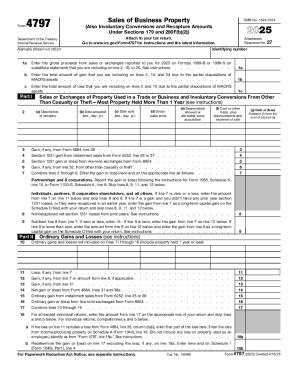

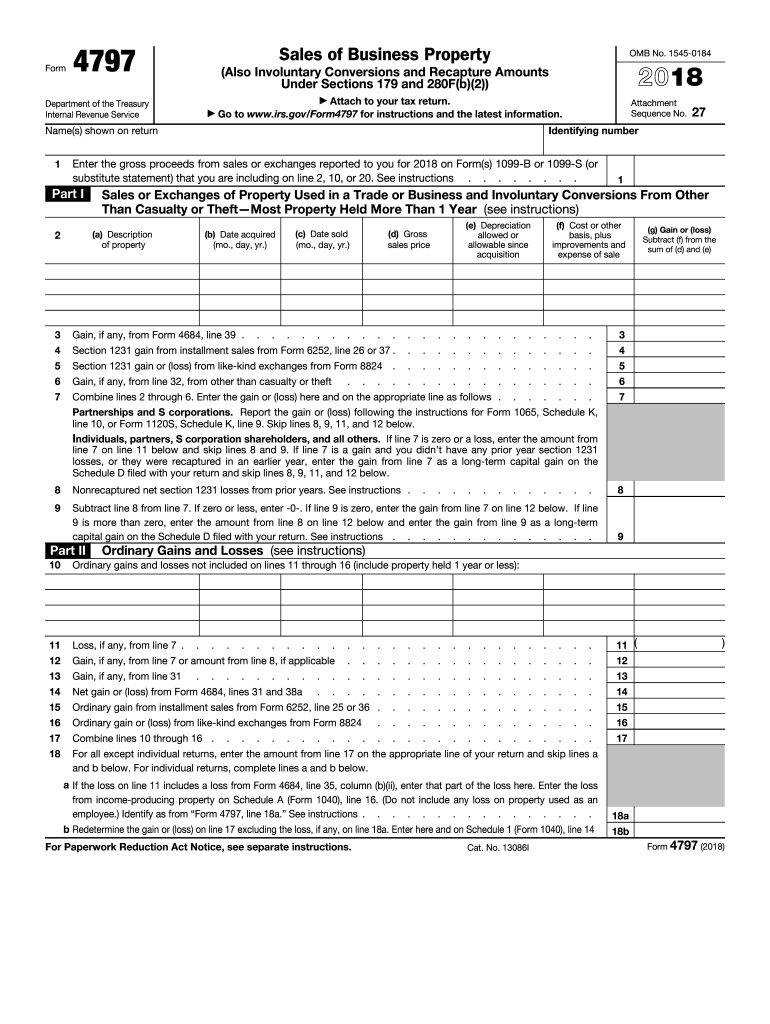

IRS 4797 2018 free printable template

Instructions and Help about IRS 4797

How to edit IRS 4797

How to fill out IRS 4797

About IRS 4 previous version

What is IRS 4797?

Who needs the form?

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Components of the form

How many copies of the form should I complete?

What information do you need when you file the form?

FAQ about IRS 4797

What should I do if I realize I've made an error on my IRS 4797 after submitting?

If you find an error on your IRS 4797 after submission, you should file Form 1040-X to amend your tax return. Ensure to include the corrected information from IRS 4797. Additionally, keep a copy of the amended return for your records. It's crucial to act promptly to avoid potential penalties or issues.

How can I track the status of my IRS 4797 after e-filing?

To track the status of your e-filed IRS 4797, you can use the IRS 'Where's My Refund?' tool if it pertains to a refund, or check the e-filing service you used, as they often provide tracking capabilities. Make sure to have your Social Security number, filing status, and refund amount ready to facilitate the process.

What should I know about privacy and data security when filing the IRS 4797 electronically?

When e-filing the IRS 4797, it's essential to ensure you're using a reputable and secure platform. Verify that the software complies with IRS security requirements and offers encryption for your sensitive data. Regularly updating your passwords and using two-factor authentication can further protect your personal information.

How do I handle filing the IRS 4797 for a foreign seller?

If you are filing the IRS 4797 for a foreign seller, ensure that the seller has an Individual Taxpayer Identification Number (ITIN) or a Social Security number. Also, report any transactions involving foreign entities according to IRS guidelines. If you’re uncertain, consulting a tax professional experienced with international tax rules can be beneficial.

What common mistakes should I avoid when submitting the IRS 4797?

Common mistakes when submitting the IRS 4797 include incorrect calculations of gains or losses, failing to report all necessary transactions, and overlooking the inclusion of required supporting documentation. Double-check your entries and consider using tax software to mitigate errors. If possible, consult a tax advisor to ensure accuracy.

See what our users say