MN DoR PCR 2019 free printable template

Show details

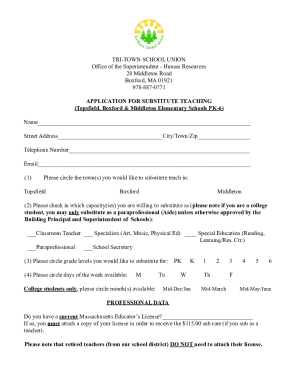

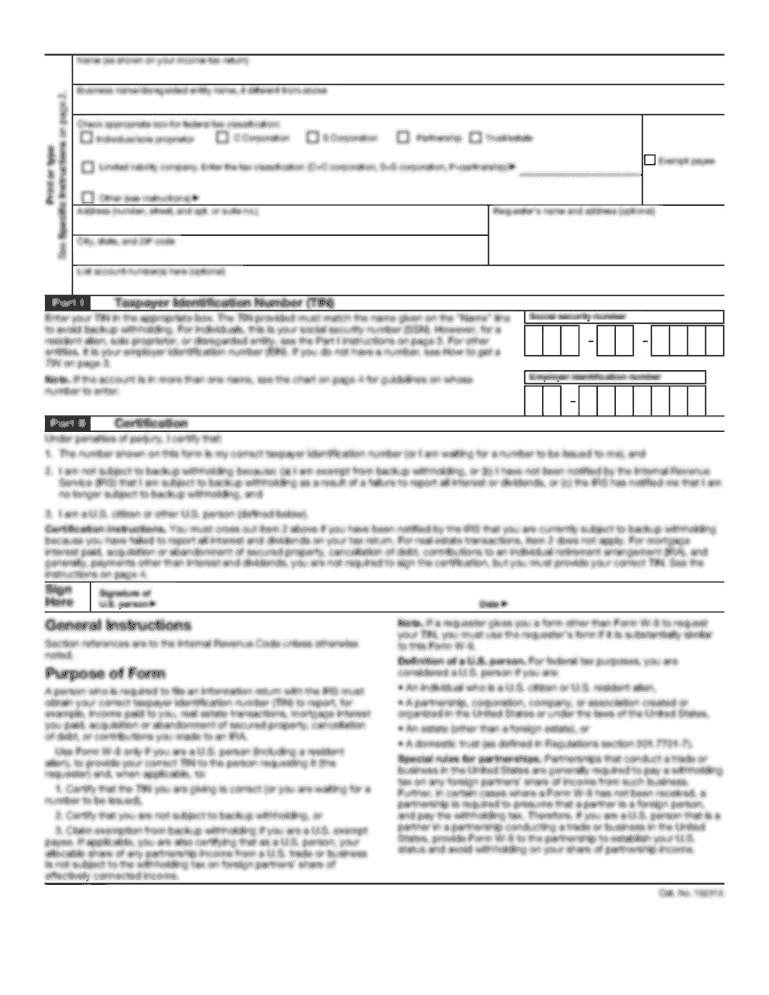

2019 Form PCR, Political Contribution Refund Application×195611×Complete×this×form×to claim×a refund×of contributions×made×to Minnesota×political×parties×and×candidates×for×Minnesota×state×offices.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MN DoR PCR

Edit your MN DoR PCR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MN DoR PCR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MN DoR PCR online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MN DoR PCR. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MN DoR PCR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MN DoR PCR

How to fill out MN DoR PCR

01

Obtain the MN DoR PCR form from the official Minnesota Department of Revenue website.

02

Fill out your personal information, including your name, address, and contact information.

03

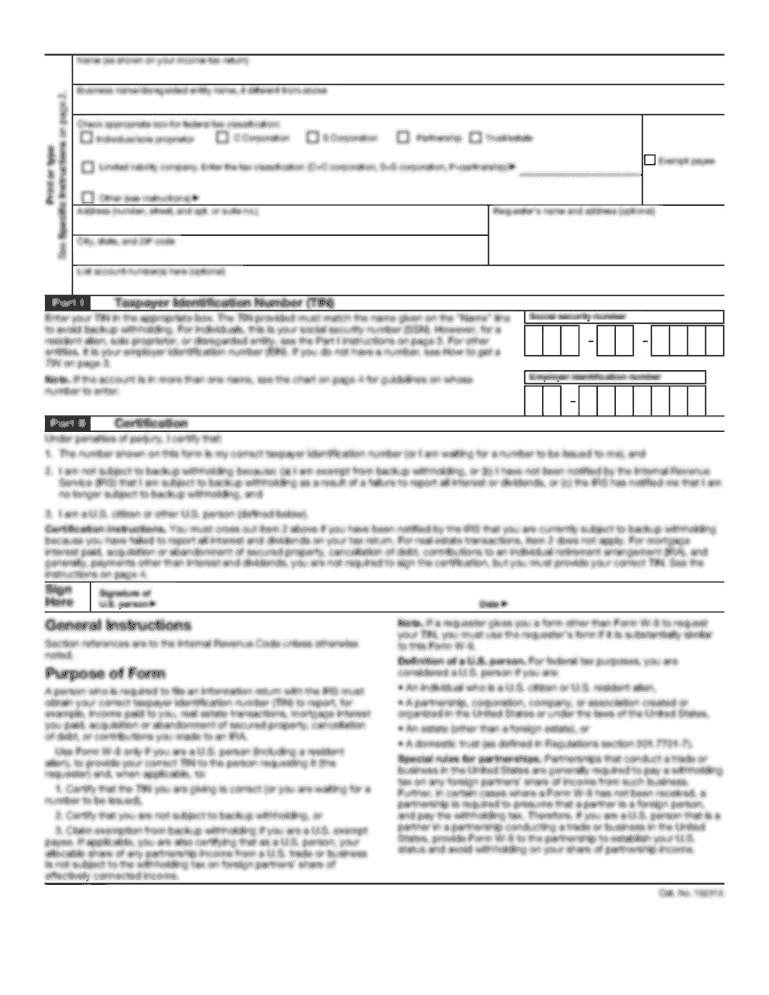

Enter your Social Security Number or Federal Employer Identification Number as required.

