Get the free Certificate of Insurance - Kiwanis International

Show details

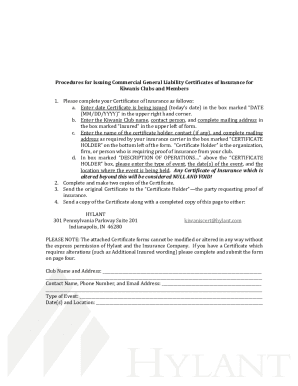

Insurance & Risk M Kiwanis CERTIFICATES OF INSURANCE current Certificate Packet is enclosed. Make copies as needed, so you have Certificates on hand for future events. On page 2, the Certificate of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificate of insurance

Edit your certificate of insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate of insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit certificate of insurance online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit certificate of insurance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certificate of insurance

How to fill out a certificate of insurance:

01

Obtain the necessary information: Gather all relevant details about your insurance policy, such as the policy number, effective dates, and coverage limits.

02

Identify the certificate holder: Clearly indicate the name and contact information of the individual or organization requesting the certificate of insurance. Ensure accuracy, as any mistakes can lead to delays or rejection.

03

Describe the coverage: Provide a comprehensive overview of the insurance coverage being certified. This may include general liability, workers' compensation, or any other specific policy.

04

Include policy endorsements: If there are any policy endorsements or special provisions, make sure to indicate them in the certificate of insurance.

05

Verify additional insured status: If required, specify any additional parties that need to be listed as insured on the certificate. This is common when working with subcontractors or clients.

06

Add any required verbiage: Some certificate holders may request specific wording or clauses to be included in the certificate. Make sure to comply with their requirements.

07

Obtain signatures: Typically, both the insurance agent/broker and the policyholder will need to sign the certificate of insurance. Ensure that all required signatures are obtained before submitting the document.

Who needs a certificate of insurance:

01

Contractors: Many clients or businesses hiring contractors will request a certificate of insurance to ensure they are adequately protected against any liabilities.

02

Rental property owners: Property owners often require tenants to provide them with a certificate of insurance to confirm that they have sufficient coverage in case of any property damage or liability claims.

03

Event organizers: Organizations hosting events, conferences, or trade shows may request certificates of insurance from vendors, exhibitors, or performers to safeguard against any mishaps that may occur during the event.

04

Business partners: When entering into joint ventures or partnerships, companies may request certificates of insurance from each other to mitigate any potential risks and ensure both parties are adequately insured.

05

Government entities: Government agencies often require certificates of insurance from contractors bidding on contracts or providing services to ensure compliance with their insurance requirements.

In summary, anyone involved in contractual agreements, property leasing, event planning, business partnerships, or working with government entities may need a certificate of insurance. It is crucial to understand the specific requirements of each situation to successfully obtain and provide the necessary documentation.

Fill

form

: Try Risk Free

People Also Ask about

Which vendors need a certificate of insurance?

5. Who Needs to Collect COIs? Business owners, contractors, property owners, and landlords should request COIs from every vendor, subcontractor, or tenant they work with or lease to. This even holds for vendors you have worked with before and know you can trust.

What is certificate of insurance COI?

A COI is a statement of coverage issued by the company that insures your business. Usually no more than one page, a COI provides a summary of your business coverage. It serves as verification that your business is indeed insured. Potential clients may request a COI as a condition of doing business with you.

What is the purpose of certificate of insurance?

A COI is a statement of coverage issued by the company that insures your business. Usually no more than one page, a COI provides a summary of your business coverage. It serves as verification that your business is indeed insured.

Is a COI free?

No, it doesn't cost anything to acquire COI. A moving company should be able to provide you with a certificate of insurance at no extra cost.

What does COI cost?

Certificates of insurance should not cost you anything. If you have a policy in place, your insurance agent should be able to provide a COI without an extra charge. In fact, most states do not allow for agencies to charge a fee for COIs.

Why do I need a COI from a vendor?

A certificate of insurance is a document that proves a vendor, subcontractor, tenant, supplier, etc. has the correct coverage, and it's for the right amount. Collecting insurance certificates ensures those you are doing business with have their own coverage, and any claims that arise can be subrogated.

What type of insurance do vendors need?

8 Common Vendor Insurance Requirements Commercial General Liability Insurance. Workers' Compensation. Employer's Liability Coverage. Business Automobile Liability. Professional Liability. Umbrella or Excess Liability Coverage. Cyber Risk Insurance. Product Liability Insurance.

Should I ask for a COI?

