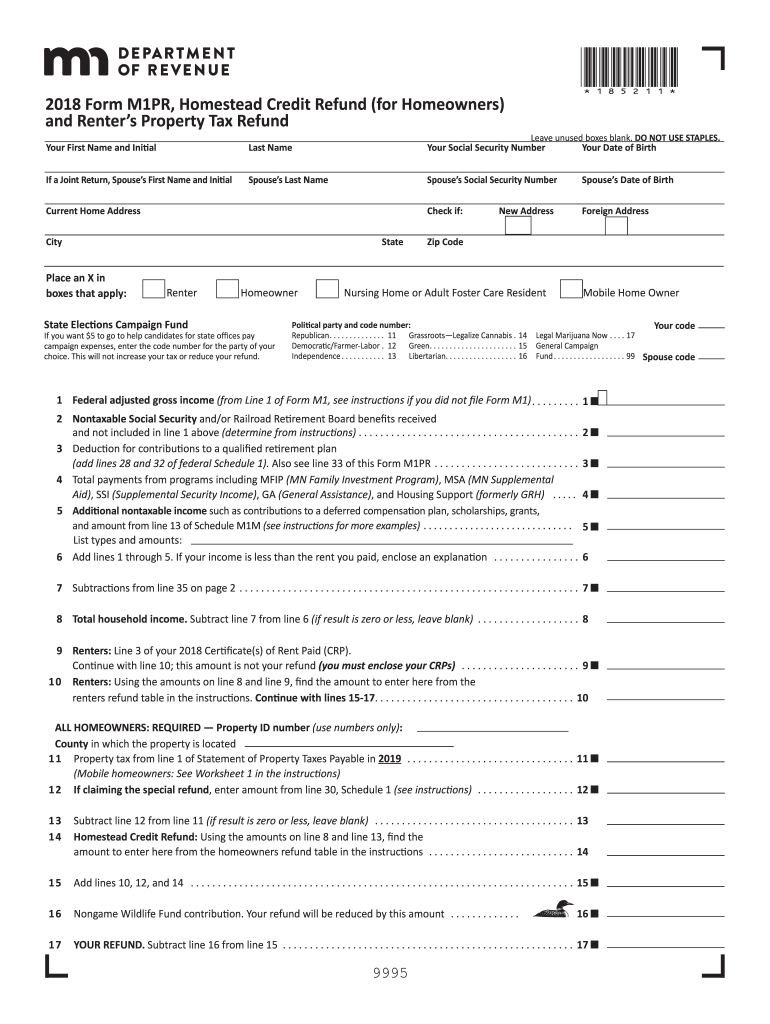

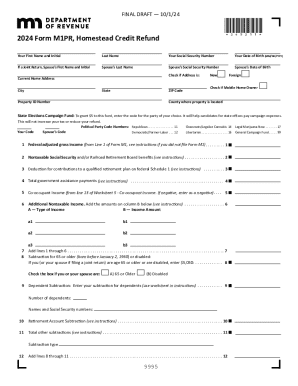

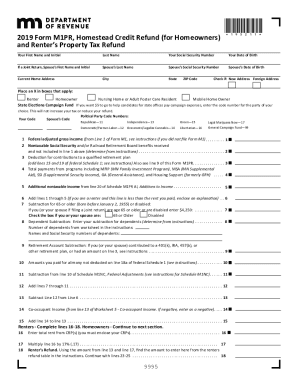

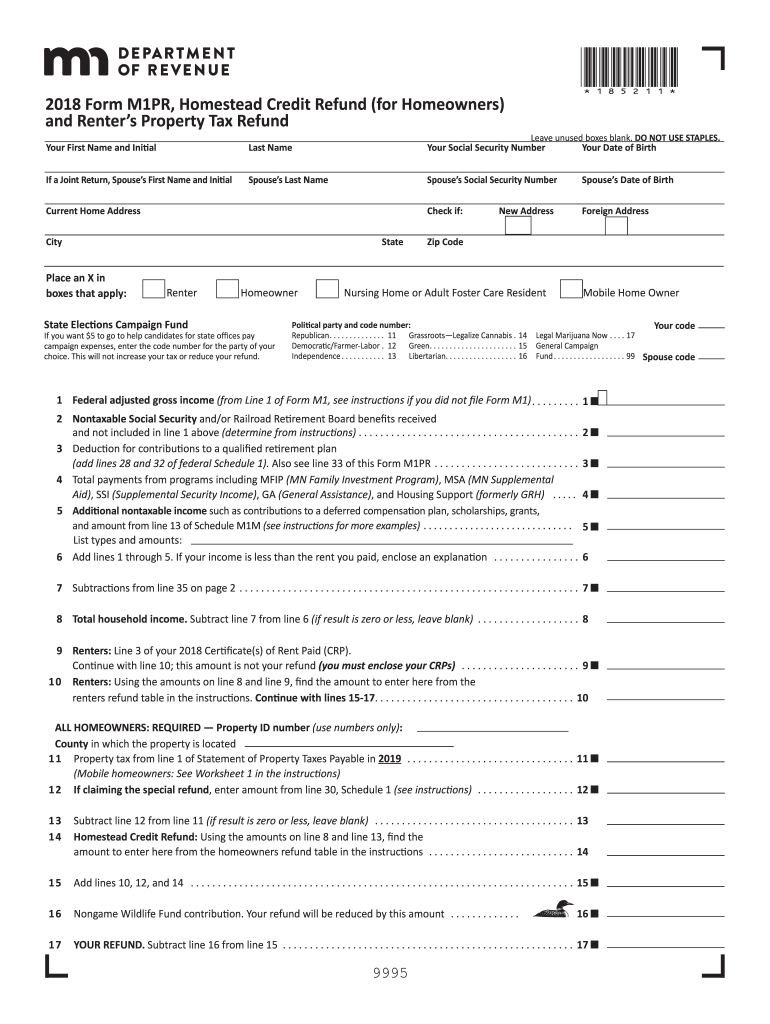

MN DoR M1PR 2018 free printable template

Get, Create, Make and Sign MN DoR M1PR

How to edit MN DoR M1PR online

Uncompromising security for your PDF editing and eSignature needs

MN DoR M1PR Form Versions

How to fill out MN DoR M1PR

How to fill out MN DoR M1PR

Who needs MN DoR M1PR?

Instructions and Help about MN DoR M1PR

Make 1 purl wise right make 1 purl wise right is a right-leaning increase you're working with the bar between the needles insert your left needle from back to front and take your right needle insert it in front of the stitch purl the stitch lets look at that one more time pearl a couple of stitches take your left needle and insert it under that bar from back to front use your right needle and purl in the front loop

People Also Ask about

How do I claim my Minnesota property tax refund?

How do I eFile a renters rebate in MN?

Who qualifies for MN property tax credit?

What makes me eligible for a tax refund?

What is the income limit for MN property tax refund?

Can you file M1PR separately?

Can I efile form M1PR?

Can I eFile MN property tax refund?

Does everyone get a property tax refund in MN?

Where do I send my M1PR in MN?

Is it too late to file renters rebate MN?

What is IRS Form M1PR?

What is MN property tax refund based on?

How do I qualify for MN property tax refund?

What is the deadline for filing M1PR?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute MN DoR M1PR online?

How do I complete MN DoR M1PR on an iOS device?

How do I fill out MN DoR M1PR on an Android device?

What is MN DoR M1PR?

Who is required to file MN DoR M1PR?

How to fill out MN DoR M1PR?

What is the purpose of MN DoR M1PR?

What information must be reported on MN DoR M1PR?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.