CA FTB 3805Q 2017 free printable template

Show details

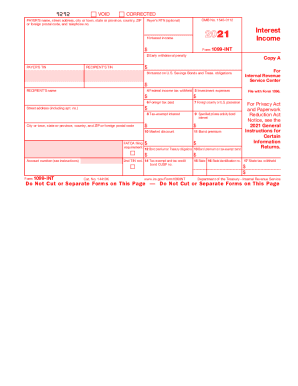

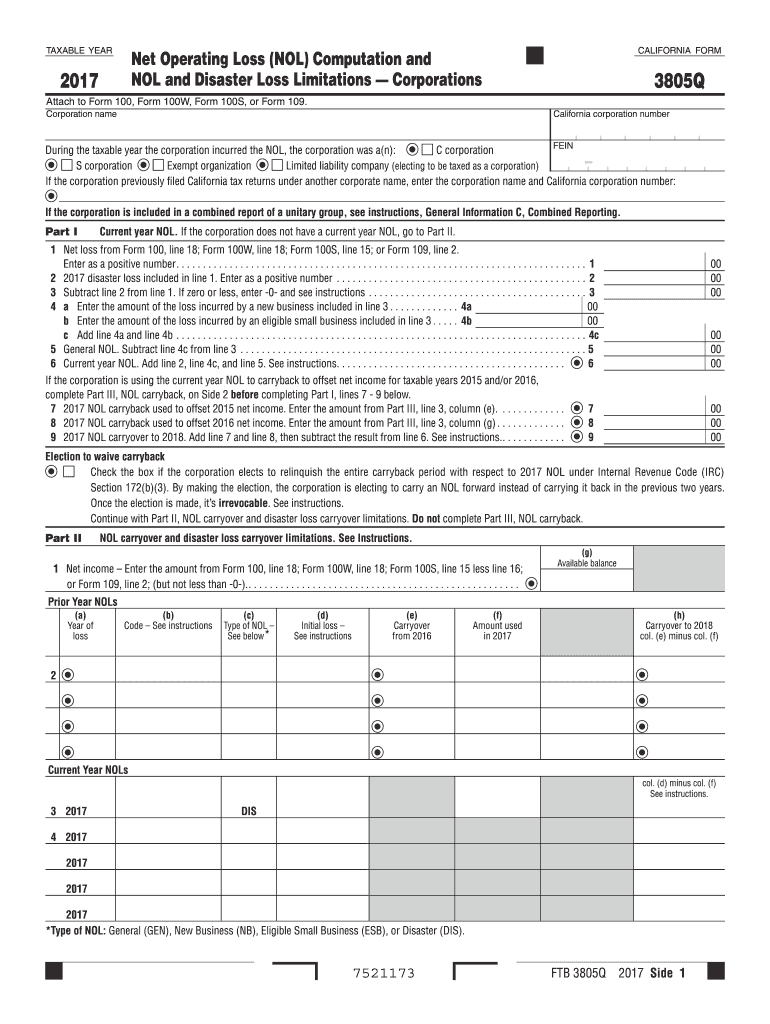

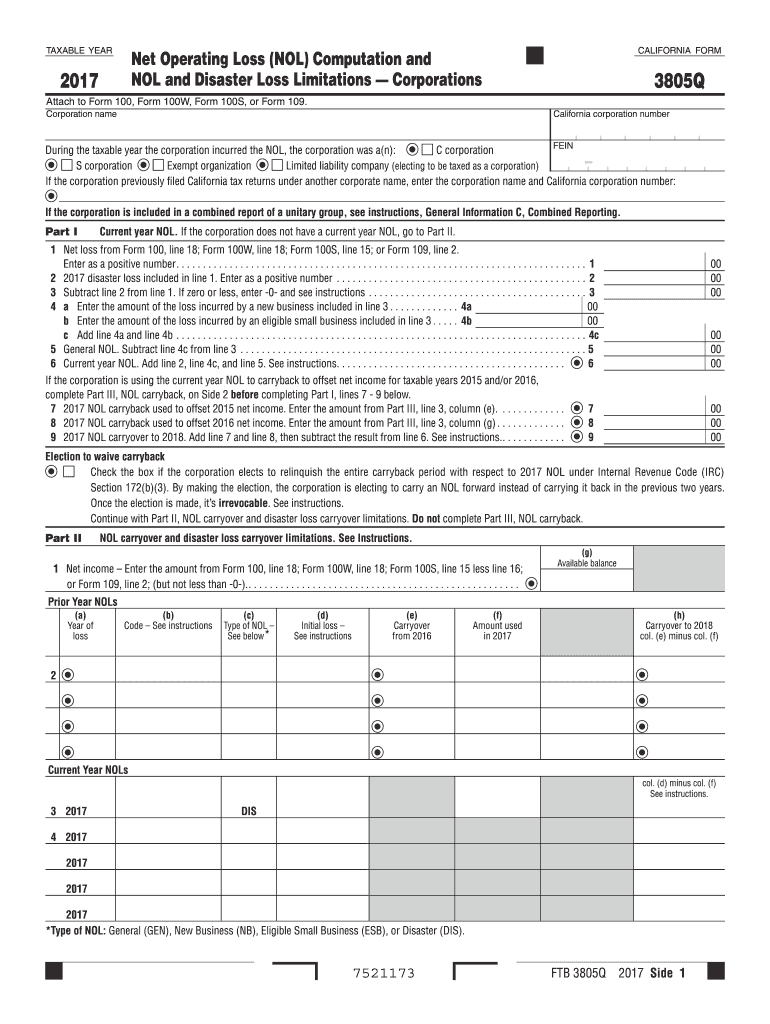

TAXABLEYEARCALIFORNIAFORMNet Operating Loss (NOT) Computation and NOT and Disaster Loss Limitations Corporations20173805QAttach to Form 100, Form 100W, Form 100S, or Form 109. Corporation name California

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA FTB 3805Q

Edit your CA FTB 3805Q form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FTB 3805Q form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA FTB 3805Q online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CA FTB 3805Q. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 3805Q Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FTB 3805Q

How to fill out CA FTB 3805Q

01

Download the CA FTB 3805Q form from the California Franchise Tax Board website.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Enter the details of your Qualified Small Business Stock (QSBS) in the designated section, including the date acquired, amount, and other required specifics.

04

Calculate your gain or loss from the sale of the QSBS as prompted in the form.

05

Input any carryover of losses, if applicable, in the relevant sections.

06

Review the instructions provided with the form for any specific requirements or exceptions.

07

Sign and date the form once completed, and keep a copy for your records before submission.

Who needs CA FTB 3805Q?

01

Individuals and entities who have sold Qualified Small Business Stock and wish to report their capital gains.

02

Taxpayers interested in taking advantage of the Capital Gain Exclusion for Qualified Small Business Stock.

Fill

form

: Try Risk Free

People Also Ask about

What are the NOL limitations for corporations?

The Act included a provision limiting net operating losses (NOL) incurred after Dec. 31, 2017, to 80% of taxable income rather than the historical 100%. This change was overshadowed by the Coronavirus Aid, Relief, and Economic Security (CARES) Act and eventually was delayed to tax years beginning after Dec. 31, 2020.

What is Form 3805Q used for?

Purpose. Use form FTB 3805Q, Net Operating Loss (NOL) Computation and NOL and Disaster Loss Limitations — Corporations, to figure the current year NOL and to limit NOL carryover and disaster loss carryover deductions.

What is an NOL deduction and why is it allowed?

A Net Operating Loss (NOL) Carryforward allows businesses suffering losses in one year to deduct them from future years' profits. Businesses thus are taxed on average profitability, making the tax code more neutral.

