Get the free Disposition of Personal Property Without Administration Form - stlucieclerk

Show details

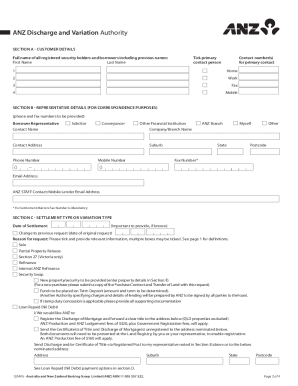

IN THE CIRCUIT COURT FOR FLORIDA ST. LUCIE COUNTY, PROBATE DIVISION IN RE: ESTATE OF File No. Division Deceased. DISPOSITION OF PERSONAL PROPERTY WITHOUT ADMINISTRATION (verified statement) Applicant,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign disposition of personal property

Edit your disposition of personal property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your disposition of personal property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit disposition of personal property online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit disposition of personal property. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out disposition of personal property

How to fill out disposition of personal property:

01

Gather all relevant information: Start by collecting all necessary information about the personal property, such as its description, value, and any identifying details.

02

List the items: Create a comprehensive list of all the personal property that needs to be included in the disposition. Include details such as the item's name, description, condition, and estimated value.

03

Determine the distribution: Determine how the personal property will be distributed among the beneficiaries. This may involve discussing and reaching agreements with family members or other interested parties.

04

Specify the intended recipients: Clearly state the names of the individuals or organizations who will be receiving the personal property.

05

Include any special instructions: If there are any specific instructions or conditions regarding the distribution of certain items, make sure to document them clearly in the disposition.

06

Sign and date the document: Once you have completed filling out the disposition of personal property, sign and date the document to make it legally valid.

07

Keep the document in a safe place: Store the disposition of personal property in a safe and easily accessible location, such as a secure filing cabinet or a safety deposit box.

Who needs disposition of personal property?

01

Individuals preparing their estate plan: Those who are creating an estate plan often need to fill out a disposition of personal property to detail how their personal belongings will be distributed after their passing.

02

Executors or administrators of estates: Executors or administrators of estates may require a disposition of personal property as part of the probate process. This document helps ensure that the deceased's personal property is distributed according to their wishes.

03

Lawyers and legal professionals: Lawyers and legal professionals use the disposition of personal property when assisting individuals with their estate planning or handling probate matters. They play a crucial role in guiding the client through the process and ensuring compliance with applicable laws and regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is disposition of personal property without Administration Leon County?

Disposition of Personal Property Without Administration - The disposition is filed to request release of assets of the deceased to the person who paid the final expenses, such as funeral bills or medical bills for the last 60 days. This procedure may be accomplished with the filing of a petition.

What is disposition of personal property without Administration Seminole County?

Disposition of Personal Property Without Administration This type of proceeding is used to request the release of assets of the deceased up to $6,000.00 or reasonable funeral expenses to the person who paid the final expenses; such as funeral bills or medical bills for the last 60 days.

What is a disposition of Personal Property without administration in Florida?

A disposition without administration is the probate process used to quickly transfer the ownership of the decedent's small estate to an heir or beneficiary. All the heir or beneficiary needs to do is petition a court to allow this transfer.

What is disposition of personal property without Administration Orange County?

Disposition of Personal Property without Administration This type of proceeding is filed to request release of the decedent's assets to the person who paid for final expenses such as funeral costs or medical bills that accrued in the last 60 days.

What is the limit for disposition without administration in Florida?

$20,000.00 of household furniture, furnishings, and appliances; Two motor vehicles used as the decedent's personal motor vehicles; and. Any qualify tuition programs under Section 529 of the Internal Revenue Code.

What is a disposition without Administration form Florida?

A disposition without administration is the probate process used to quickly transfer the ownership of the decedent's small estate to an heir or beneficiary. All the heir or beneficiary needs to do is petition a court to allow this transfer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is disposition of personal property?

Disposition of personal property refers to the process of transferring ownership or getting rid of personal belongings.

Who is required to file disposition of personal property?

Individuals who have sold, transferred, or disposed of personal property during the tax year are required to file disposition of personal property.

How to fill out disposition of personal property?

To fill out disposition of personal property, individuals need to provide details about the property, the date of disposition, the method of disposition, and any gain or loss incurred.

What is the purpose of disposition of personal property?

The purpose of disposition of personal property is to report any gains or losses on the sale or transfer of personal belongings for tax purposes.

What information must be reported on disposition of personal property?

Information such as the description of the property, date of disposition, method of disposition, and any gain or loss on the transaction must be reported on disposition of personal property.

How do I complete disposition of personal property online?

Easy online disposition of personal property completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How can I edit disposition of personal property on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing disposition of personal property.

How do I edit disposition of personal property on an Android device?

The pdfFiller app for Android allows you to edit PDF files like disposition of personal property. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your disposition of personal property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Disposition Of Personal Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.