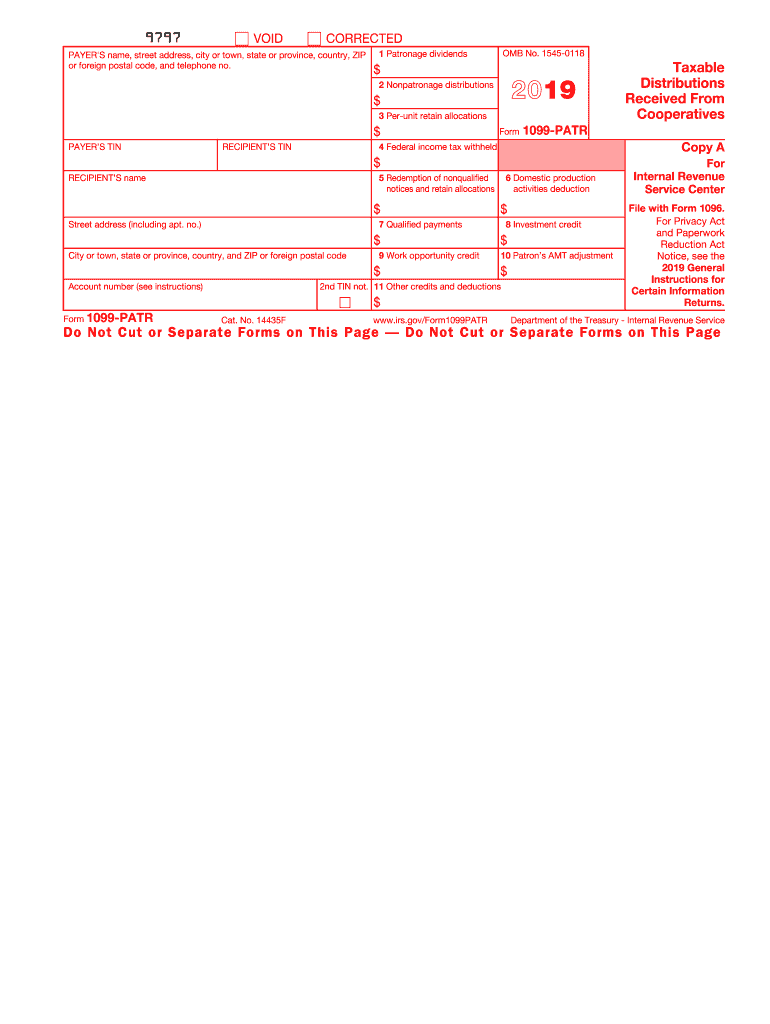

Who needs a 1099-PATR form?

Any person who received funds of at least in $10 as patronage, as a dividend or as the result of any other kind of distribution needs this form.

What is the 1099-PATR form for?

The 1099-PATR form (Taxable Distributions Received from Cooperatives) is an application, which informs IRS about items, funds and incomes that were passed to patrons to report a tax return.

In most cases, this form is not needed for filing if contributions were made to private corporations, tax-exempt organization like HAS, Archer MSA's, Cover dell ESA. If an individual has non-taxable income, it must be noted in the following forms:

- Form 1040 (Schedule F)

- Form 4835

- Or Schedule C

These forms are related to specific cases, so you must check Pub. 225 for more detailed information about filing those forms.

Never forget that all data provided by a person, must be also indicated in the declaration of the patron.

Is the 1099-PATR Form accompanied by other forms?

The 1099-PATR is accompanied by the 1099-DIV form and the 1096 form.

When does the 1099-PATR Form expire?

The 1099-PATR form will expire at the end of the tax period.

How do I fill out 1099-PATR Form?

You must fill out this form by providing the following information:

-

Information about payer

-

Patronage dividends

-

Non-patronage distributions

-

Allocation retain (per-unit)

-

Income tax withheld

-

Investment credit

-

Redemption of non-qualified notices and retain allocations.

-

Patron’s AMT adjustment

-

Credits and deductions

-

Legal and actual addresses of the applicant and patron.

Any data, which is untrue or is unreported may result in penalties.

Where do I send the 1099-PATR Form?

The completed 1099 PAIR form must be sent to the Internal Revenue Service.