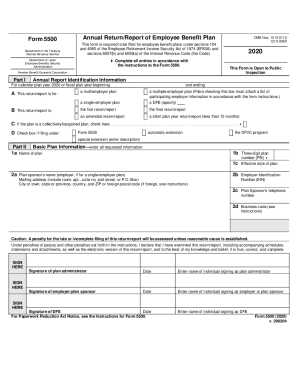

DoL 5500 2014 free printable template

Instructions and Help about DoL 5500

How to edit DoL 5500

How to fill out DoL 5500

About DoL 5 previous version

What is DoL 5500?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about DoL 5500

What should I do if I realize there’s an error after filing my DoL 5500?

If you discover an error in your filed DoL 5500, you can submit an amended or corrected form. It’s important to clearly indicate that the filing is a correction, and follow the IRS guidelines for making amendments. Doing this promptly can help avoid any potential penalties.

How can I verify that my DoL 5500 has been received and processed?

To track the status of your DoL 5500 submission, you can use the online tracking tools provided by the filing agency. Look for email confirmations or receipts you might receive upon filing. If issues arise, it’s useful to keep records of submission dates and any reference numbers.

Are electronic signatures accepted when filing the DoL 5500?

Yes, electronic signatures are generally acceptable for the DoL 5500, as long as the e-filing provider complies with IRS regulations. Ensure your chosen provider is authorized and follows the required procedures to maintain compliance and data security.

What should I prepare if I receive an audit notice related to my DoL 5500?

If you receive an audit notice regarding your DoL 5500, gather all relevant documentation, including your original filing and any supporting records. Be prepared to explain discrepancies and respond by the deadline outlined in the notice to avoid further complications.

Can I e-file the DoL 5500 from a mobile device, and are there specific technical requirements?

Yes, many authorized e-filing services allow you to file the DoL 5500 from mobile devices. However, ensure your device has a compatible browser, and check the service provider for their specific technical requirements to ensure a smooth filing experience.