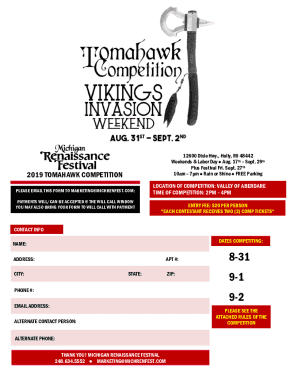

UK HMRC APSS255 2019-2025 free printable template

Show details

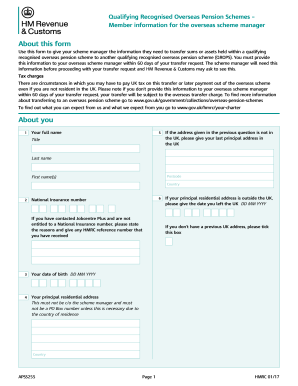

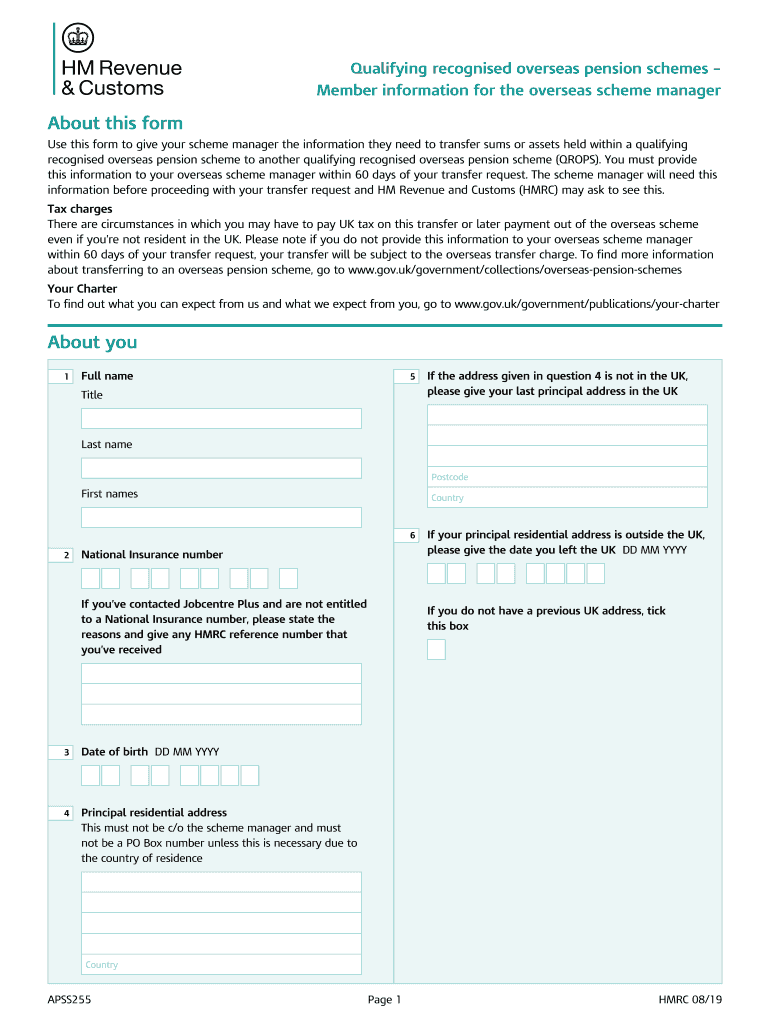

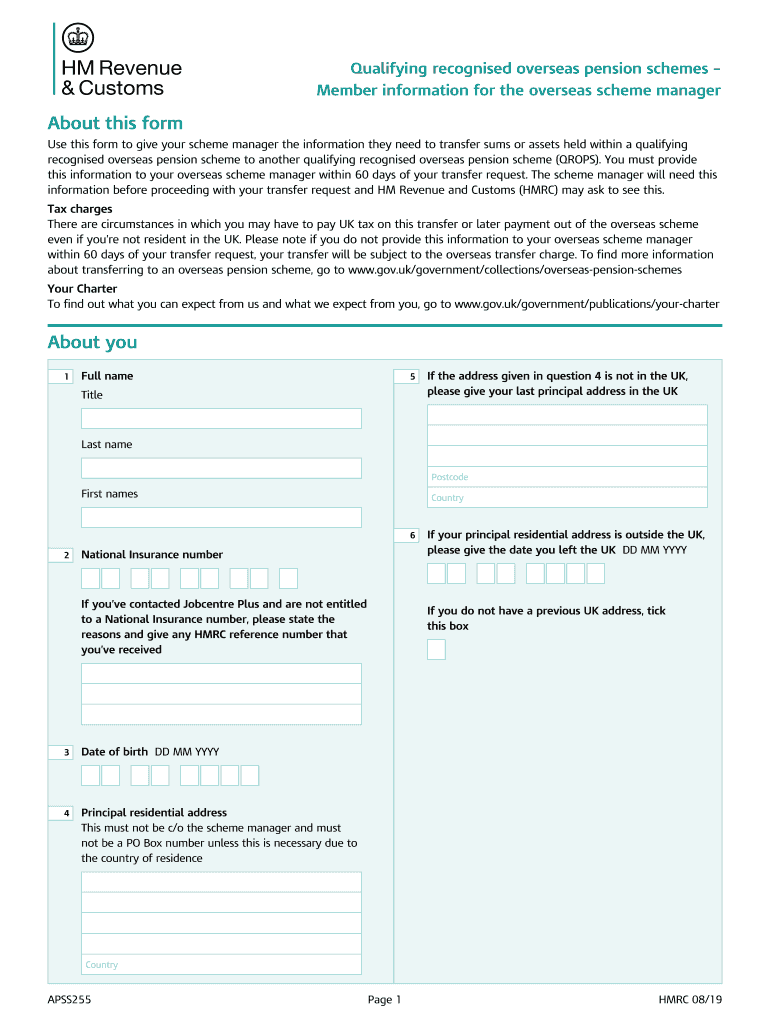

This form is used to provide information necessary for transferring sums or assets within a qualifying recognised overseas pension scheme (QROPS) to another QROPS.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK HMRC APSS255

Edit your UK HMRC APSS255 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK HMRC APSS255 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK HMRC APSS255 online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit UK HMRC APSS255. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC APSS255 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK HMRC APSS255

How to fill out UK HMRC APSS255

01

Obtain the APSS255 form from the HMRC website or your financial advisor.

02

Fill in your personal details including your name, address, and National Insurance number.

03

Provide details of your pension scheme, including its name and reference number.

04

Specify the reason for applying for a tax refund or obtaining confirmation of non-residency.

05

Carefully review the information provided to ensure accuracy.

06

Sign and date the form to confirm that all information is correct.

07

Submit the completed form to HMRC by post or through the specified online method.

Who needs UK HMRC APSS255?

01

Individuals who have made contributions to a pension scheme in the UK but are not UK residents.

02

People who are seeking a refund on overpaid taxes related to their pension contributions.

03

Those who need confirmation of their non-residency status for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is a C1601?

For UK locations, where CHIEF arrival facilities are not available, an approved loader for the location can request that HMRC input the goods as 'arrived' on the system using form C1601. If this is successful, the arrival message will be entered onto CHIEF .

What is a C1603 form?

C1603 Retrospective Arrival v4.0. This form is designed to be filled in on screen. You must answer all the questions except those marked 'optional'. Once you've completed the form you'll be able to save a copy and upload it to the online service or send by email if you're unable to use the online service.

What is a c1602 form?

