AU NAT 1067 2018 free printable template

Show details

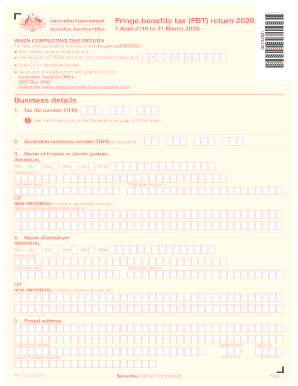

Fringe benefits tax (FBI) return 2018 106701181 April 2017 to 31 March 2018 WHEN COMPLETING THIS Returner help with completing this return visit ato.gov.au/FBT2018 Print clearly using a black pen

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AU NAT 1067

Edit your AU NAT 1067 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU NAT 1067 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AU NAT 1067 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit AU NAT 1067. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU NAT 1067 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU NAT 1067

How to fill out AU NAT 1067

01

Begin by downloading the AU NAT 1067 form from the official website.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide any specific details required regarding the purpose of the form.

04

Attach any supporting documentation as specified in the instructions.

05

Review your completed form for any errors or omissions.

06

Submit the form by mail or electronically as instructed in the guidelines.

Who needs AU NAT 1067?

01

Individuals who are applying for a visa or residency in Australia may need to fill out AU NAT 1067.

02

Those who are undergoing certain assessments relevant to immigration processes will also require this form.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to complete an FBT return?

Do you need to lodge a return? You must lodge a fringe benefits tax (FBT) return if, for the FBT year (1 April to 31 March), you either: have FBT payable on fringe benefits you provided to your employees. paid FBT instalments through your activity statements.

Do fringe benefits include payroll taxes?

FICA, also known as the Federal Insurance Contributions Act, is a mandatory payroll tax that is equally split between employees and employers. Most fringe benefits are subject to FICA, as well as income tax withholding and employment taxes, although there are some fringe benefits that may be considered nontaxable.

What is the reportable FBT threshold?

If you receive fringe benefits with a total taxable value of more than $2,000 in a fringe benefits tax (FBT) year (1 April to 31 March), your employer will report this amount to us. Some benefits don't have to be reported to us.

What are reportable fringe benefits?

The amount you report for an employee is called their reportable fringe benefits amount (RFBA). The RFBA is 'grossed-up' to reflect the pre-tax income the employee would have had to earn, at the highest marginal tax rate (plus the Medicare levy), to buy the benefits themselves.

Are fringe benefits subject to payroll tax?

Fringe benefits are generally included in an employee's gross income (there are some exceptions). The benefits are subject to income tax withholding and employment taxes.

What is the threshold for annual FBT returns?

Annual returns Annual FBT returns cover the tax year from 1 April to 31 March. You can only file annual FBT returns if one of the following applies: your gross PAYE and employer superannuation contribution tax (ESCT) for the previous year were $1,000,000 or less. you were not an employer in the previous tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the AU NAT 1067 electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I edit AU NAT 1067 on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit AU NAT 1067.

How do I fill out AU NAT 1067 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign AU NAT 1067 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is AU NAT 1067?

AU NAT 1067 is a form used by businesses in Australia to report their withheld amounts of tax, specifically for payments made to non-residents.

Who is required to file AU NAT 1067?

Businesses that make payments to non-residents for services or works performed in Australia are required to file AU NAT 1067.

How to fill out AU NAT 1067?

To fill out AU NAT 1067, gather the necessary information about the payments made, complete the required sections of the form, including details of the payee and the amounts withheld, then submit it to the Australian Taxation Office (ATO).

What is the purpose of AU NAT 1067?

The purpose of AU NAT 1067 is to report and remit amounts withheld from payments to non-residents, ensuring compliance with Australian tax laws.

What information must be reported on AU NAT 1067?

The information that must be reported on AU NAT 1067 includes the payer's details, the payee's details, the amount paid, the amount withheld, and the relevant withholding tax information.

Fill out your AU NAT 1067 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU NAT 1067 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.