CA FTB 3805Q 2018 free printable template

Show details

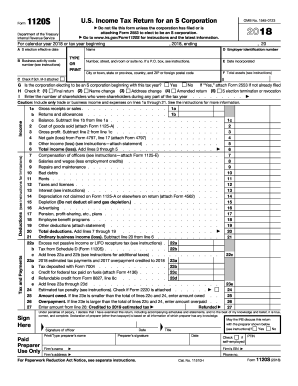

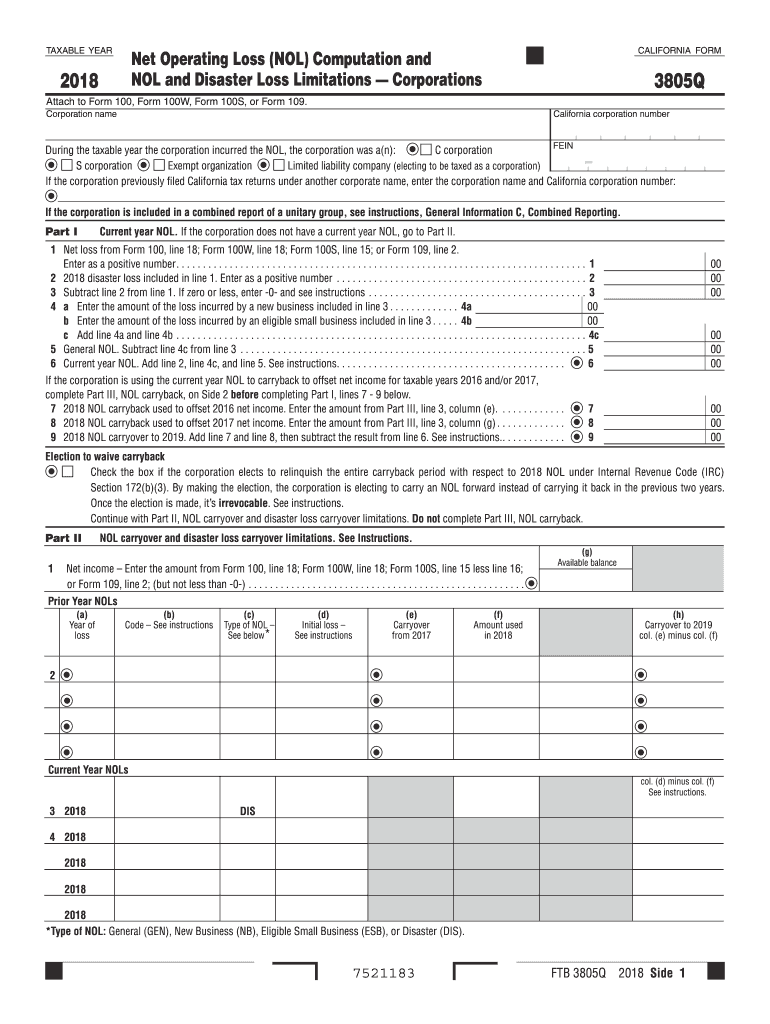

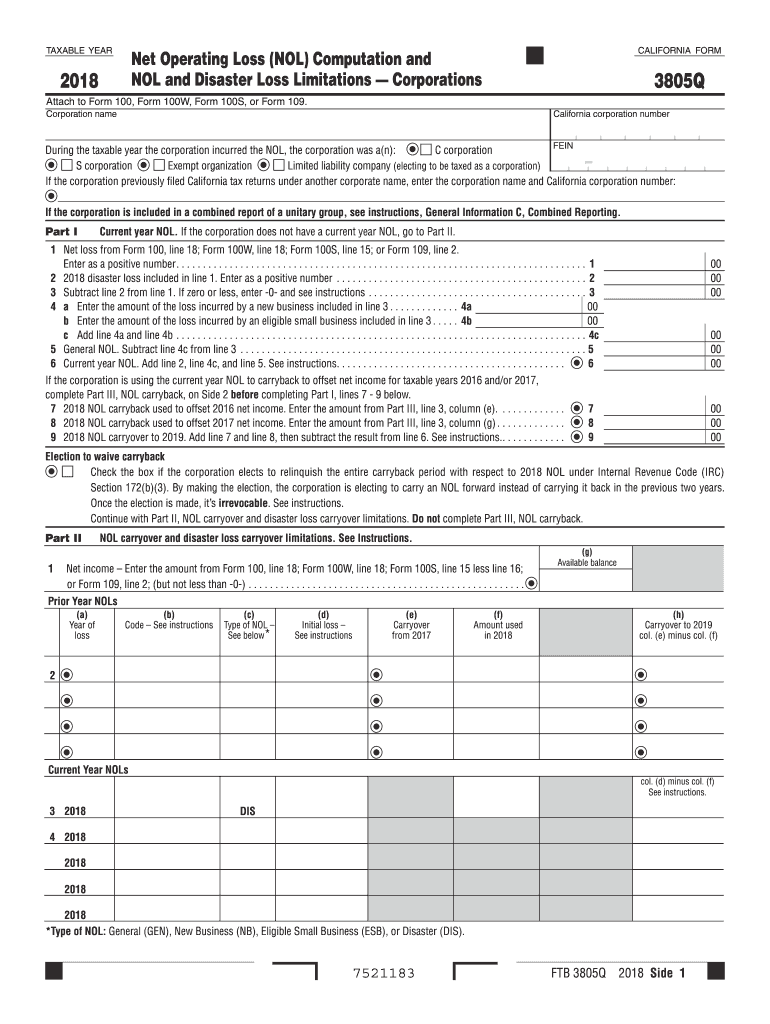

TAXABLE YEARCALIFORNIA Former Operating Loss (NOT) Computation and NOT and Disaster Loss Limitations Corporations20183805QAttach to Form 100, Form 100W, Form 100S, or Form 109. Corporation name California

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA FTB 3805Q

Edit your CA FTB 3805Q form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FTB 3805Q form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA FTB 3805Q online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CA FTB 3805Q. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 3805Q Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FTB 3805Q

How to fill out CA FTB 3805Q

01

Obtain the CA FTB 3805Q form from the California Franchise Tax Board website or request a physical copy.

02

Read the instructions carefully to understand the specific requirements for your situation.

03

Fill in your personal information including your name, Social Security Number (SSN), and address at the top of the form.

04

Report your income as required. Include the types of income you received and calculate the total.

05

Deduct any allowable expenses or losses according to the guidelines in the instructions.

06

Complete the calculations to determine your net income or loss.

07

Review your entries for accuracy and ensure that you have included all necessary documentation.

08

Sign and date the form before submission.

09

Submit the completed form to the California Franchise Tax Board by the deadline indicated in the instructions.

Who needs CA FTB 3805Q?

01

Taxpayers who are engaged in a trade or business in California and need to report income and deductions.

02

Individuals who are seeking to claim tax credits related to their business activities in California.

03

Partnerships, S corporations, and sole proprietorships that meet the filing requirements for California state taxes.

Fill

form

: Try Risk Free

People Also Ask about

What is the corporate NOL limitation in California?

Now, two years later, the California Legislature enacted SB 113, which includes an early termination to the NOL suspension and removes the $5 million limit on the usage of business tax credits for the 2022 tax year. Taxpayers may now deduct NOLs and utilize business tax credits without the cap on their 2022 tax return.

What is the CA Form 3805?

Individuals, estates, or trusts use form FTB 3805V, Net Operating Loss (NOL) Computation and NOL and Disaster Loss Limitations – Individuals, Estates, and Trusts, to figure the current year NOL and to limit the NOL carryover and disaster loss deductions.

What is an NOL deduction and why is it allowed?

