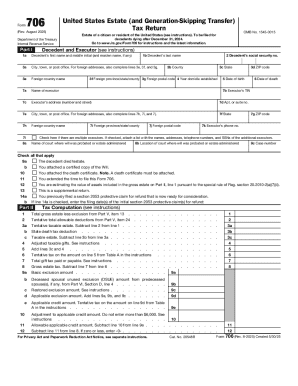

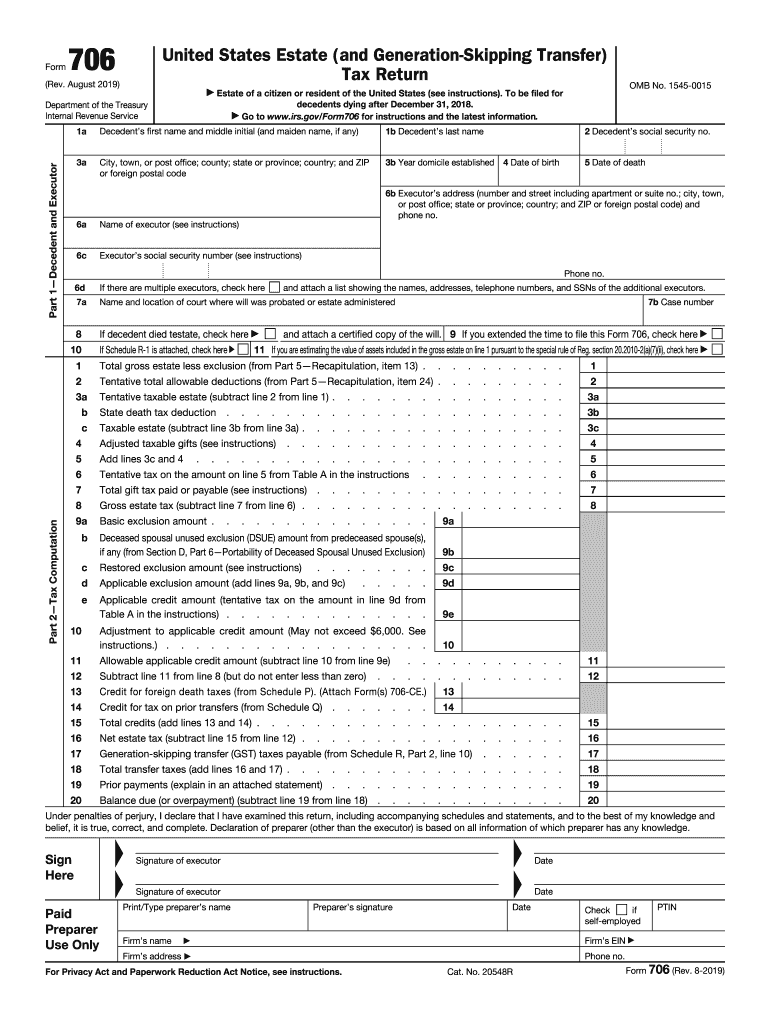

IRS 706 2019 free printable template

Instructions and Help about 1999 form 706

How to edit 1999 form 706

How to fill out 1999 form 706

Latest updates to 1999 form 706

All You Need to Know About 1999 form 706

What is 1999 form 706?

When am I exempt from filling out this form?

Due date

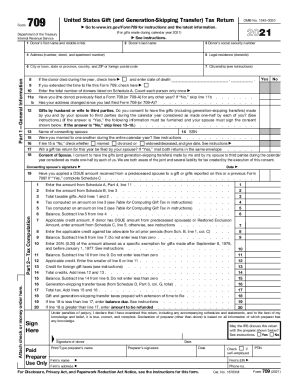

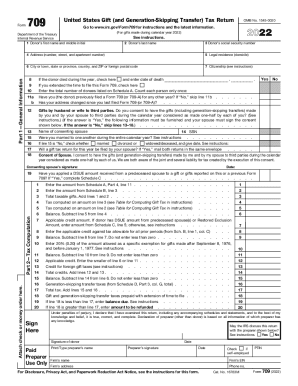

What payments and purchases are reported?

What are the penalties for not issuing the form?

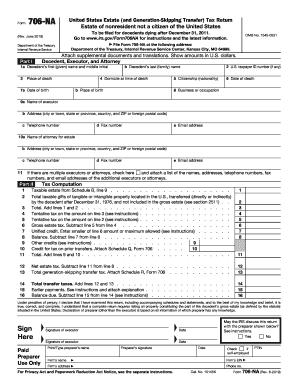

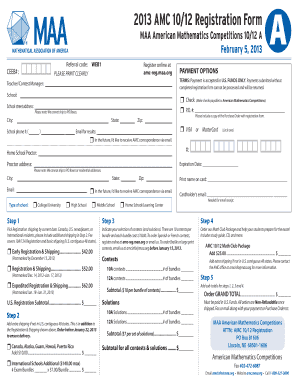

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

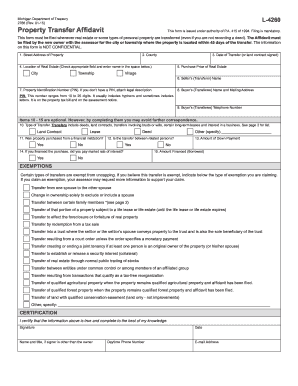

Components of the form

How many copies of the form should I complete?

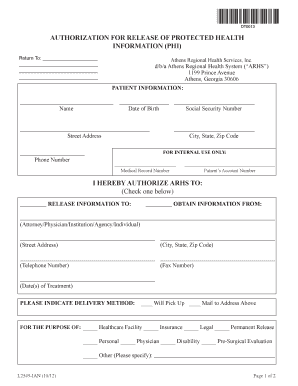

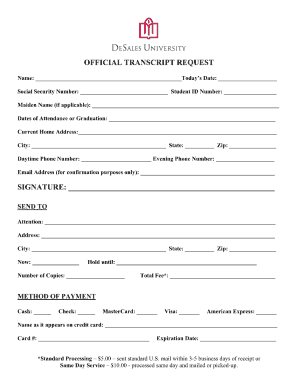

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 706

What should I do if I realize I've made a mistake on my submitted 1999 form 706?

If you discover an error on your submitted 1999 form 706, you can file an amended return to correct the mistake. Ensure the amended form includes all relevant details and clarifications. It's advisable to submit this amendment as soon as possible to avoid potential penalties or complications.

How can I track the status of my 1999 form 706 after submission?

You can verify the status of your submitted 1999 form 706 by checking with the agency you submitted it to, either online or via phone. Avoid common e-file rejection codes by ensuring all information provided matches records, which can expedite processing times.

What steps should I take if I receive a notice regarding my 1999 form 706?

If you receive a notice related to your 1999 form 706, read it carefully to understand the issue. Prepare any necessary documentation that supports your position and respond promptly, ensuring you follow the instructions provided in the notice to resolve the matter effectively.

Are there special considerations for authorized representatives when filing a 1999 form 706?

Yes, authorized representatives must ensure they have a valid Power of Attorney (POA) on file when submitting a 1999 form 706 on behalf of someone else. This documentation is crucial for verifying their authority and ensuring compliance with filing requirements.

What common errors should I be aware of when preparing my 1999 form 706?

Common errors when preparing the 1999 form 706 include incorrect social security numbers, mismatched information regarding valuations, or failing to provide all required schedules. Double-checking all figures and required attachments can help avoid these pitfalls.

See what our users say