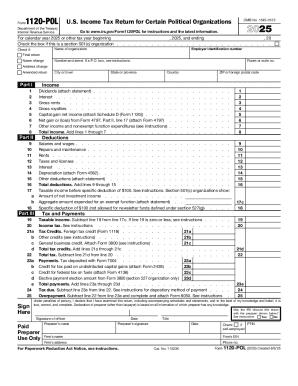

IRS 1120-POL 2018 free printable template

Instructions and Help about IRS 1120-POL

How to edit IRS 1120-POL

How to fill out IRS 1120-POL

About IRS 1120-POL 2018 previous version

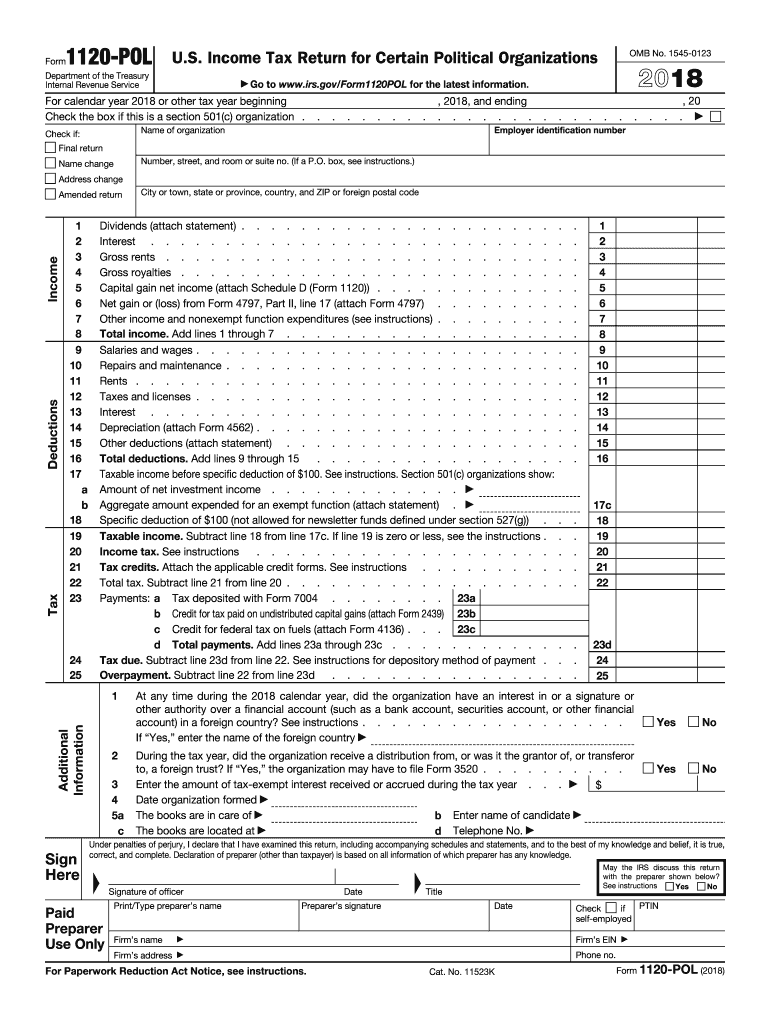

What is IRS 1120-POL?

Who needs the form?

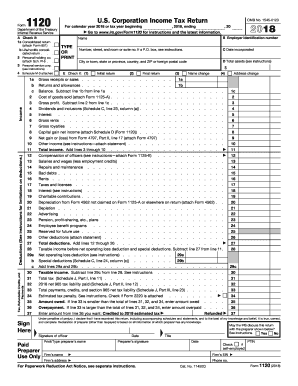

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1120-POL

What should I do if I realize I made a mistake on my 2016 form 1120 after filing?

If you discover an error after submitting your 2016 form 1120, you should file an amended return using Form 1120-X. It's essential to do this promptly to ensure compliance and avoid potential penalties. Keep in mind that an amended return also allows you to rectify any deductions or credits you may have missed.

How can I check the status of my 2016 form 1120 filing?

To verify the status of your 2016 form 1120, you can contact the IRS directly or use their online tools if available. Be prepared to provide your tax identification number and relevant details from your filing. Regular tracking helps ensure your submission has been processed without issues.

Are electronic signatures acceptable when filing the 2016 form 1120?

Yes, electronic signatures are generally acceptable for the 2016 form 1120, but specific requirements must be met. Make sure your e-filing software is compliant and check for any additional guidelines the IRS may have provided to ensure your submission is valid.

What should I do if my e-file submission of the 2016 form 1120 gets rejected?

If your e-file submission of the 2016 form 1120 is rejected, review the rejection codes provided by the IRS carefully. Typically, these codes indicate the nature of the issue, which you can address. Once corrected, resubmit the form; the IRS provides instructions for proper re-filing in these cases.

What are some common errors people make when filing the 2016 form 1120, and how can I avoid them?

Common errors when filing the 2016 form 1120 include incorrect tax identification numbers, missing signatures, and inaccuracies in financial data. To avoid these mistakes, double-check all entries, ensure all required fields are completed, and take your time during the filing process.