IL DoR EAR-14 2020-2025 free printable template

Show details

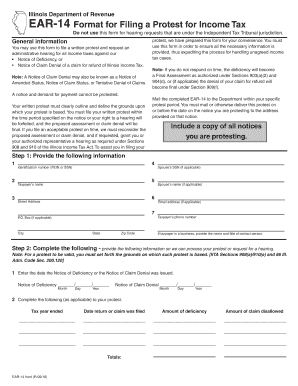

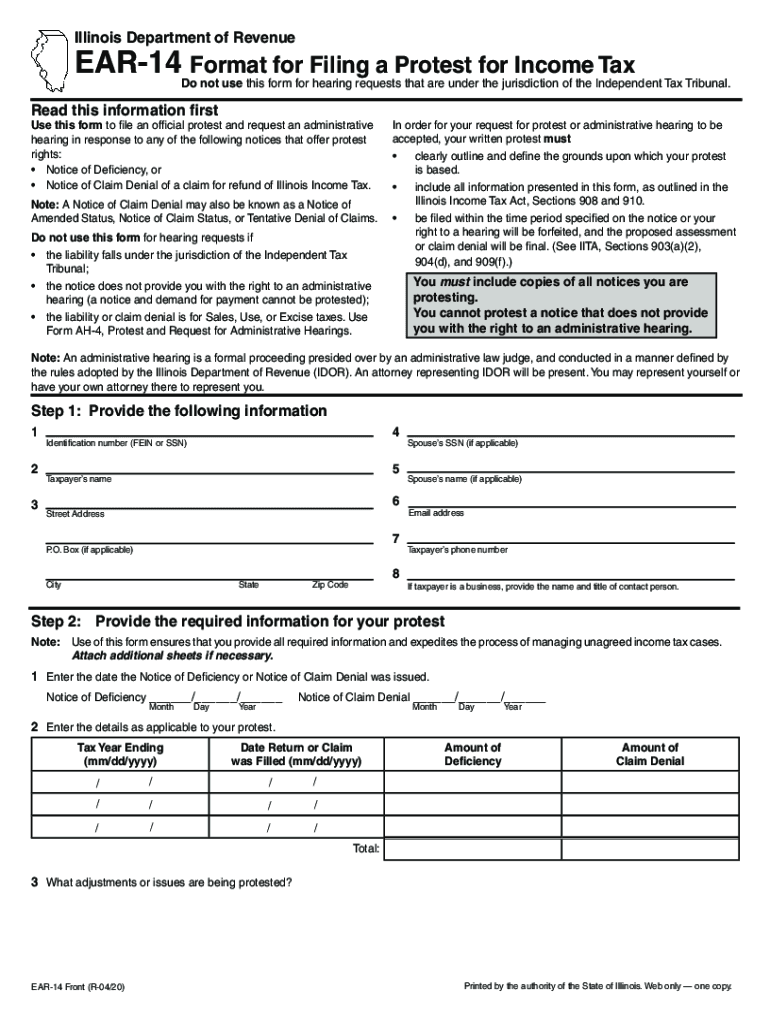

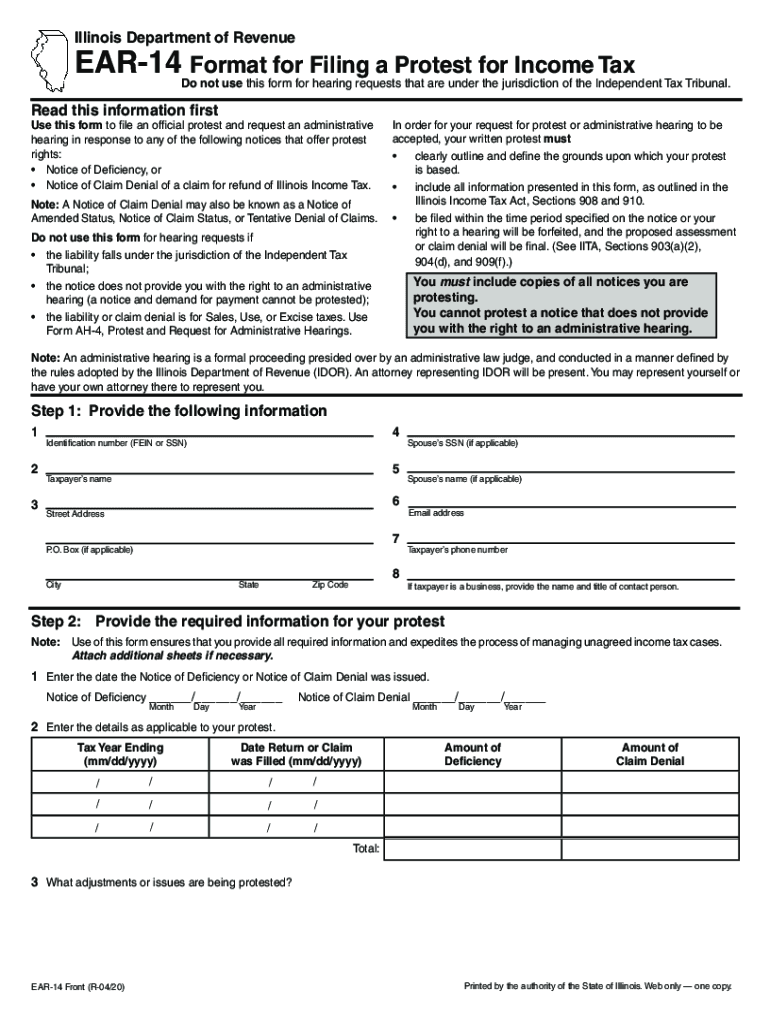

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes. Illinois Department of RevenueFormat for Filing a Protest for Income TaxEAR14 Do

not use this

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign format protest

Edit your ear 14 illinois form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ear 14 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ear14 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit il ear 14 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL DoR EAR-14 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out il ear tax form

How to fill out IL DoR EAR-14

01

Obtain a copy of the IL DoR EAR-14 form from the Illinois Department of Revenue website or your local office.

02

Fill in your personal information including your name, address, and Social Security number at the top of the form.

03

Indicate the type of tax return you are filing: individual or corporate.

04

Provide any necessary information regarding your income sources and deductions as prompted on the form.

05

Review all entries for accuracy and completeness before proceeding.

06

Sign and date the form where indicated.

07

Submit the completed form to the Department of Revenue by mail or electronically, as allowed.

Who needs IL DoR EAR-14?

01

Individuals and businesses who need to report and pay specific tax obligations to the Illinois Department of Revenue.

02

Taxpayers seeking to claim a refund or report changes to their tax filings.

03

Any entity required to provide updated tax information as mandated by Illinois state law.

Video instructions and help with filling out and completing illinois ear 14

Instructions and Help about ear 14 form

Fill

format protest pdf

: Try Risk Free

People Also Ask about

How do I file a protest with the Illinois Department of Revenue?

Use Form AH-4, Protest and Request for Administrative Hearings. If taxpayer is a business, provide the name and title of contact person. In order for your request for protest or administrative hearing to be accepted, your written protest must • clearly outline and define the grounds upon which your protest is based.

How do I find out how much I owe the Illinois Department of Revenue?

You can view the amounts of estimated payments you have made by visiting our IL-1040-ES Payment Inquiry application. You will be required to enter your primary Social Security number and the first four letters of your last name.

Does tax debt fall off after 10 years?

Generally, under IRC § 6502, the IRS will have 10 years to collect a liability from the date of assessment. After this 10-year period or statute of limitations has expired, the IRS can no longer try and collect on an IRS balance due.

What happens if you don't pay your taxes in Illinois?

