ID ST-133 2018 free printable template

Show details

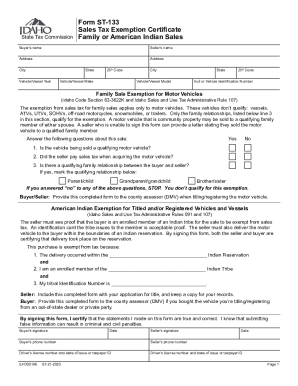

Form ST133

Sales Tax Exemption Certificate

Family or American Indian Sales

Buyers Name Sellers NameAddressAddressCityStateVehicle/Vessel Year ZIP CodeVehicle/Vessel Capacity

Vehicle/Vessel ModelStateZIP

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ID ST-133

Edit your ID ST-133 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ID ST-133 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ID ST-133 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ID ST-133. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ID ST-133 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ID ST-133

How to fill out ID ST-133

01

Start by downloading the ID ST-133 form from the official website or obtain a physical copy from the relevant authority.

02

Fill in your personal information, including your name, address, and date of birth, at the top of the form.

03

Provide any required identification numbers, such as Social Security Number or Taxpayer ID, in the designated fields.

04

Outline the specific purpose for which you are requesting the ID ST-133 in the provided section.

05

Include any additional documentation or proof required alongside the form, as per the instructions.

06

Review the form to ensure all information is accurate and complete.

07

Sign and date the form where indicated.

08

Submit the filled-out form as directed, either by mail or in person.

Who needs ID ST-133?

01

Individuals or businesses needing to certify sales tax exemption in New York State.

02

Organizations making tax-exempt purchases.

03

Entities involved in certain charitable activities requiring exemption from sales tax.

Instructions and Help about ID ST-133

Fill

form

: Try Risk Free

People Also Ask about

How do I pay sales tax in Idaho?

How to File and Pay Sales Tax in Idaho File online – File online at the Idaho State Tax Commission's Taxpayer Access Point (TAP). You can remit your payment through their online system. File by mail – You can use Form 850 and file and pay through the mail. AutoFile – Let TaxJar file your sales tax for you.

What items are exempt from sales tax in Idaho?

Sales Tax Exemptions in Idaho Clothing. 6% Groceries. 6% Prepared Food. 6% Prescription Drugs. EXEMPT. OTC Drugs. 6%

Does Idaho charge sales tax on used cars?

Idaho Sales Tax on Car Purchases: Idaho collects a 6% state sales tax rate on the purchase of all vehicles. In addition to taxes, car purchases in Idaho may be subject to other fees like registration, title, and plate fees.

Is sales tax collected in Idaho on the sale of used vehicles?

Sales or use tax is due on the sale, lease, rental, transfer, donation or use of a motor vehicle in Idaho unless a valid exemption applies.

Is Idaho a tax exempt state?

All retail sales in Idaho are taxable unless specifically exempted by Idaho or federal law. A sale is exempt from sales and use tax only if Idaho law specifically allows an exemption.

Does Idaho collect sales tax on out of state purchases?

Idaho imposes a use tax on out-of-state purchases You will generally be allowed a credit for sales or use tax paid in another state for tangible personal property used in Idaho. The amount of the credit may not exceed the amount of the Idaho tax. Responsibility for collecting use tax.

Do resale certificates expire in Idaho?

Does an Idaho Resale Certificate Expire? While sales tax numbers can become inactive or revoked if not used, resale certificates will not expire. To ensure the buyer's information is up-to-date, it is recommended that certificates be updated at least every three years.

Do I have to pay sales tax on my car when I move to Idaho?

You must pay sales or use tax on the sales price of the motor vehicle unless you have an exemption. The sales price is the amount you paid for the motor vehicle. You must provide a bill of sale or receipt as proof of the sales price when titling your motor vehicle in Idaho.

Does OK accept out of state resale certificates?

Does OK accept out of state resale certificates? Oklahoma allows the use of uniform sales tax exemption certificates, which are general exemption certificates that can be used across multiple states.

How do I become a sales tax exempt reseller in Idaho?

If you buy goods for resale from a seller doing business in Idaho, you must give the seller a completed form ST-101, Sales Tax Resale or Exemption Certificate. The seller should keep this form on file and not charge tax on your future qualifying purchases.

How is sales tax calculated on a car in Idaho?

How Much Is the Car Sales Tax in Idaho? The car sales tax rate for Idaho is 6% on the purchase price of each vehicle you buy. However, there may be an extra local or county sales tax added onto the base 6% state tax.

What qualifies a person as tax exempt?

Typically, you can be exempt from withholding tax only if two things are true: You got a refund of all your federal income tax withheld last year because you had no tax liability. You expect the same thing to happen this year. Internal Revenue Service.

What is exempt from Idaho sales tax?

While the Idaho sales tax of 6% applies to most transactions, there are certain items that may be exempt from taxation.Other tax-exempt items in Idaho. CategoryExemption StatusManufacturing and MachineryRaw MaterialsEXEMPTUtilities & FuelEXEMPT *Medical Goods and Services16 more rows

How do I get a resale permit in Idaho?

To apply for a seller's permit, complete the Idaho Business Registration application. It's free. If you apply online, you'll get the permit in about 10 days. If you mail your application, it can take up to four weeks to get the permit.

Does Idaho accept out of state resale certificates?

If you buy goods for resale from out-of-state businesses that are registered Idaho retailers, you can complete the Uniform Sales and Use Tax Certificate - Multijurisdiction instead of form ST-101.

How do I avoid paying sales tax on a car in Idaho?

The buyer must give you a completed Form ST-104IC, Idaho Sales Tax Exemption Certificate – Motor Vehicle. Keep a copy of the form for your records. The certificate requires buyers to verify that they'll use the vehicle in a fleet with at least 10 percent of its mileage outside of Idaho.

Who is exempt from Idaho sales tax?

While the Idaho sales tax of 6% applies to most transactions, there are certain items that may be exempt from taxation.Other tax-exempt items in Idaho. CategoryExemption StatusManufacturing and MachineryRaw MaterialsEXEMPTUtilities & FuelEXEMPT *Medical Goods and Services16 more rows

Does Idaho have a salt workaround?

31, 2021. ing IRS Notice 2020-75, pass-through entities that want to deduct the state and local tax (SALT) payment from their 2021 income on their federal tax return need to send the payment to the Idaho State Tax Commission by December 31, 2021.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ID ST-133 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your ID ST-133 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send ID ST-133 to be eSigned by others?

ID ST-133 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an electronic signature for signing my ID ST-133 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your ID ST-133 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is ID ST-133?

ID ST-133 is a form used for reporting sales tax information in certain jurisdictions, specifically for transactions involving items that are exempt from sales tax.

Who is required to file ID ST-133?

Businesses or individuals who sell goods or services that are exempt from sales tax are required to file ID ST-133 to report their exempt transactions.

How to fill out ID ST-133?

To fill out ID ST-133, you need to provide information such as your business name, address, type of exemption, details of the exempt sales, and any other required identifying information.

What is the purpose of ID ST-133?

The purpose of ID ST-133 is to document and verify sales tax exemptions and to ensure that the proper records are maintained for tax compliance purposes.

What information must be reported on ID ST-133?

The information that must be reported on ID ST-133 includes the seller's information, the buyer's information, details about the transaction, and the specific reason for the tax exemption.

Fill out your ID ST-133 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ID ST-133 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.