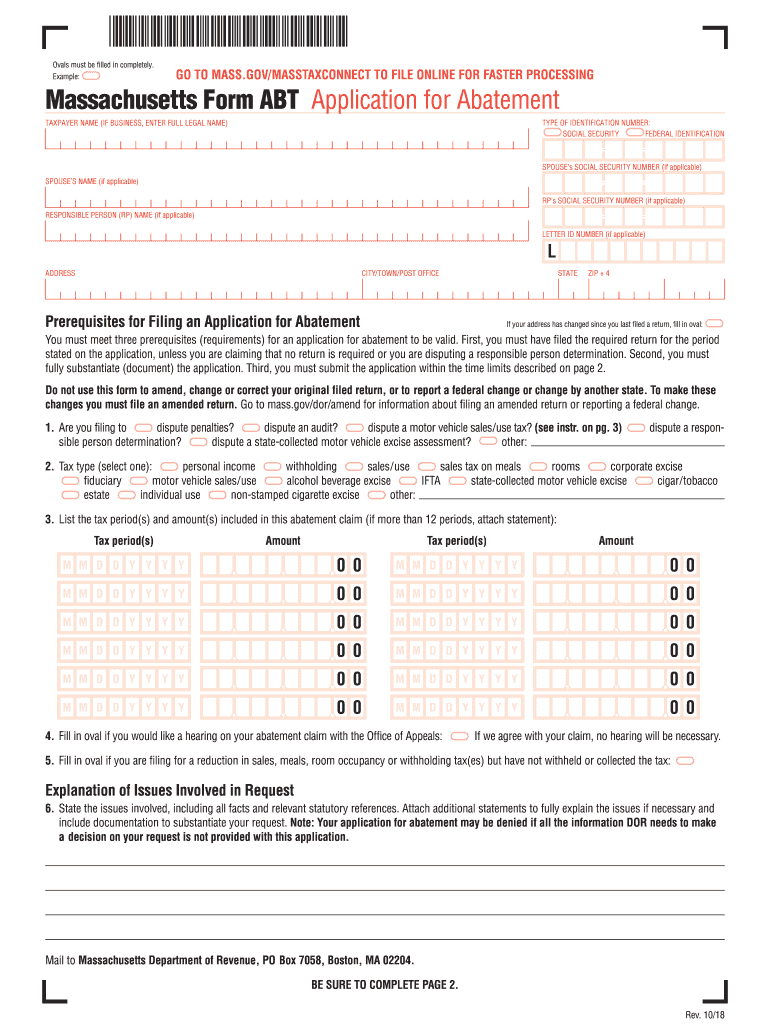

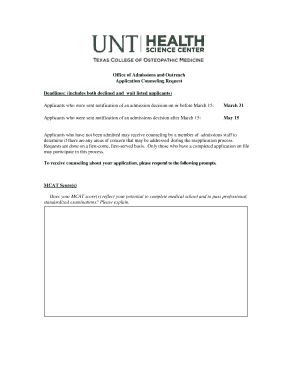

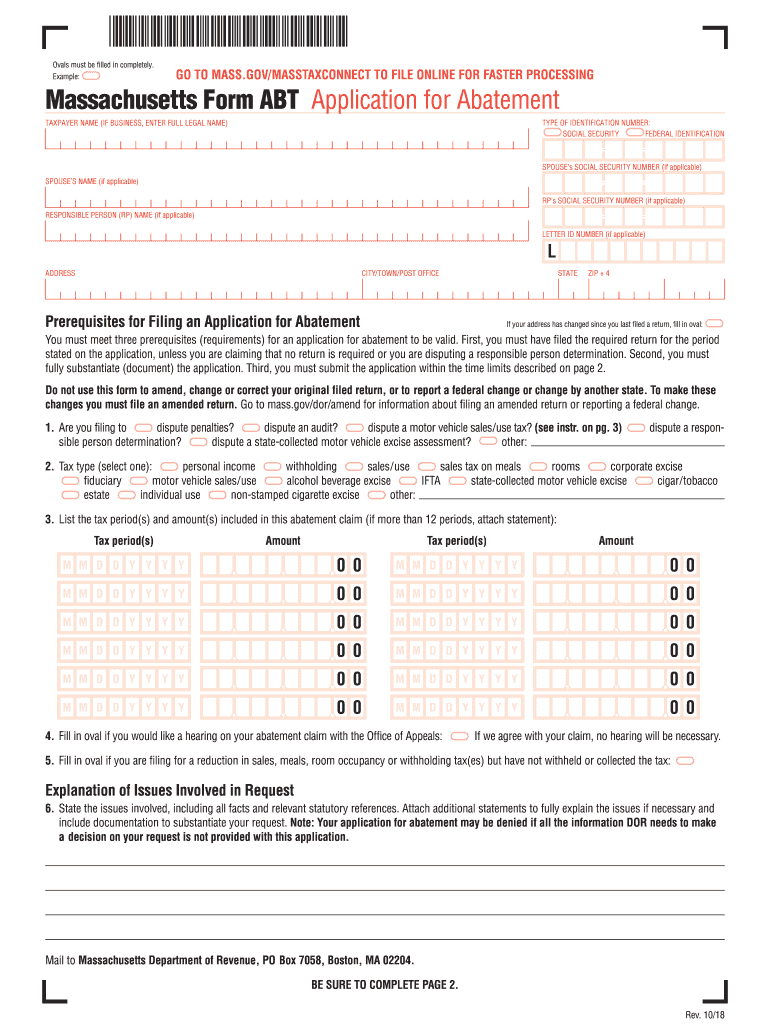

MA DoR ABT 2018 free printable template

Get, Create, Make and Sign MA DoR ABT

How to edit MA DoR ABT online

Uncompromising security for your PDF editing and eSignature needs

MA DoR ABT Form Versions

How to fill out MA DoR ABT

How to fill out MA DoR ABT

Who needs MA DoR ABT?

Instructions and Help about MA DoR ABT

Good afternoon. My name is Ricotta Scott, and I'm with the Division of IT's Training department at the University of Missouri — Columbia. Today we're going to take a look at how to create editable forms with Acrobat DC. Give me just a second here... Alright. These are the things we will look at today. The exercises and manual are available to download from training.Missouri.edu. Just click the IT Training Manuals and Exercise Files link in the gray box on the right side of the page when you get there. So when this recording is available in about a week you'll be able to watch the video, go through the exercises if you like, pause and rewind when you need to, or do your own form at the same time. So we're going to prepare a Word document for form fields. Actually, we're just going to look at the Word document to see how you prepare it. We'll create a PDF in Acrobat from that Word file, and we'll then look at adding the interactive form fields and editing them and a few other things. And finally we'll stop with export return data to Microsoft Excel. And I think we should have time for everything in this hour, but if it goes a little long, I'll just keep going. If you have to go back to work, that's fine, but I'll keep going, and then you'll be able to see the rest on the recording. So I'm going to go through a couple of slides first. Why do we want to use Word today instead of just using Acrobat? Acrobat isn't a word processor; it was really just designed to allow people to view documents made in other programs even if they don't have that program. And most programs that produce digital documents have an Export or Save As command