Get the free pdffiller

Show details

SAVE A COPY01339(Rev.907/6)CLEAR SIDEREAL SALES AND USE TAX RESALE CERTIFICATE Name of purchaser, firm or agency as shown on Persephone (Area code and number)STACEY SUPPLY DBA HUFCO7134600810Address

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pdffiller form

Edit your pdffiller form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pdffiller form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pdffiller form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

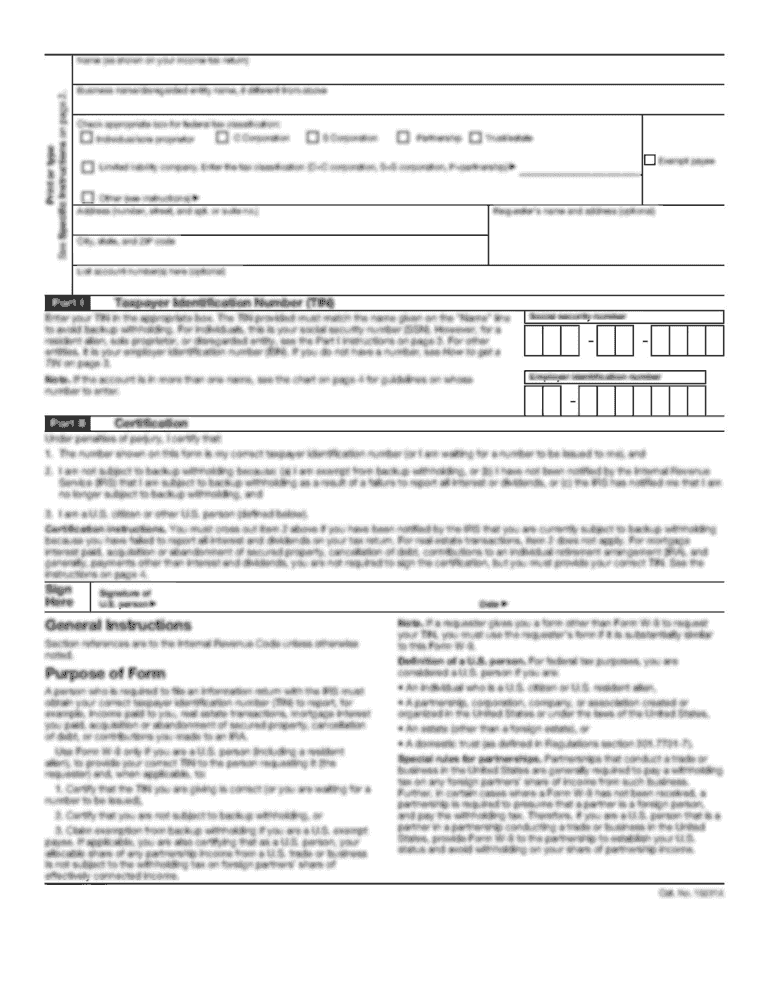

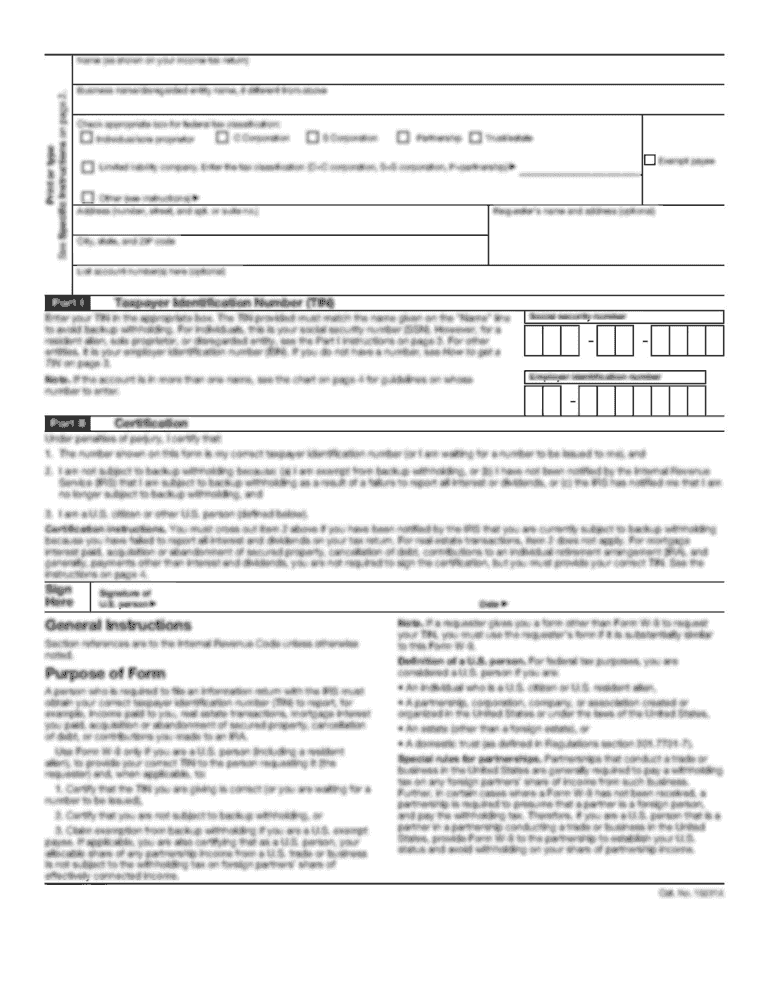

How to fill out pdffiller form

How to fill out resale certificate texas?

01

Obtain a copy of the resale certificate form from the Texas Comptroller of Public Accounts website or a local tax office.

