AU NAT 1067 2020-2026 free printable template

Show details

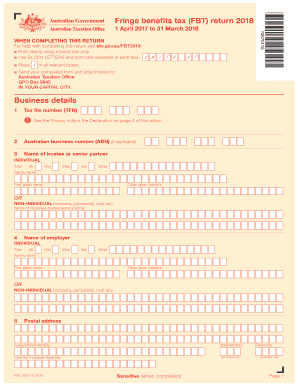

Fringe benefits tax (FBI) return 2020 106701201 April 2019 to 31 March 2020 WHEN COMPLETING THIS Returner help with completing this return visit ato.gov.au/FBT2020 Print clearly using a black pen

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign fbt return form 2025

Edit your AU NAT 1067 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU NAT 1067 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AU NAT 1067 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit AU NAT 1067. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU NAT 1067 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU NAT 1067

How to fill out AU NAT 1067

01

Obtain the AU NAT 1067 form from the official website or your local taxation office.

02

Fill in your personal details including your name, address, and contact information at the top of the form.

03

Provide your Australian Business Number (ABN) if applicable.

04

Complete the sections relevant to your income, deductions, and other financial information.

05

Review all your entries for accuracy.

06

Sign and date the form at the designated area.

07

Submit the completed form either electronically or via mail as instructed.

Who needs AU NAT 1067?

01

Individuals and businesses that are required to report income to the Australian Taxation Office.

02

Those who are claiming specific tax deductions or allowances.

03

People applying for government benefits or other financial assessments that require disclosure of income.

Fill

form

: Try Risk Free

People Also Ask about

What is considered fringe benefits for tax purposes?

Bonuses, company-provided vehicles, and group term life insurance (with coverage that exceeds $50,000) are considered taxable fringe benefits. Nontaxable fringe benefits can include adoption assistance, on-premises meals and athletic facilities, disability insurance, health insurance, and educational assistance.

What are reportable fringe benefits?

The reportable fringe benefit amount reflects the gross salary that you would have to earn to purchase the benefit from your after-tax income. Example: working out amounts for income statements or payment summaries.

Are all fringe benefits taxable?

Any fringe benefit offered as a bonus to an employee from an employer is considered taxable income unless it falls under a specific list of excluded benefits as determined by the IRS.

Do I need to lodge FBT return?

Employers must lodge a fringe benefits tax (FBT) return if they have a liability – also known as a fringe benefits taxable amount – during an FBT year (1 April to 31 March). If you prepare your own FBT return, you must lodge a return and pay the FBT you owe for the FBT year by 21 May.

How do I submit a return to FBT?

You can lodge your FBT return: electronically, using Standard Business Reporting (SBR)-enabled software. through your tax agent. by posting a paper FBT return to us.

What is included in FBT?

FBT is a tax that employers pay on benefits paid to an employee (or their associate, such as a family member) in addition to their salary or wages. FBT is calculated on the taxable value of the benefits you provide.

Where are taxable fringe benefits reported?

If the recipient of a taxable fringe benefit is your employee, the benefit is generally subject to employment taxes and must be reported on Form W-2, Wage and Tax Statement. However, you can use special rules to withhold, deposit, and report the employment taxes.

What are types of fringe benefits?

Some of the most common examples of fringe benefits are health insurance, workers' compensation, retirement plans, and family and medical leave. Less common fringe benefits might include paid vacation, meal subsidization, commuter benefits, and more.

What are examples of fringe benefits?

What Are Fringe Benefits Examples. Some of the most common examples of fringe benefits are health insurance, workers' compensation, retirement plans, and family and medical leave. Less common fringe benefits might include paid vacation, meal subsidization, commuter benefits, and more.

What is a Type 1 FBT?

Type 1 fringe benefits are benefits where you (or a member of the same GST group) are entitled to a GST credit for GST paid on the benefits provided to an employee. These are referred to as GST-creditable benefits.

What is FBT in income tax?

Fringe benefit tax is levied on the fringe benefits that are provided by the company to the employees. This tax is paid to the government by the employers for offering these fringe benefits. This was abolished in the fiscal year 2010-11.

How do I record FBT in Xero?

These notes are not sent to the ATO, and are for your reference only. In the Tax menu, select Returns. Click the return to open it. Click New Non-ATO return Notes. Enter any notes. Notes aren't sent to the ATO. They're for your reference only. Click Back to FBT Summary to save your notes and return to the FBT.

What is a Type 2 fringe benefit?

The FBTA Act categorises fringe benefits into two types - Type 1 and Type 2. Type 2 fringe benefits attract a lower gross up figure for income tax purposes than Type 1 fringe benefits. This lower figure, called the type 2 gross up amount, is used for payroll tax purpose.

How much is FBT 2022?

total instalments for the FBT year (1 April 2021 – 31 March 2022) – $16,000.

How do you calculate FBT?

How is the amount of FBT calculated? The taxable value of a benefit is calculated ing to the valuation rules. 1.8868 if there is no GST in the price of the benefit or the employer is unable to claim input tax credits.

How do I lodge a 2022 FBT return?

You can lodge your FBT return: electronically, using your Standard Business Reporting (SBR)-enabled software. through your tax agent.

What is the difference between Type 1 and Type 2 FBT?

The difference between a Type 1 fringe benefit and Type 2 fringe benefit is whether the amount is entitled to a GST credit. Type 1 fringe benefits are a GST taxable supply with an entitlement to a GST credit whereas with Type 2 fringe benefits, the provider of the benefit is unable to claim a GST credit.

What is the FBT gross-up factor?

Gross up factor – there are two different gross-up rates used to calculate the amount of FBT payable: The Type 1 (higher) gross-up factor is currently 2.0802. This factor is applied when the employer is entitled to a goods and services tax (GST) credit for GST paid on the benefit provided to an employee.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete AU NAT 1067 online?

Easy online AU NAT 1067 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit AU NAT 1067 online?

With pdfFiller, it's easy to make changes. Open your AU NAT 1067 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an eSignature for the AU NAT 1067 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your AU NAT 1067 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is AU NAT 1067?

AU NAT 1067 is a form used by Australian individuals and entities to report information regarding their tax obligations, specifically concerning the Australian government's withholding tax.

Who is required to file AU NAT 1067?

Entities and individuals who withhold tax from payments made to employees or contractors, as well as those who are required to report specific tax information to the Australian Taxation Office (ATO), must file AU NAT 1067.

How to fill out AU NAT 1067?

To fill out AU NAT 1067, individuals and entities must provide accurate details such as their name, contact information, the amount of tax withheld, and any relevant financial information related to the payments made.

What is the purpose of AU NAT 1067?

The purpose of AU NAT 1067 is to ensure that the Australian Taxation Office receives accurate information regarding withholdings, which helps in the assessment of tax liabilities and compliance with Australian tax laws.

What information must be reported on AU NAT 1067?

Information that must be reported on AU NAT 1067 includes the reported income, the amounts withheld, payer and payee details, and any other relevant information stipulated by the Australian Taxation Office.

Fill out your AU NAT 1067 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU NAT 1067 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.