What is the tax form for disaster loss?

Qualified disaster losses in those tax years may be claimed on Form 4684. See Qualified disaster loss, later, for more information.

How does the 80% NOL limitation work?

How It Works. The rules state that the amount of the NOL is limited to 80% of the excess of taxable income without respect to any § 199A (QBI), § 250 (GILTI), or the NOL. For example: In this example, tax is paid on $20,000 of income even though there was an NOL carryover more than the current year's income.

What is Form 3805P?

Purpose. Use form FTB 3805P, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts, to report any additional tax you may owe on an early distribution from an IRA, other qualified retirement plan, annuity, modified endowment contract, or medical savings account (MSA).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get CA FTB 3805Q?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the CA FTB 3805Q in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit CA FTB 3805Q in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your CA FTB 3805Q, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out the CA FTB 3805Q form on my smartphone?

Use the pdfFiller mobile app to complete and sign CA FTB 3805Q on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is CA FTB 3805Q?

CA FTB 3805Q is a form used by California taxpayers to report the sale of a business asset or the sale of an asset connected to a business operation.

Who is required to file CA FTB 3805Q?

Taxpayers who sell or dispose of a business asset and are subject to California income tax must file CA FTB 3805Q.

How to fill out CA FTB 3805Q?

To fill out CA FTB 3805Q, provide detailed information about the asset sold, including the date of sale, sale price, basis, and any applicable adjustments. Complete all required sections and calculations accurately.

What is the purpose of CA FTB 3805Q?

The purpose of CA FTB 3805Q is to ensure that taxpayers report the gain or loss from the sale of business assets for accurate income tax assessment by the California Franchise Tax Board.

What information must be reported on CA FTB 3805Q?

Information that must be reported includes the description of the asset, date of acquisition, date of sale, sales price, the adjusted basis of the asset, and any gains or losses derived from the sale.

Fill out your CA FTB 3805Q online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 3805q is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.