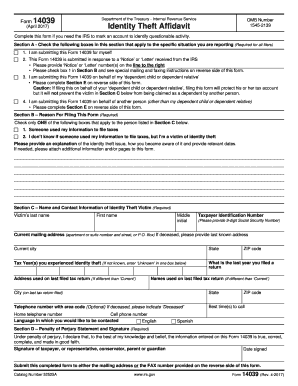

Get the free 14157 from

Instructions and Help about IRS 14157-A

How to edit IRS 14157-A

How to fill out IRS 14157-A

About IRS 14157-A 2018 previous version

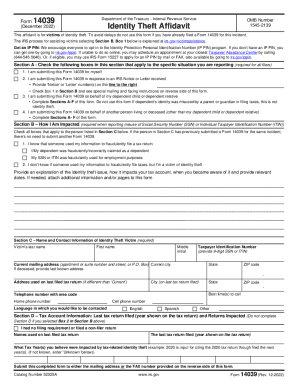

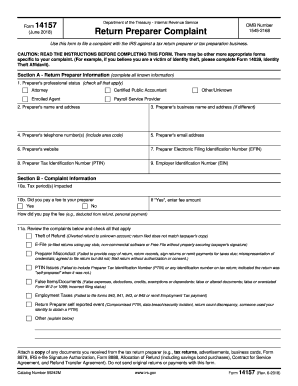

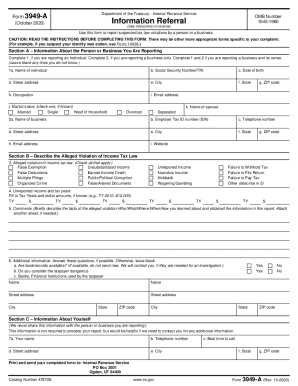

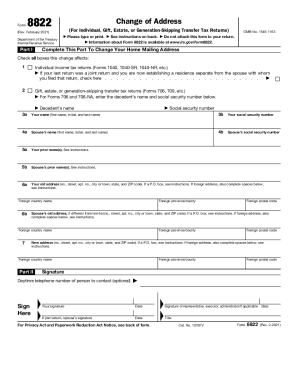

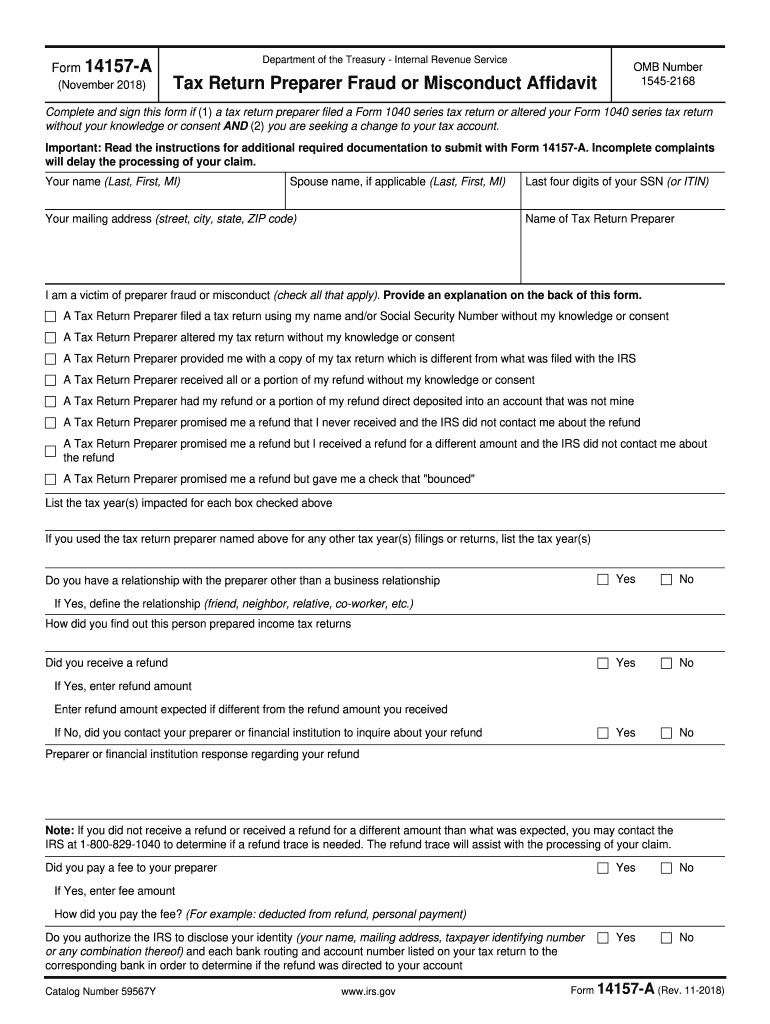

What is IRS 14157-A?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about 14157 from

What should I do if I need to amend my IRS 14157-A after submission?

If you need to correct mistakes on your submitted IRS 14157-A, you should prepare a new version or an amended document clearly indicating the corrections. Ensure you keep a copy and track its submission. It’s advisable to maintain records of all correspondence with the IRS regarding the amendment.

How can I track the status of my IRS 14157-A submission?

To verify the receipt and processing of your IRS 14157-A, you can use IRS online tools designated for tracking submissions. If you experience e-file rejections, common codes are provided, which can guide you on necessary actions to correct the issues and resubmit.

Are e-signatures acceptable for filing the IRS 14157-A?

Yes, e-signatures are accepted for the IRS 14157-A, facilitating a more efficient submission process. Ensure that your e-signature complies with IRS standards, as maintaining privacy and data security is critical during the filing.

What steps should I take if I receive an IRS notice regarding my IRS 14157-A?

If you receive an IRS notice related to your IRS 14157-A submission, carefully read the notice to understand the issue. Gather the relevant documentation and prepare a response if necessary; consider consulting a tax professional for guidance on how to proceed.

What are common errors I should avoid when submitting IRS 14157-A?

Common errors when submitting the IRS 14157-A include incorrect personal information, miscalculations, and missing signatures. Review the form methodically before submission and consider utilizing tax software which may help flag these issues in advance.