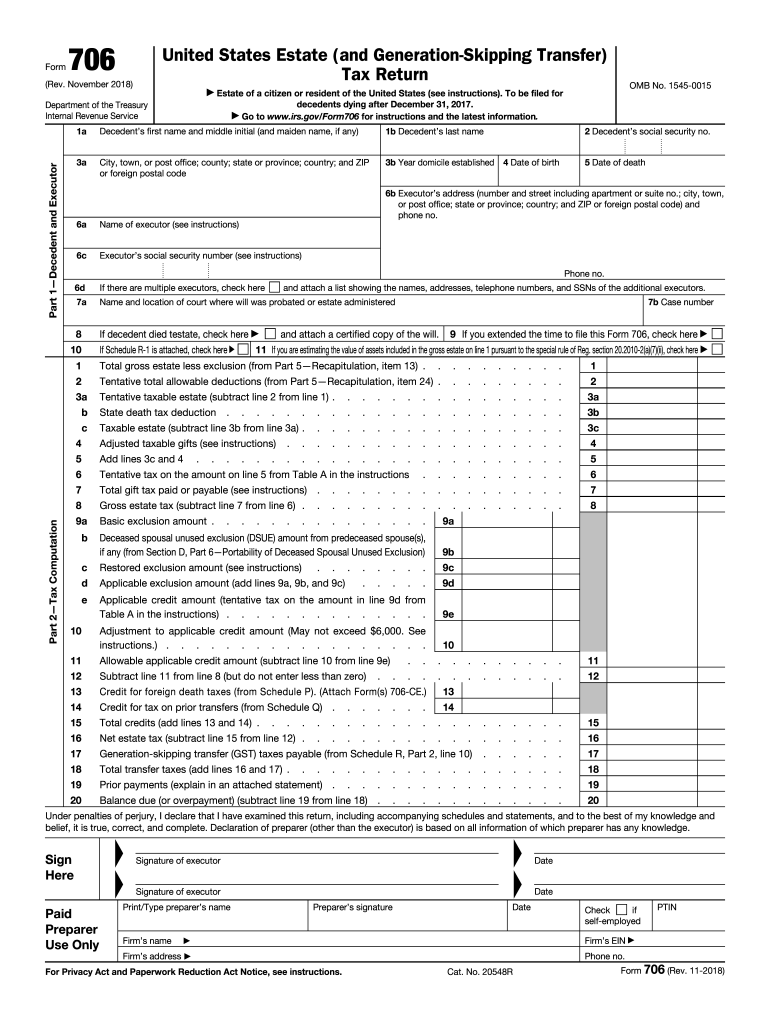

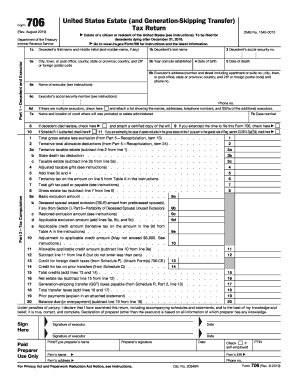

What is IRS 706?

IRS Form 706 is officially known as the "United States Estate (and Generation-Skipping Transfer) Tax Return." This form is required for estates exceeding a certain value threshold, currently set at $11.7 million for the year 2021, although the threshold may vary over time. It collects information regarding the decedent's assets, liabilities, and the taxes owed on the estate's value upon their death.

When am I exempt from filling out this form?

You may be exempt from filing IRS Form 706 if the total value of the estate is less than the federal estate tax exemption threshold in effect for the year of death. Additionally, certain transfers and gifts made prior to death may be excluded from the calculations. It's important to verify these criteria with current IRS guidelines or consult a tax professional to determine your obligation accurately.

Due date

The due date for filing IRS Form 706 is typically nine months after the date of the decedent's death. However, executors may request an extension for up to six months using Form 4768, but additional interest may accrue on unpaid tax. It is essential to adhere to this timeline to avoid penalties and interest.