In addition, you should always ensure that you request and verify COIs before allowing the vendor or contractor to begin work. Even if a contractor provides verbal assurance, there is no guarantee that they fully understand the terms and conditions of their insurance as they relate to your business.

What does a COI cover?

A COI is a statement of coverage issued by the company that insures your business. Usually no more than one page, a COI provides a summary of your business coverage. It serves as verification that your business is indeed insured. Potential clients may request a COI as a condition of doing business with you.

Is a COI the same as proof of insurance?

A certificate of insurance (COI) is a document from an insurer to show you have business insurance. They're also known as certificates of liability insurance or proof of insurance. With a COI, your clients can make sure you have the right insurance before they start working with you.

Why do companies need a COI?

A COI is a statement of coverage issued by the company that insures your business. Usually no more than one page, a COI provides a summary of your business coverage. It serves as verification that your business is indeed insured. Potential clients may request a COI as a condition of doing business with you.

Why do people request COI?

A certificate of insurance protects both small business owners and their partners. Offering both parties peace of mind, financial protection, and a risk transfer solution, before they begin working together. A COI essentially summarizes your business insurance coverage details.

Why would a customer need a certificate of insurance?

Certificates of insurance (COIs) are documents containing all the essential details of an insurance policy in an easily digestible, standardized format. A COI is intended to prove a policy's status, provide quick access to its coverage details, reduce risk exposure, and protect against third-party liability.

Why is a COI needed?

A certificate of insurance (COI) is issued by an insurance company or broker and verifies the existence of an insurance policy. Small-business owners and contractors typically require a COI that grants protection against liability for workplace accidents or injuries to conduct business.

What is a COI insurance certificate?

A COI is a statement of coverage issued by the company that insures your business. Usually no more than one page, a COI provides a summary of your business coverage. It serves as verification that your business is indeed insured. Potential clients may request a COI as a condition of doing business with you.

When should I ask for a certificate of insurance?

When Should I Get a Certificate of Insurance? You should ask for and receive a COI before anyone works on your home or property. If you have a written contract, it should contain insurance requirements, including coverage and limits required that are verified with a COI.

How long is a COI good for?

Typically, a COI is good for five years. You should hold on to any COI you get indefinitely, since you do not know when a problem may arise for a job carried out on your premises or you completed for someone else.

Why would a customer request a certificate of insurance?

it assures they have the correct coverage, exposure to risk is reduced, and there is protection in place against third-party liability.

Who uses certificates of insurance?

Certificates of insurance are important in two main situations: When you need to provide proof of insurance coverage to someone you plan to work with, and when you need to verify that another company has insurance. Clients, business partners, and landlords often require proof of insurance.

What is a certificate of insurance for customers?

What Are Certificates of Insurance? A certificate of insurance (COI) is a document from an insurer to show you have business insurance. They're also known as certificates of liability insurance or proof of insurance. With a COI, your clients can make sure you have the right insurance before they start working with you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the certificate of insurance in Gmail?

Create your eSignature using pdfFiller and then eSign your certificate of insurance immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out certificate of insurance using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign certificate of insurance and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit certificate of insurance on an iOS device?

You certainly can. You can quickly edit, distribute, and sign certificate of insurance on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

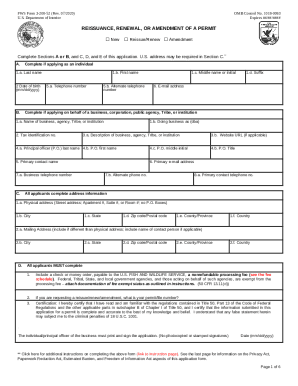

What is certificate of insurance?

A certificate of insurance is a document that verifies the existence of an insurance policy and provides details about the coverage, policy number, insurer, and the insured.

Who is required to file certificate of insurance?

Generally, businesses and individuals who are required to provide proof of insurance to other parties, such as clients, vendors, or government entities, must file a certificate of insurance.

How to fill out certificate of insurance?

To fill out a certificate of insurance, you need to provide details such as the insured's name and address, the insurer's information, policy number, effective dates of coverage, types of coverage provided, and any additional insured parties if applicable.

What is the purpose of certificate of insurance?

The purpose of a certificate of insurance is to establish proof of insurance coverage and to inform third parties about the type and amount of coverage that is in place.

What information must be reported on certificate of insurance?

A certificate of insurance must report the insured's name and address, insurer's name and contact information, type of coverage, policy numbers, effective dates, limits of liability, and any endorsements or special conditions.

Fill out your certificate of insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificate Of Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.