Get the free 1099Q Form-illustration1

Show details

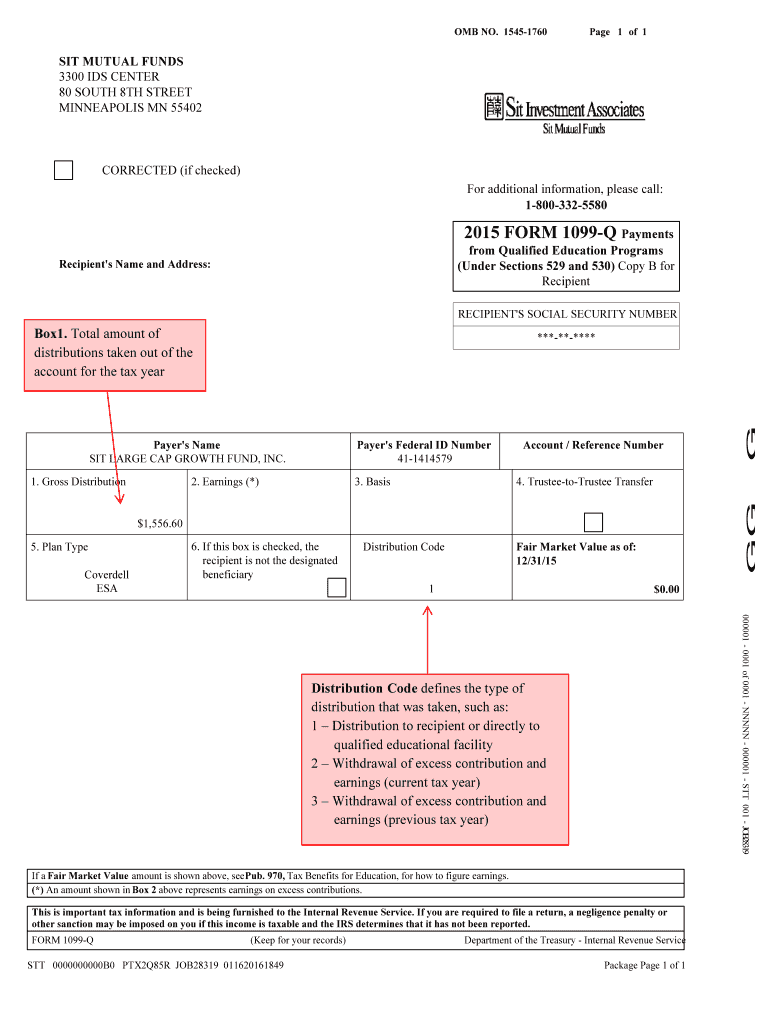

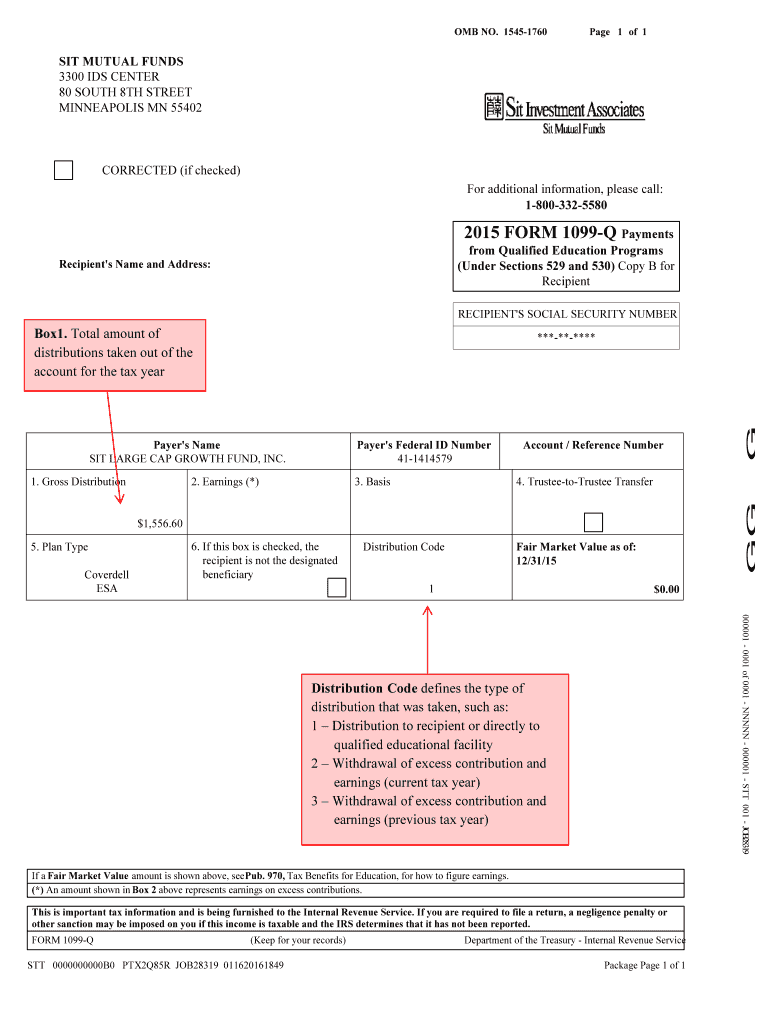

OMB NO. 15451760Page 1 of 1SIT MUTUAL FUNDS

3300 IDS CENTER

80 SOUTH 8TH STREET

MINNEAPOLIS MN 55402CORRECTED (if checked)For additional information, please call:

180033255802015 FORM 1099Q PaymentsRecipient\'s

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1099q form-illustration1

Edit your 1099q form-illustration1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1099q form-illustration1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1099q form-illustration1 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 1099q form-illustration1. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1099q form-illustration1

How to fill out 1099q form-illustration1

01

To fill out Form 1099-Q, follow these steps:

02

Enter the name, address, and TIN (Taxpayer Identification Number) of the person or organization who received the distribution in Box 1.

03

Provide the recipient's social security number in Box 2.

04

Enter the name, address, and TIN of the account owner in Box 3.

05

Report the total distribution amount in Box 1, Box 2a, and Box 2b.

06

Indicate whether the distribution is a payment for qualified education expenses or not in Box 3.

07

Complete Boxes 4-9 according to the specific details of the distribution.

08

If applicable, report any earnings on the distribution in Box 10.

09

Sign and date the form before sending it to the recipient and the IRS.

10

Remember to retain a copy for your records.

Who needs 1099q form-illustration1?

01

Form 1099-Q is required for anyone who made a distribution from a Coverdell ESA or a qualified tuition program.

02

The form is used by account owners, trustees, or custodians of the education savings accounts to report distributions made to beneficiaries.

03

Additionally, educational institutions that make distributions are also required to file Form 1099-Q.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 1099q form-illustration1 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your 1099q form-illustration1 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Where do I find 1099q form-illustration1?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific 1099q form-illustration1 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make changes in 1099q form-illustration1?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your 1099q form-illustration1 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

What is 1099q form-illustration1?

1099-Q form is used to report distributions from qualified education programs (529 plans and ESAs).

Who is required to file 1099q form-illustration1?

Financial institutions or program administrators that made distributions from qualified education programs are required to file 1099-Q forms.

How to fill out 1099q form-illustration1?

You can fill out 1099-Q form by providing information about the recipient, the distribution amount, and any earnings included in the distribution.

What is the purpose of 1099q form-illustration1?

The purpose of 1099-Q form is to report distributions from qualified education programs to the IRS and the recipients.

What information must be reported on 1099q form-illustration1?

The information that must be reported on 1099-Q form includes the recipient's name, address, Social Security number, and the amount of distribution.

Fill out your 1099q form-illustration1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1099q Form-illustration1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.