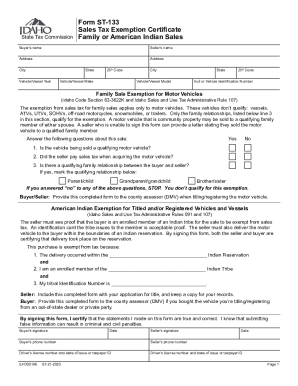

ID ST-133 2014 free printable template

Show details

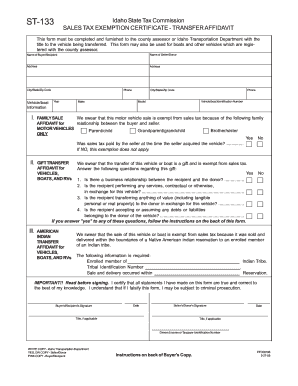

ST-133 Idaho State Tax Commission SALES TAX EXEMPTION CERTIFICATE TRANSFER AFFIDAVIT This form must be completed and furnished to the county assessor or Idaho Transportation Department with the title

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ID ST-133

Edit your ID ST-133 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ID ST-133 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ID ST-133 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ID ST-133. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ID ST-133 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ID ST-133

How to fill out ID ST-133

01

Obtain the ID ST-133 form from the official website or local tax office.

02

Fill out the top section with your personal information, including your name, address, and contact details.

03

Indicate your tax identification number (if applicable) in the specified field.

04

Provide details about the property or item for which you are claiming the exemption.

05

Specify the reason for seeking the exemption in the designated area.

06

Review all entered information for accuracy and completeness.

07

Sign and date the form at the bottom.

Who needs ID ST-133?

01

Individuals or businesses claiming an exemption on sales tax for certain purchases in New York State.

02

Anyone involved in a transaction that is eligible for an exemption under specific tax laws.

Instructions and Help about ID ST-133

Fill

form

: Try Risk Free

People Also Ask about

What is Boise sales tax?

What is the sales tax rate in Boise, Idaho? The minimum combined 2023 sales tax rate for Boise, Idaho is 6%. This is the total of state, county and city sales tax rates. The Idaho sales tax rate is currently 6%.

What is the sales tax in Idaho 2022?

Idaho Tax Rates, Collections, and Burdens Idaho has a 6.00 percent state sales tax rate, a 3.00 percent max local sales tax rate, and an average combined state and local sales tax rate of 6.02 percent. Idaho's tax system ranks 17th overall on our 2022 State Business Tax Climate Index.

What are the sales tax rules in Idaho?

Idaho has a statewide sales tax rate of 6%, which has been in place since 1965. Municipal governments in Idaho are also allowed to collect a local-option sales tax that ranges from 0% to 3% across the state, with an average local tax of 0.07% (for a total of 6.07% when combined with the state sales tax).

What is the current sales tax in Idaho?

Idaho sales tax details The Idaho (ID) state sales tax rate is currently 6%. Depending on local municipalities, the total tax rate can be as high as 9%.

What is not taxed in Idaho?

While the Idaho sales tax of 6% applies to most transactions, there are certain items that may be exempt from taxation.Other tax-exempt items in Idaho. CategoryExemption StatusManufacturing and MachineryUtilities & FuelEXEMPT *Medical Goods and ServicesMedical DevicesEXEMPT *16 more rows

What taxes do you pay in Idaho?

Idaho Tax Rates, Collections, and Burdens Idaho has a 6.00 percent state sales tax rate, a 3.00 percent max local sales tax rate, and an average combined state and local sales tax rate of 6.02 percent. Idaho's tax system ranks 17th overall on our 2022 State Business Tax Climate Index.

Are groceries taxed in Idaho?

Idaho applies its full 6% sales tax to food, but then offsets that tax by providing a credit on income tax returns.

What is the sales tax rate in Idaho for 2023?

The minimum combined 2023 sales tax rate for Boise, Idaho is 6%. This is the total of state, county and city sales tax rates. The Idaho sales tax rate is currently 6%.

Is there state sales tax in Idaho?

This article answers some of the basic questions regarding sales tax in Idaho. In Idaho, a 6 percent state tax is imposed on retail sales to be collected by the retailer from the consumer. In addition, make sure you contact your local (county, municipal etc.)

What is exempt from Idaho state sales tax?

Sales Tax Exemptions in Idaho Several examples of exemptions are prescription drugs, some groceries, truck campers, office trailers, and transport trailers. These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ID ST-133 online?

With pdfFiller, the editing process is straightforward. Open your ID ST-133 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit ID ST-133 in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your ID ST-133, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out the ID ST-133 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign ID ST-133 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is ID ST-133?

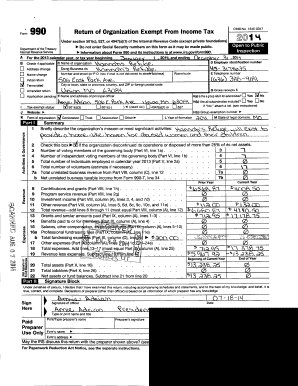

ID ST-133 is a reporting form used for sales tax purposes in the state of Idaho.

Who is required to file ID ST-133?

Businesses or individuals who make sales subject to Idaho sales tax are required to file ID ST-133.

How to fill out ID ST-133?

To fill out ID ST-133, provide the required information such as business details, sales figures, and other relevant data as instructed on the form.

What is the purpose of ID ST-133?

The purpose of ID ST-133 is to report sales tax collected from customers and remit it to the state of Idaho.

What information must be reported on ID ST-133?

Information that must be reported on ID ST-133 includes the total sales, amount of sales tax collected, business identification details, and any exemptions applicable.

Fill out your ID ST-133 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ID ST-133 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.