02

Provide your personal information, including your name, address, and social security number or taxpayer identification number.

03

Include your business information, such as the legal name, address, and tax identification number.

04

Specify the type of business you operate and the nature of your sales activities.

05

Indicate whether you are a retailer, wholesaler, manufacturer, or other relevant category.

06

Provide details about the items or property you will be purchasing for resale.

07

Include the method by which you will be purchasing the items, such as directly from manufacturers or through distributors.

08

Sign and date the resale certificate, certifying that the information provided is accurate and that the purchased items will be resold in the ordinary course of business.

Who needs resale certificate texas?

01

Individuals and businesses engaged in the sale of tangible personal property in Texas may require a resale certificate.

02

Retailers, wholesalers, manufacturers, and other entities involved in purchasing goods for resale often need a resale certificate to exempt them from paying sales tax on those purchases.

03

Resale certificates are used to document that the items being purchased will be resold rather than consumed by the buyer.

04

By obtaining a resale certificate, eligible businesses can avoid paying sales tax on their inventory purchases and then collect sales tax from their customers when the items are sold.

05

It is important to note that not all businesses require a resale certificate in Texas. Service providers, for example, generally do not need a resale certificate as their services are not considered tangible personal property.

Fill

form

: Try Risk Free

People Also Ask about

How much is a reseller permit in Texas?

It's free to apply for a Texas sales tax permit. A bond may be required but only after the application is filed and reviewed. Other business registration fees may apply. Contact each state's individual department of revenue for more about registering your business.

Do I need a reseller permit in Texas?

Do I need to submit a resale certificate each time I make a purchase? Yes, except that if a customer purchases exclusively for resale, a seller can accept a blanket resale certificate. The certificate should state that all purchases will be resold in the regular course of business.

Who orders HOA resale certificate in Texas?

In Texas, the seller must provide a resale certificate to the buyer by the deadline stated in the purchase contract. The Texas Real Estate Commission provides a standardized resale certificate form for both single-family homes and condominiums.

Why do you need a reseller certificate?

A resale certificate is a signed document that indicates that the purchaser intends to resell the goods. It is usually provided by a retailer to a wholesale dealer. In addition, manufacturers issue resale certificates to suppliers of materials that become incorporated into the products they manufacture.

How long does it take to get a Texas resale Certificate?

You should receive your permit within two weeks. If you want to avoid the wait and eliminate the hassle of filling out forms and going through several channels before your license request is answered, choose FastFilings.

What is a resale certificate in Texas?

The resale certificate is the seller's evidence as to why sales tax was not collected on that transaction and should be retained in the seller's books and records for four years.

Do I need a tax ID to be a reseller?

If you have a business through which you are purchasing products for resale, you should have a reseller's permit, also known as a resale number, reseller's license, or sales tax identification number. This permit allows you to collect and remit sales tax to your state Department of Revenue.

Does Texas require a resale certificate?

Do I need to submit a resale certificate each time I make a purchase? Yes, except that if a customer purchases exclusively for resale, a seller can accept a blanket resale certificate. The certificate should state that all purchases will be resold in the regular course of business.

Does Texas issue resale certificates?

Yes, except that if a customer purchases exclusively for resale, a seller can accept a blanket resale certificate. The certificate should state that all purchases will be resold in the regular course of business. What are my responsibilities as a seller accepting a resale certificate?

Is a seller's permit free in Texas?

Austin, TX 78774-0100 Is there a fee for a permit? There is no fee for the permit, but you may be required to post a security bond. For more information on security bonds, contact a Comptroller field office.

How do I get a resale certificate in Texas?

HOW TO GET A RESALE CERTIFICATE IN TEXAS ✔ STEP 1 : Complete the Texas Sales Tax Form. ✔ STEP 2 : Fill out the Texas resale certificate form. ✔ STEP 3 : Present a copy of this certificate to suppliers when you wish to purchase items for resale.

Who orders resale certificate in Texas?

Traditionally, the seller is obligated to provide the resale package when a purchase contract is signed. Title companies, however, often assist sellers by ordering the documents required for closing and passing the cost to the seller.

How do I get a reseller ID in Texas?

You can apply for a Texas seller's permit online through the Texas Online Tax Registration Application or by filling out the Texas Application for Sales and Use Tax Permit (Form AP-201) and mailing it to the comptroller's office at the address listed on the form.

How much does it cost to get a resale certificate in Texas?

Any business identified as needing a resale license can obtain one at no cost.

How do I get a reseller certificate in Texas?

You can apply for a Texas seller's permit online through the Texas Online Tax Registration Application or by filling out the Texas Application for Sales and Use Tax Permit (Form AP-201) and mailing it to the comptroller's office at the address listed on the form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my pdffiller form directly from Gmail?

pdffiller form and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I modify pdffiller form without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your pdffiller form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Where do I find pdffiller form?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific pdffiller form and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

What is resale certificate texas?

A resale certificate in Texas is a document used by business owners to purchase goods intended for resale without paying sales tax on those goods.

Who is required to file resale certificate texas?

Buyers who purchase items for resale in the course of their business are required to file a resale certificate in Texas.

How to fill out resale certificate texas?

To fill out a resale certificate in Texas, the buyer must provide their information, such as name, address, and seller's permit number, as well as details about the items being purchased.

What is the purpose of resale certificate texas?

The purpose of a resale certificate in Texas is to allow sellers to exempt the sales tax on items bought for resale, ensuring that tax is only paid when the final consumer purchases the item.

What information must be reported on resale certificate texas?

The resale certificate must report the buyer's name, address, seller's permit number, a description of the property purchased, and a statement certifying the intent to resell the items.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.