How many copies of the form should I complete?

When completing IRS Form 706, it is advisable to prepare multiple copies: one for submission to the IRS and another for your records. Additionally, some executors may need to provide copies to state tax authorities or beneficiaries. Keeping thorough records helps ensure compliance and provides a reference for any future inquiries.

What are the penalties for not issuing the form?

Failure to file IRS Form 706 when required can result in significant penalties, including a late filing penalty of up to 5% of the tax owed per month, with a maximum of 25%. Additionally, interest may accrue on any unpaid tax amount. It's critical to file on time to avoid these financial repercussions and ensure compliance with federal tax law.

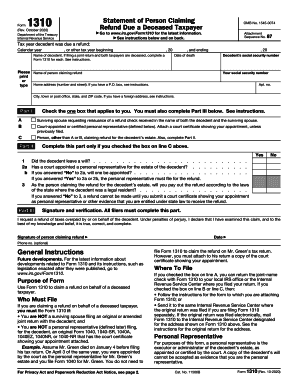

Is the form accompanied by other forms?

IRS Form 706 may need to be accompanied by additional forms, depending on the specifics of the estate. This could include schedules for listing various types of property, Form 706-NA for foreign decedents, and supporting documentation that provides evidence for valuations and deductions claimed. Always check the IRS guidelines to ensure all necessary forms are included with your submission.

What is the purpose of this form?

The primary purpose of IRS Form 706 is to compute the estate tax owed to the federal government. When a person passes away, their taxable estate may be subject to estate tax based on its total value. The form serves to report these details and ensures that the appropriate tax is assessed and paid in a timely manner.

Who needs the form?

Form 706 must be filed by the executor of the estate if the gross estate exceeds the estate tax exemption amount set for the year of the decedent's death. This includes the fair market value of all assets plus any taxable gifts made by the decedent in their lifetime, which can impact the overall tax liability. Executors must also be aware of specific state requirements, which may differ from federal rules.

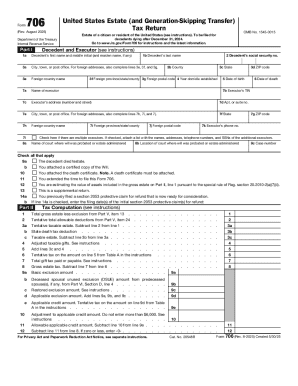

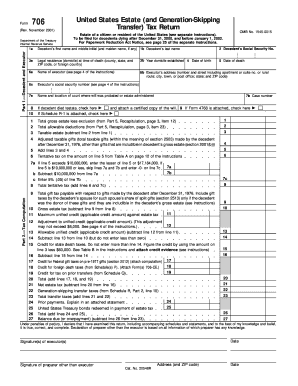

Components of the form

IRS Form 706 consists of several key components, including schedules that detail different types of assets, deductions, and credits. Main sections include information on the decedent's estate, adjustments, taxable value, and tax computation sections. Each schedule has specific instructions that must be carefully followed to ensure accurate reporting.

What payments and purchases are reported?

While IRS Form 706 primarily deals with the valuation of the estate, it also requires the reporting of certain payments and purchases made by the decedent prior to death. This can include expenses related to outstanding debts, funeral expenses, and administrative costs associated with managing the estate. Accurately documenting these amounts can impact the overall taxa calculation.

What information do you need when you file the form?

Filing IRS Form 706 requires comprehensive information about the decedent's assets and liabilities. Key details necessary include the decedent’s name, Social Security number, date of death, details of assets (real estate, investments, and personal property), debts, and previous taxable gifts. Gathering this information in advance streamlines the filing process.

Where do I send the form?

IRS Form 706 should be sent to the address specified in the form instructions, which typically depends on whether you are enclosing payment. For estates that do not require payment, the form can typically be sent to the appropriate processing center, as indicated for the relevant tax year. Ensure all forms are mailed to the correct location to avoid delays in processing.