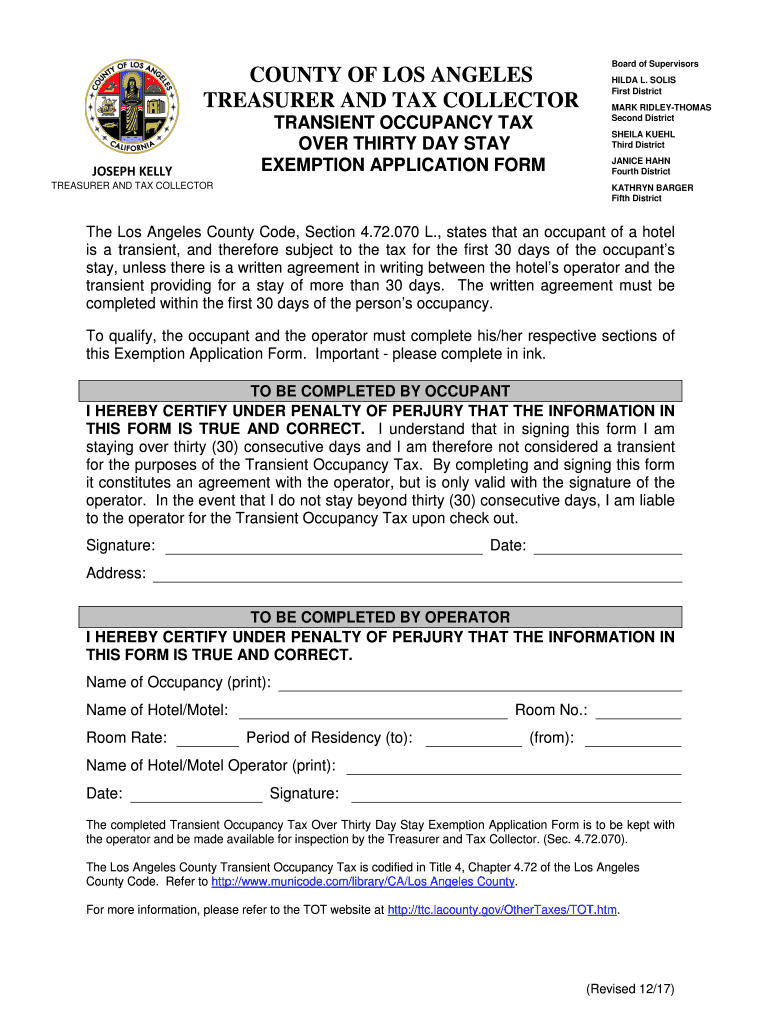

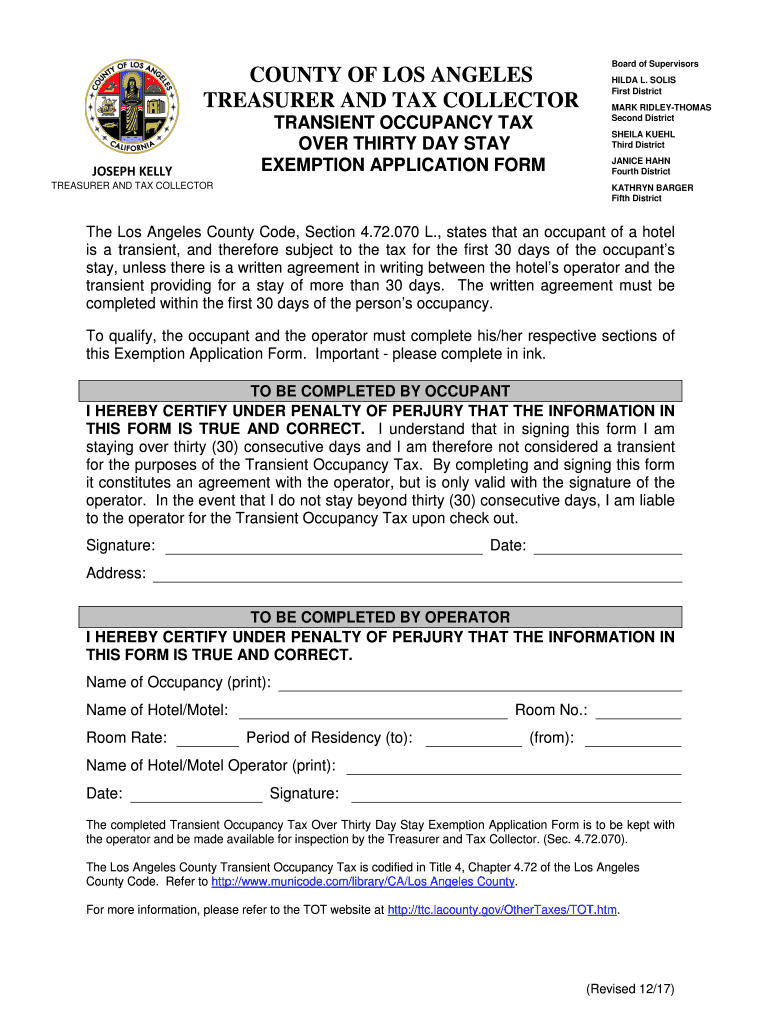

CA Transient Occupancy Tax Over Thirty Day Stay Exemption Application Form - Los Angeles 2017 free printable template

