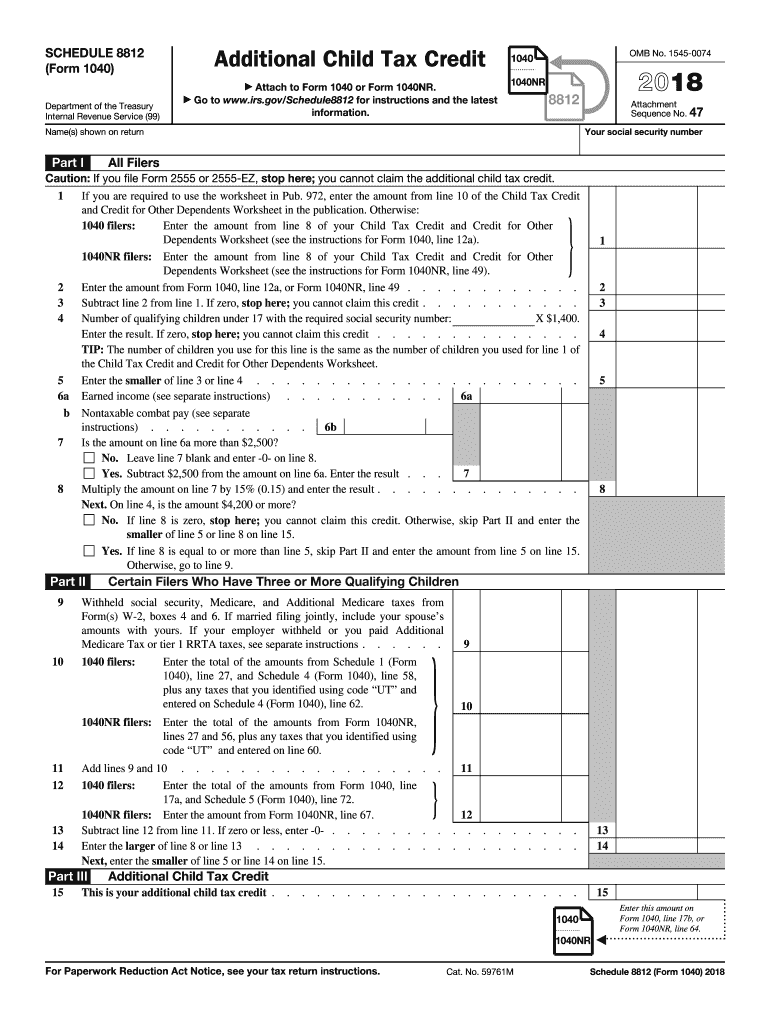

Who Needs Schedule 8812?

Schedule 8812 or as it is called the Child Tax Credit will be useful for everyone who has a family. If you have a child you might need Schedule 8812 for Form 1040.

What is Schedule 8812 for?

The primary goal of Schedule 8812 is to claim a dependent child on a tax return. However, not all the dependent children may be qualified for a credit. Here are some exceptions:

- Children who don’treside in U.S.

- Can’t be identified with SSN or ITIN

- Has been in the U.S. for 31 days during the tax year

- Has been in U.S. for 183 days during 3 tax years

The Child Tax Credit may be added to the total tax amount and may impact the amount of money you receive on a tax return or owe.

Is Schedule 8812 Accompanied by Other Forms?

If you have filed all necessary tax returns for the year, Schedule 8812 doesn’t require additional documents. In some cases, the IRS may ask you to provide evidence of the child’s presence in the U.S.

When is Schedule 8812 Due?

The deadline for Schedule 8812 is exactly the same as it is for your tax return. This year, it is April, 18th.

How do I Fill out Schedule 8812?

Schedule 8812 is two pages with four parts. There is much information to be provided on the Schedule. As usual, you will have to start with:

- Contact information

- SSN,

- Child’s SSN or ITIN

- Financial records

- Completed Form 1040

- Etc.

Where do I send Schedule 8812?

Schedule 8812 is mailed together with Form 1040 to the IRS.