UK HMRC APSS255 2017 free printable template

Show details

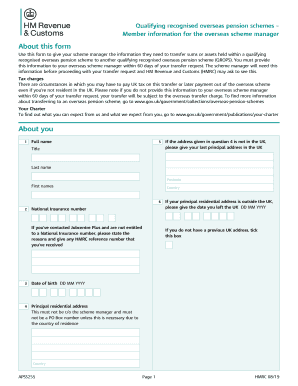

Qualifying Recognized Overseas Pension Schemes Member information for the overseas scheme managerAbout this form Use this form to give your scheme manager the information they need to transfer sums

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK HMRC APSS255

Edit your UK HMRC APSS255 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK HMRC APSS255 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK HMRC APSS255 online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit UK HMRC APSS255. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC APSS255 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK HMRC APSS255

How to fill out UK HMRC APSS255

01

Obtain the APSS255 form from the HMRC website or relevant HMRC office.

02

Fill in your personal details, including your name, address, and National Insurance number.

03

Provide information about your pension scheme, including the scheme name and number.

04

Indicate the type of contribution you are making and the amount.

05

Ensure all information is accurate and complete to avoid processing delays.

06

Sign and date the form to confirm the information provided.

07

Submit the completed form to HMRC via post or online submission, if available.

Who needs UK HMRC APSS255?

01

Individuals who are members of a registered pension scheme wishing to claim tax relief on contributions made.

02

Employers making contributions on behalf of their employees to pension schemes.

03

Any person who has made pension contributions and needs to report them for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is a C1601?

For UK locations, where CHIEF arrival facilities are not available, an approved loader for the location can request that HMRC input the goods as 'arrived' on the system using form C1601. If this is successful, the arrival message will be entered onto CHIEF .

What is a C1603 form?

C1603 Retrospective Arrival v4.0. This form is designed to be filled in on screen. You must answer all the questions except those marked 'optional'. Once you've completed the form you'll be able to save a copy and upload it to the online service or send by email if you're unable to use the online service.

What is a c1602 form?

Notification of exit of goods (Departure)

What is a C1601 form?

Use this step-by-step guide to fill out the C1601 — Presentation of goods for export (Arrival). This form is only to be used to arrive/present goods at UK locations where commercial CHIEF arrival facilities are not available — HMRC gov promptly and with idEval precision.

Do I need certificate of origin to import into UK?

Unless the trade agreement says you do not need a proof of origin because the goods have been sent in a small consignment, you'll need to: prove to HMRC that you can claim preference for the goods you are importing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find UK HMRC APSS255?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific UK HMRC APSS255 and other forms. Find the template you need and change it using powerful tools.

How do I execute UK HMRC APSS255 online?

Filling out and eSigning UK HMRC APSS255 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit UK HMRC APSS255 online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your UK HMRC APSS255 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

What is UK HMRC APSS255?

UK HMRC APSS255 is a form used by individuals to inform HM Revenue and Customs about their tax affairs related to certain pension schemes, specifically when they are applying for tax relief on contributions to a registered pension scheme.

Who is required to file UK HMRC APSS255?

Individuals who are members of registered pension schemes and wish to claim tax relief on their contributions or make changes to their tax relief arrangement may be required to file UK HMRC APSS255.

How to fill out UK HMRC APSS255?

To fill out UK HMRC APSS255, individuals must provide personal details, information about their pension scheme, contribution amounts, and any other relevant financial information as required on the form.

What is the purpose of UK HMRC APSS255?

The purpose of UK HMRC APSS255 is to allow individuals to notify HMRC of their pension contributions, enabling the proper calculation and application of tax relief on those contributions.

What information must be reported on UK HMRC APSS255?

Information that must be reported on UK HMRC APSS255 includes personal identification details, the name and reference of the pension scheme, the amount contributed, and any additional declarations relevant to the contribution and tax relief.

Fill out your UK HMRC APSS255 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK HMRC apss255 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.