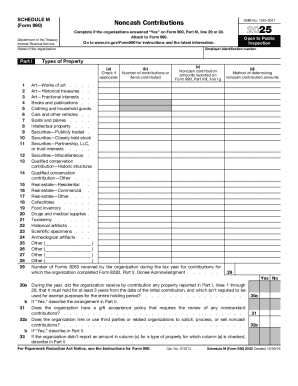

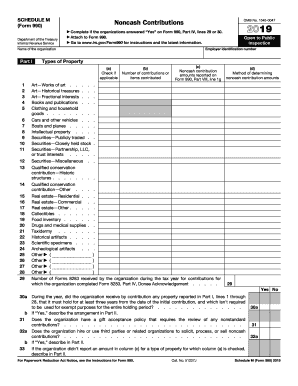

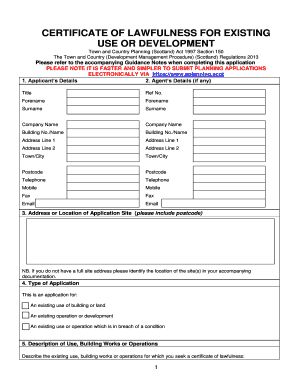

IRS 990 - Schedule M 2018 free printable template

Instructions and Help about IRS 990 - Schedule M

How to edit IRS 990 - Schedule M

How to fill out IRS 990 - Schedule M

About IRS 990 - Schedule M 2018 previous version

What is IRS 990 - Schedule M?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

What information do you need when you file the form?

What is the purpose of this form?

Who needs the form?

Components of the form

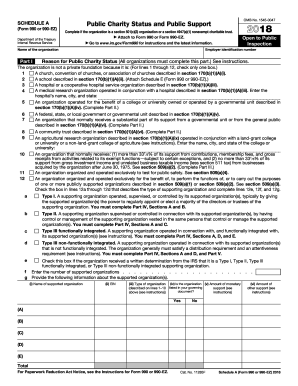

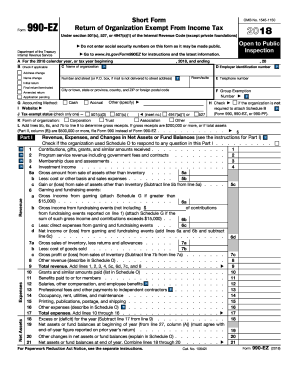

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 990 - Schedule M

What should I do if I need to amend my printable 990 form 2018 after submission?

If you realize there are mistakes on your printable 990 form 2018 after it has been submitted, you can file an amended return. Ensure you use the latest version of the form and indicate that it is an amended return. Submitting an amendment helps correct the errors and maintain compliance.

How can I track the status of my submitted printable 990 form 2018?

To track the status of your submitted printable 990 form 2018, you can contact the IRS directly or use their online services if you filed electronically. Keep your confirmation number at hand as it will help in retrieving the status of your submission efficiently.

What are common errors to avoid when filing the printable 990 form 2018?

Common errors when filing the printable 990 form 2018 include incorrect calculation of totals and forgetting to sign the form. Always double-check numbers and ensure all required fields are completed before submission to avoid delays or rejections.

Can I use an e-signature when filing my printable 990 form 2018?

Yes, an e-signature is acceptable for the printable 990 form 2018 when filing electronically. Ensure that your e-signature complies with IRS guidelines for electronic submissions to avoid issues with your filing.

What should I do if my e-filed printable 990 form 2018 gets rejected?

If your e-filed printable 990 form 2018 is rejected, review the rejection codes provided by the IRS to determine the issues. Correct the errors and resubmit the form promptly, ensuring you check for any specific guidelines related to the rejection reasons.