04

Provide details about the tax period you are reporting for.

05

Complete the income section by reporting your total income as per MN tax regulations.

06

Fill in the deductions and credits you are eligible for, ensuring you have the necessary documentation.

07

Verify and double-check all the information for accuracy.

08

Sign and date the form as required.

09

Submit the form through the designated method indicated on the MN DoR website (e.g., online, mail).

Who needs MN DoR PCR?

01

Individuals and businesses in Minnesota who need to report their tax information.

02

Taxpayers who are eligible for credits, deductions, or any tax refunds.

03

Anyone required to file a personal income tax return with the Minnesota Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

What is the main source of campaign funds?

Contributions are the most common source of campaign support. A contribution is anything of value given, loaned or advanced to influence a federal election.

How are political parties funded in the UK?

Political parties in the UK may be funded through membership fees, party donations or through state funding, the latter of which is reserved for administrative costs.

What is the maximum donation to a political party in Canada?

As of 2021, the maximum yearly contribution limit is $1650 to a given federal political party, $1650 to a given party's riding associations, $1650 to a given party's leadership candidates, and $1650 for each independent candidate. The maximum total contribution is set at $3300.

How to find political campaign contributions?

Power Search can be used to quickly search for contributions to candidates and ballot measures and contributions from individuals, businesses and other campaign committees. It can also be used to search for independent expenditures made to support or oppose candidates or ballot measures.

What are political party donations?

A political donation is a gift made to, or for the benefit of, a political party, elected member, candidate, group of candidates, or other person or entity including an associated entity or third-party campaigner in New South Wales. People and entities making political donations are called donors.

Are political donations considered gifts?

A political contribution is not a gift if properly reported or is exempt from the reporting. The use of a bulk mailing permit owned by a legislator's campaign committee or used in a legislator's election campaign is not a gift.

Are political donations legal in Australia?

Political donations made to political parties, elected members, candidates, groups of candidates, associated entities, and third-party campaigners are capped in New South Wales. Additionally, indirect campaign contributions that exceed certain threshold amounts are prohibited.

Are political donations subject to gift tax?

Contributions are not tax-deductible, and are not subject to gift tax rules. There are also no deductions available for donations of in-kind services or for time that you volunteer with a campaign or political committee.

What are considered political contributions?

A contribution is anything of value given, loaned or advanced to influence a federal election.

Which is the main source of campaign funds quizlet?

Where do campaign contributions come from? - Most money comes from private givers, such as small contributors, wealthy individuals, political action committees (PACs), temporary fundraising groups, and candidates themselves.

What is Minnesota's PCR program?

Minnesota refunds up to $50 per calendar year of contributions made by an eligible voter to a qualified candidate or a recognized political party.

What are some sources of campaign funding?

Sources of campaign funding small individual contributors (defined by the government as being from individuals who contribute $200 or less), large individual contributors (individuals who contribute more than $200), political action committees, and. self-financing (the candidate's own money).

What is the largest source of funding for political parties?

Political parties are funded by contributions from multiple sources. One of the largest sources of funding comes from party members and individual supporters through membership fees, subscriptions and small donations.

What is it called when you give money to a political party?

Contributions are the most common source of campaign support. A contribution is anything of value given, loaned or advanced to influence a federal election.

What are illegal political contributions?

Federal law prohibits contributions, donations, expenditures(including independent expenditures) and disbursements solicited, directed, received or made directly or indirectly by or from foreign nationals in connection with any federal, state or local election.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my MN DoR PCR in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your MN DoR PCR and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Where do I find MN DoR PCR?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific MN DoR PCR and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I edit MN DoR PCR on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign MN DoR PCR. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is MN DoR PCR?

MN DoR PCR stands for Minnesota Department of Revenue Payment Compliance Report, which is a document used to report certain financial information to ensure compliance with state revenue requirements.

Who is required to file MN DoR PCR?

Businesses and individuals who meet specific state revenue thresholds or are required by Minnesota state law to report their financial activities must file the MN DoR PCR.

How to fill out MN DoR PCR?

To fill out the MN DoR PCR, one must provide accurate financial information, including income, expenses, and taxes owed, following the guidelines provided on the Minnesota Department of Revenue website.

What is the purpose of MN DoR PCR?

The purpose of the MN DoR PCR is to ensure tax compliance, provide the state with necessary financial data, and facilitate the auditing process for businesses and individuals.

What information must be reported on MN DoR PCR?

The MN DoR PCR requires the reporting of income figures, expenses, tax credits, deductions, and any other information relevant to the taxpayer's financial situation.

Fill out your MN DoR PCR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MN DoR PCR is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.