CA Transient Occupancy Tax Over Thirty Day Stay Exemption Application Form - Los Angeles 2019 free printable template

Show details

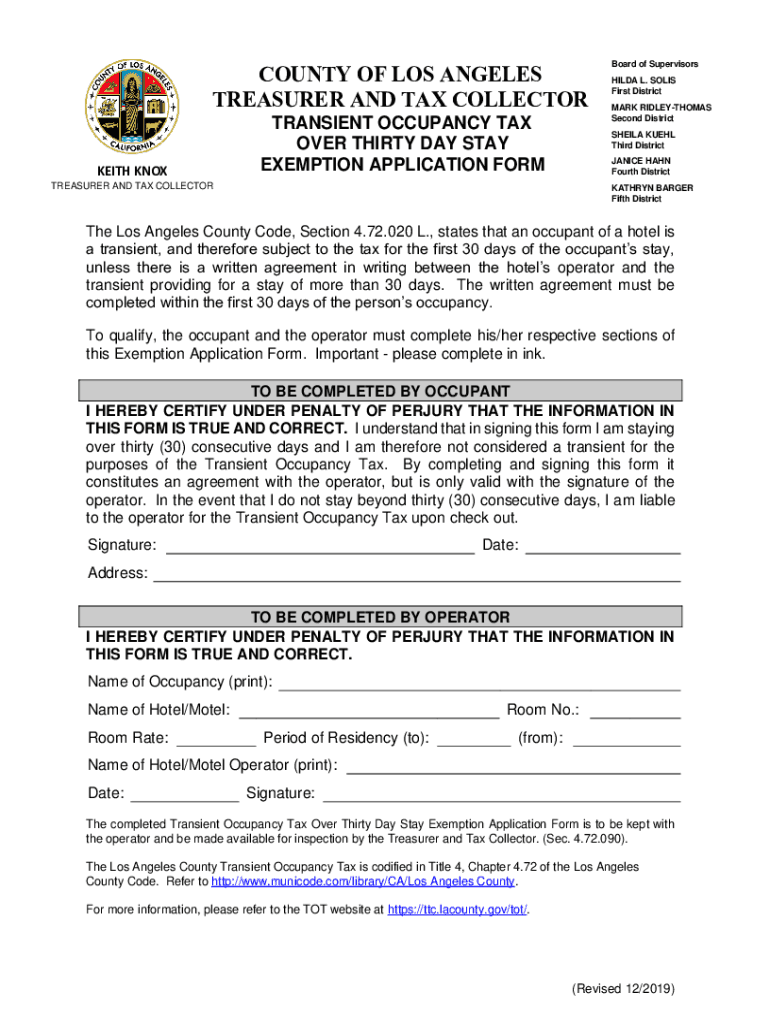

COUNTY OF LOS ANGELES

TREASURER AND TAX COLLECTOR

KEITH KNOXTRANSIENT OCCUPANCY TAX

OVER THIRTY DAY STAY

EXEMPTION APPLICATION FORMATTING TREASURER AND TAX COLLECTORBoard of Supervisors

HILDA L. SOLIS

First

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA Transient Occupancy Tax Over Thirty Day

Edit your CA Transient Occupancy Tax Over Thirty Day form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA Transient Occupancy Tax Over Thirty Day form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA Transient Occupancy Tax Over Thirty Day online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CA Transient Occupancy Tax Over Thirty Day. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA Transient Occupancy Tax Over Thirty Day Stay Exemption Application Form - Los Angeles Form Versions

Version

Form Popularity

Fillable & printabley

4.7 Satisfied (45 Votes)

4.8 Satisfied (65 Votes)

4.3 Satisfied (87 Votes)

4.4 Satisfied (38 Votes)

4.0 Satisfied (32 Votes)

How to fill out CA Transient Occupancy Tax Over Thirty Day

How to fill out CA Transient Occupancy Tax Over Thirty Day Stay

01

Obtain the CA Transient Occupancy Tax form for Over Thirty Day Stay from your local tax authority's website or office.

02

Fill in the property owner's name and contact information in the appropriate fields.

03

Enter the rental property's address, including city and zip code.