that allows them to save a document as a PDF. A PDF document can be opened and viewed in the free Adobe Reader, which is nice, so people don't have to have Acrobat to watch it, and in most of the latest browsers it will open as well, and there are other third-party applications. So it's just one of those programs that everyone can have access to. So we're going to use Word, though, because people are so used to using it, especially for creating forms and things. So that's what we decided to do today. And then why Acrobat Pro for creating forms? You can create editable forms in Word, but the process is pretty cumbersome and some users might not have Word installed to open the document. So Acrobat allows us to add form fields and interactivity easily, and virtually any user can open a PDF on their computer, fill in the form fields, and save and email the form. And what version? We're using Acrobat Pro DC in this webinar. Most of what we're doing works the same way in Acrobat Pro XI, but the toolbars and tools panels have been updated, so you'll have a little harder time finding things. But if you are using Acrobat Pro XI, you might benefit from watching a recording of our webinar, Create Editable Forms in Acrobat Pro XI, to see where the buttons and controls are located in that program. And that video is out at training....

People Also Ask about

Does Massachusetts have a property tax benefit for seniors?

How do I file an abatement in Boston?

How do I appeal a real estate tax abatement in Massachusetts?

How do I file for abatement in MA?

How do I get a property tax abatement in Massachusetts?

What does local tax abatement mean?

What is a real estate tax abatement in MA?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MA DoR ABT to be eSigned by others?

How do I execute MA DoR ABT online?

How do I complete MA DoR ABT on an Android device?

What is MA DoR ABT?

Who is required to file MA DoR ABT?

How to fill out MA DoR ABT?

What is the purpose of MA DoR ABT?

What information must be reported on MA DoR ABT?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.