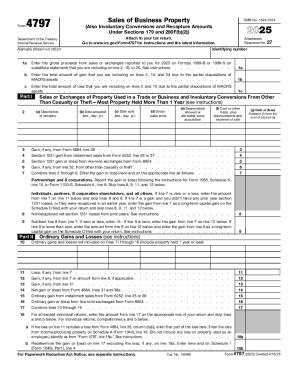

IRS 4797 2024 free printable template

Instructions and Help about IRS 4797

How to edit IRS 4797

How to fill out IRS 4797

Latest updates to IRS 4797

About IRS 4 previous version

What is IRS 4797?

Who needs the form?

Components of the form

Is the form accompanied by other forms?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

What information do you need when you file the form?

FAQ about IRS 4797

What should I do if I realize I made an error after filing IRS 4797?

If you notice a mistake after submitting your IRS 4797, you may need to file an amended return. You can do this by using Form 1040-X along with correcting the IRS 4797, ensuring that any discrepancies are addressed promptly to avoid complications.

How can I check the status of my IRS 4797 submission?

To verify the processing status of your IRS 4797, you can use the IRS 'Where's My Refund?' tool for e-filed returns or call the IRS directly for paper submissions. Be prepared with your Social Security number, filing status, and exact refund amount for assistance.

What are some common errors to avoid when filing IRS 4797?

Common errors when completing the IRS 4797 include incorrect property descriptions, miscalculation of gain or loss, and failure to include adequate supporting documentation. Double-checking figures and ensuring alignment with original purchase information can help prevent these mistakes.

Are there e-filing software requirements for submitting IRS 4797?

When using e-filing software for IRS 4797, ensure that it complies with IRS standards and supports the form's specific features. Check for browser compatibility and the latest updates to avoid technical difficulties during submission.

What should I do if I receive an audit notice related to my IRS 4797?

If you receive an audit notice concerning your IRS 4797, review the notice carefully and gather all related documentation, such as purchase records and past filings. It's advisable to consult a tax professional to understand the requirements and develop an appropriate response strategy.

See what our users say