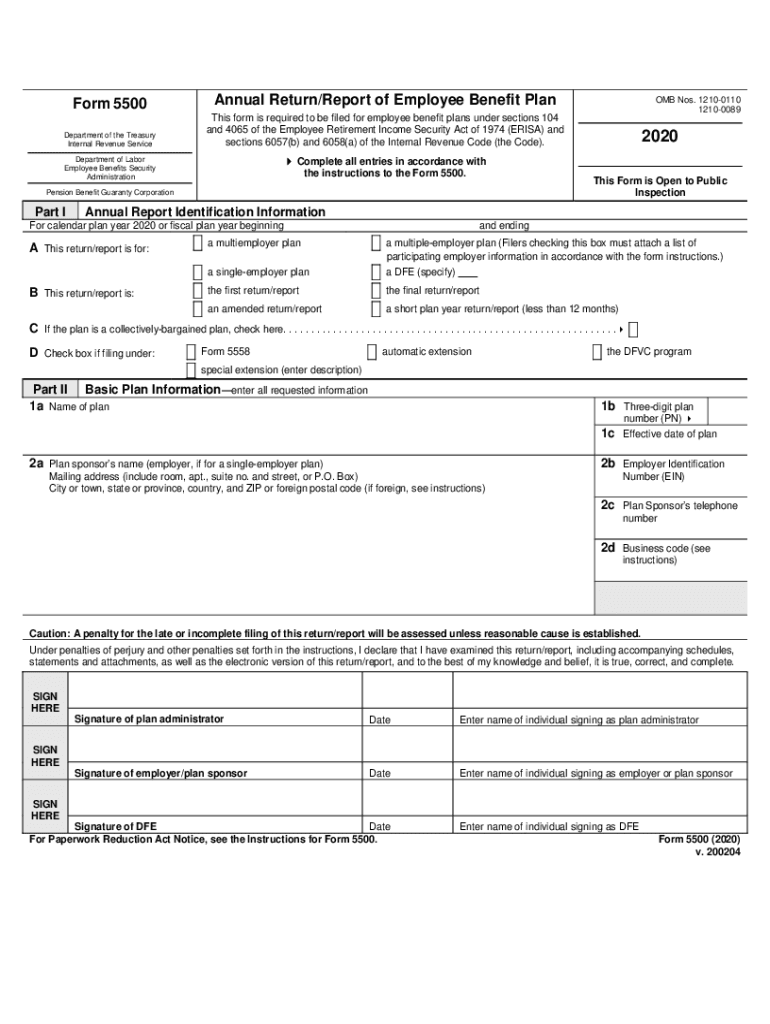

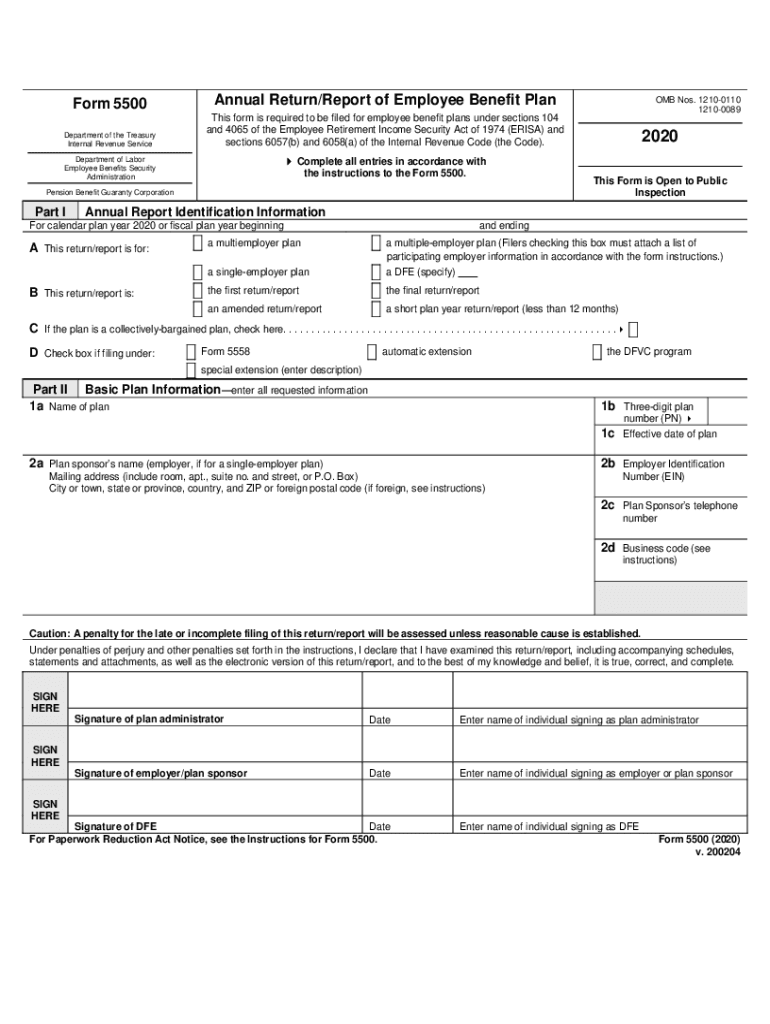

DoL 5500 2020-2024 free printable template

Get, Create, Make and Sign

Editing online

DoL 5500 Form Versions

Video instructions and help with filling out and completing

Instructions and Help about irs return form

Today we're going to talk a little about filing form 5500 specifically form 5500 easy now 5500 EZ is the IRS and Department of Labor a filing requirement for single member that's one participant plans that have assets greater than 250 thousand dollars anything below that they are not required to file the form 5500 EZ anything above that they're gonna fall under the filing requirements one thing that's very important to note is that when you combine retirement plans and this is significant if you've got a cash balance plan along with the solo 401k if you combine that the requirements say that if the combination of the plans exceeds two hundred and fifty thousand dollars you'll have to file a 5500 easy for each of the plans and so often we see that slip through the cracks for example you might find someone who has a hundred and fifty thousand dollars in a cash balance plan and a hundred and ten thousand dollars in a 401k the combined amounts are two hundred and sixty thousand dollars they're beyond the $250,000 limits they're going to have to file form 5500 easy for each plan okay very critical to understand...

Fill form : Try Risk Free

People Also Ask about

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.