Show details

Board of SupervisorsCOUNTY OF LOS ANGELES

TREASURER AND TAX COLLECTOR

JOSEPH KELLYHILDA L. SOLIS

First District

MARK RIDLEYTHOMAS

Second DistrictTRANSIENT OCCUPANCY TAX

OVER THIRTY DAY STAY

EXEMPTION

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA Transient Occupancy Tax Over Thirty Day

Edit your CA Transient Occupancy Tax Over Thirty Day form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA Transient Occupancy Tax Over Thirty Day form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA Transient Occupancy Tax Over Thirty Day online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CA Transient Occupancy Tax Over Thirty Day. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA Transient Occupancy Tax Over Thirty Day Stay Exemption Application Form - Los Angeles Form Versions

Version

Form Popularity

Fillable & printabley

4.7 Satisfied (45 Votes)

4.8 Satisfied (65 Votes)

4.3 Satisfied (87 Votes)

4.4 Satisfied (38 Votes)

4.0 Satisfied (32 Votes)

How to fill out CA Transient Occupancy Tax Over Thirty Day

How to fill out CA Transient Occupancy Tax Over Thirty Day Stay

01

Obtain the CA Transient Occupancy Tax Over Thirty Day Stay form from the local tax authority's website.

02

Fill in the required personal information, including your name, address, and contact details.

03

Provide details about the property you are staying in, including the address and owner's name.

04

Specify the dates of your stay and the total number of days.

05

Calculate the total amount of tax due based on the applicable transient occupancy tax rate.

06

Review the form for accuracy before submitting.

07

Submit the completed form to the local tax authority, along with any required payment.

Who needs CA Transient Occupancy Tax Over Thirty Day Stay?

01

Individuals or groups planning to stay in a short-term rental or hotel for more than thirty days.

02

Property owners or managers who rent out their property for extended stays.

03

Any entity that is subject to transient occupancy tax regulations in California.

Fill

form

: Try Risk Free

People Also Ask about

What is the hotel room tax in California?

Types of Hotel Taxes in California Transient Occupancy Tax (TOT): This tax is also known as a “hotel tax” and is charged to guests who stay in a hotel room for less than 30 days. The rate of TOT varies depending on the location of the hotel and can range from 8% to 15.5% of the room rate.

How much is hotel taxes in SF?

Hotel fees in San Francisco include 14 percent occupancy tax, 0.195 percent California Tourism fee, and an 1.5 - 2.25 percent Tourism Improvement District assessment dependent upon the location of the hotel property.

What is the form for 30 day hotel tax exemption in Texas?

Permanent Residents (30-Day Rule) Guests who do not notify the hotel must pay the tax for the first 30 days and will be exempt after that. Hotel records are proof of a permanent resident's exemption, and Form 12-302, Texas Hotel Occupancy Tax Exemption Certificate (PDF), is not required.

Who is exempt from occupancy tax in Los Angeles County?

Any person who has a written agreement with the operator, entered into within the first thirty (30) days of the person's occupancy, which states the person will stay for more than thirty (30) consecutive calendar days is exempt from the TOT, for the first 30 days of the person's stay.

Does California have hotel tax exempt form?

We've got more versions of the california hotel tax exempt form pdf form. Select the right california hotel tax exempt form pdf version from the list and start editing it straight away!

What percentage of tax is on a hotel room?

Transient Occupancy Tax (TOT): This tax is also known as a “hotel tax” and is charged to guests who stay in a hotel room for less than 30 days. The rate of TOT varies depending on the location of the hotel and can range from 8% to 15.5% of the room rate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get CA Transient Occupancy Tax Over Thirty Day?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the CA Transient Occupancy Tax Over Thirty Day. Open it immediately and start altering it with sophisticated capabilities.

How do I fill out CA Transient Occupancy Tax Over Thirty Day using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign CA Transient Occupancy Tax Over Thirty Day. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How can I fill out CA Transient Occupancy Tax Over Thirty Day on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your CA Transient Occupancy Tax Over Thirty Day. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is CA Transient Occupancy Tax Over Thirty Day Stay?

CA Transient Occupancy Tax Over Thirty Day Stay refers to a tax imposed by the state of California on individuals or entities that rent lodging for more than thirty consecutive days in order to fund local services and tourism-related programs.

Who is required to file CA Transient Occupancy Tax Over Thirty Day Stay?

Hosts or property owners who rent out their properties for over thirty days are required to file the CA Transient Occupancy Tax. This typically includes hotels, motels, rental homes, and other short-term rental providers.

How to fill out CA Transient Occupancy Tax Over Thirty Day Stay?

To fill out the CA Transient Occupancy Tax Over Thirty Day Stay, you need to complete the appropriate tax form provided by the local tax authority, include the relevant rental information, calculate the tax owed based on your rental income, and submit the form along with any payment by the due date.

What is the purpose of CA Transient Occupancy Tax Over Thirty Day Stay?

The purpose of the CA Transient Occupancy Tax Over Thirty Day Stay is to generate revenue for local governments to support public services, infrastructure, and tourism initiatives that benefit the community.

What information must be reported on CA Transient Occupancy Tax Over Thirty Day Stay?

Information that must be reported includes the total amount of rent collected, the number of days rented, the name and address of the property, the name of the tenant, and any other details required by the local tax authority.

Fill out your CA Transient Occupancy Tax Over Thirty Day online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA Transient Occupancy Tax Over Thirty Day is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.