04

Specify the dates of the guest's stay, ensuring to include the start and end dates.

05

Calculate the total amount of rent charged for the entire stay and enter that in the designated area.

06

If applicable, include any additional fees that are subject to tax.

07

Provide details of any exemptions claimed and attach supporting documents.

08

Sign and date the form, certifying that the information provided is accurate.

09

Submit the completed form along with any required payment to your local tax authority.

Who needs CA Transient Occupancy Tax Over Thirty Day Stay?

01

Property owners or managers renting out accommodations for more than thirty days.

02

Landlords or lessors who are required to collect and report the transient occupancy tax.

03

Individuals or organizations providing lodging services that exceed the thirty-day period.

04

Taxpayers looking to comply with California state tax regulations regarding extended stays.

Fill

form

: Try Risk Free

People Also Ask about

What is the hotel room tax in California?

Types of Hotel Taxes in California Transient Occupancy Tax (TOT): This tax is also known as a “hotel tax” and is charged to guests who stay in a hotel room for less than 30 days. The rate of TOT varies depending on the location of the hotel and can range from 8% to 15.5% of the room rate.

How much is hotel taxes in SF?

Hotel fees in San Francisco include 14 percent occupancy tax, 0.195 percent California Tourism fee, and an 1.5 - 2.25 percent Tourism Improvement District assessment dependent upon the location of the hotel property.

What is the form for 30 day hotel tax exemption in Texas?

Permanent Residents (30-Day Rule) Guests who do not notify the hotel must pay the tax for the first 30 days and will be exempt after that. Hotel records are proof of a permanent resident's exemption, and Form 12-302, Texas Hotel Occupancy Tax Exemption Certificate (PDF), is not required.

Who is exempt from occupancy tax in Los Angeles County?

Any person who has a written agreement with the operator, entered into within the first thirty (30) days of the person's occupancy, which states the person will stay for more than thirty (30) consecutive calendar days is exempt from the TOT, for the first 30 days of the person's stay.

Does California have hotel tax exempt form?

We've got more versions of the california hotel tax exempt form pdf form. Select the right california hotel tax exempt form pdf version from the list and start editing it straight away!

What percentage of tax is on a hotel room?

Transient Occupancy Tax (TOT): This tax is also known as a “hotel tax” and is charged to guests who stay in a hotel room for less than 30 days. The rate of TOT varies depending on the location of the hotel and can range from 8% to 15.5% of the room rate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send CA Transient Occupancy Tax Over Thirty Day for eSignature?

When you're ready to share your CA Transient Occupancy Tax Over Thirty Day, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I fill out CA Transient Occupancy Tax Over Thirty Day using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign CA Transient Occupancy Tax Over Thirty Day and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit CA Transient Occupancy Tax Over Thirty Day on an Android device?

You can edit, sign, and distribute CA Transient Occupancy Tax Over Thirty Day on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is CA Transient Occupancy Tax Over Thirty Day Stay?

The CA Transient Occupancy Tax Over Thirty Day Stay is a tax that applies to individuals who rent accommodations for over thirty days in California, typically including hotels, motels, and other short-term rentals.

Who is required to file CA Transient Occupancy Tax Over Thirty Day Stay?

Property owners, operators of transient lodging facilities, or any entity providing accommodations for a stay exceeding thirty days are required to file and remit the CA Transient Occupancy Tax.

How to fill out CA Transient Occupancy Tax Over Thirty Day Stay?

To fill out the CA Transient Occupancy Tax form, property owners must provide details such as the rental dates, total rent collected, and the tax amount due. Accurate accounting of all stays and corresponding charges must be maintained.

What is the purpose of CA Transient Occupancy Tax Over Thirty Day Stay?

The purpose of the CA Transient Occupancy Tax Over Thirty Day Stay is to generate revenue for local governments in California to support public services and infrastructure that benefit residents and visitors.

What information must be reported on CA Transient Occupancy Tax Over Thirty Day Stay?

The information that must be reported includes the property address, total number of days rented, rental income, the amount of tax collected, and the applicable rental period.

Fill out your CA Transient Occupancy Tax Over Thirty Day online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA Transient Occupancy Tax Over Thirty Day is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.