A net operating loss (NOL) occurs when a company's allowable deductions exceed its taxable income within a tax period. The NOL can generally be used to offset a company's tax payments in other tax periods through an Internal Revenue Service (IRS) tax provision called a loss carryforward.

What is Form 3805Q used for?

Purpose. Use form FTB 3805Q, Net Operating Loss (NOL) Computation and NOL and Disaster Loss Limitations — Corporations, to figure the current year NOL and to limit NOL carryover and disaster loss carryover deductions.

What is the business loss limitation in California?

Complete form FTB 3461, California Limitation on Business Losses, if you are a noncorporate taxpayer and your net losses from all of your trades or businesses are more than $262,000 ($524,000 for married taxpayers filing a joint return).

What is the maximum business loss you can claim?

For taxable years beginning in 2021, the threshold amounts are $262,000 (or $524,000 in the case of a joint return). A "trade or business" can include, but is not limited to, Schedule F and Schedule C activities and other business activities reported on Schedule E.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit CA FTB 3805Q from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including CA FTB 3805Q, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I edit CA FTB 3805Q straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing CA FTB 3805Q right away.

How do I complete CA FTB 3805Q on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your CA FTB 3805Q. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is CA FTB 3805Q?

CA FTB 3805Q is the California tax form used to calculate and report the Qualified Medical Expenses for individuals who are claiming the California Earned Income Tax Credit (EITC) and other related benefits.

Who is required to file CA FTB 3805Q?

Individuals who claim the California Earned Income Tax Credit (EITC) and need to report their medical expenses may be required to file CA FTB 3805Q.

How to fill out CA FTB 3805Q?

To fill out CA FTB 3805Q, taxpayers should collect their medical expense receipts, complete the required sections of the form detailing their qualified medical expenses, and ensure all calculations are accurately reflected before submitting it with their tax return.

What is the purpose of CA FTB 3805Q?

The purpose of CA FTB 3805Q is to allow taxpayers to report their eligible medical expenses and to determine their eligibility for tax credits, specifically related to the California Earned Income Tax Credit.

What information must be reported on CA FTB 3805Q?

CA FTB 3805Q requires taxpayers to report information such as their total qualified medical expenses, details of expenses incurred, and any relevant calculations that support their claim for the California Earned Income Tax Credit.

Fill out your CA FTB 3805Q online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 3805q is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.