Notification of exit of goods (Departure)

What is a C1601 form?

Use this step-by-step guide to fill out the C1601 — Presentation of goods for export (Arrival). This form is only to be used to arrive/present goods at UK locations where commercial CHIEF arrival facilities are not available — HMRC gov promptly and with idEval precision.

Do I need certificate of origin to import into UK?

Unless the trade agreement says you do not need a proof of origin because the goods have been sent in a small consignment, you'll need to: prove to HMRC that you can claim preference for the goods you are importing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute UK HMRC APSS255 online?

pdfFiller has made it easy to fill out and sign UK HMRC APSS255. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit UK HMRC APSS255 straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit UK HMRC APSS255.

How do I complete UK HMRC APSS255 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your UK HMRC APSS255. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is UK HMRC APSS255?

UK HMRC APSS255 is a form used by pension schemes in the UK to report information related to registered pension schemes in compliance with the regulations set by HM Revenue and Customs (HMRC).

Who is required to file UK HMRC APSS255?

Trustees of registered pension schemes in the UK are required to file the APSS255 form when they need to report certain events or changes in the scheme, particularly concerning lump sum payments.

How to fill out UK HMRC APSS255?

To fill out the APSS255 form, trustees need to provide relevant details regarding the scheme, the member, and the payments being reported. It involves entering personal information, scheme information, and financial details in the prescribed format.

What is the purpose of UK HMRC APSS255?

The purpose of UK HMRC APSS255 is to ensure transparency and compliance in reporting pension scheme activities, particularly in relation to payments made to members and their tax obligations.

What information must be reported on UK HMRC APSS255?

The information that must be reported includes the member's details (name, National Insurance number), details about the lump sum payment, the reason for the payment, and any relevant dates.

Fill out your UK HMRC APSS255 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK HMRC apss255 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.