Before the county sells unpaid taxes it sends the taxpayer notice by mail that the taxes are past due, or “delinquent.” The past due notice usually contains a deadline by which to pay the taxes. If you do not pay the taxes owed before the deadline, the collector will publish notice that it will sell your taxes.

Why would I get a letter from the Illinois Comptroller?

The Illinois Department of Revenue (IDOR) sends letters and notices to request additional information and support for information you report on your tax return, or to inform you of a change made to your return, balance due or overpayment amount.

Do federal tax liens ever go away?

Paying your tax debt - in full - is the best way to get rid of a federal tax lien. The IRS releases your lien within 30 days after you have paid your tax debt. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist.

What does the Illinois Department of Revenue do?

Our Mission To serve Illinois' taxpayers by administering Illinois tax laws and collecting tax revenues in a fair, consistent, and efficient manner and by providing accurate and reliable funding and information in a timely manner.

How to file a protest with Illinois Department of Revenue?

Income tax protests ─ Form EAR-14, Format for Filing a Protest for Income Tax. file a complaint in circuit court, obtain a preliminary injunction, and. serve the preliminary injunction on the Illinois Department of Revenue and Illinois State Treasurer within 30 days of making your protest payment.

How do I claim my Illinois sales tax back?

You should file Form ST-6, Claim for Sales and Use Tax Overpayment/Request for Action on a Credit Memorandum, if you are a registered retailer who has • a sales and use tax overpayment on file and you want to - convert this overpayment to a credit memorandum, or - convert it to a credit memorandum and transfer

Who do I call about my Illinois State refund?

Taxpayer Assistance To receive assistance by phone, please call 1 800 732-8866 or 217 782-3336. Representatives are available Monday through Friday, 8 am - 5 pm. Our TDD (telecommunication device for the deaf) number is 1 800 544-5304. To receive assistance by email, use the information below.

What is the statute of limitations on tax debt in Illinois?

No statute of limitations exists for assessing a liability in cases of fraud or failure to file returns (except for a non-filed use tax return, which has a six-year statute of limitations).

Can you sue Illinois Department of Revenue?

Taxpayer's suits. Taxpayers have the right to sue the Department of Revenue if such Department intentionally or recklessly disregards tax laws or regulations in collecting taxes. The maximum recovery for damages in such a suit shall be $100,000.

How long do Illinois state tax liens last?

The lien will remain for 20 years or until you pay it off, whichever comes first.

How do I contact Illinois Department of Revenue?

To receive assistance by phone, please call 1 800 732-8866 or 217 782-3336. Representatives are available Monday through Friday, 8 am - 5 pm. Our TDD (telecommunication device for the deaf) number is 1 800 544-5304.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit illinois ear 14 2020-2025 on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit illinois ear 14 2020-2025.

How do I fill out the illinois ear 14 2020-2025 form on my smartphone?

Use the pdfFiller mobile app to complete and sign illinois ear 14 2020-2025 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete illinois ear 14 2020-2025 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your illinois ear 14 2020-2025, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is IL DoR EAR-14?

IL DoR EAR-14 is a specific form used by the Illinois Department of Revenue for reporting certain tax-related information.

Who is required to file IL DoR EAR-14?

Businesses and individuals who meet specific eligibility criteria set by the Illinois Department of Revenue are required to file IL DoR EAR-14.

How to fill out IL DoR EAR-14?

To fill out IL DoR EAR-14, follow the instructions provided on the form, ensuring that all required fields are completed accurately, and any necessary documentation is attached.

What is the purpose of IL DoR EAR-14?

The purpose of IL DoR EAR-14 is to gather information for tax assessment and compliance purposes as mandated by the state of Illinois.

What information must be reported on IL DoR EAR-14?

IL DoR EAR-14 requires reporting of various details including taxpayer identification, financial data, and specifics related to the taxes applicable to the filer.

Fill out your illinois ear 14 2020-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Illinois Ear 14 2020-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.